Oil and gold remain becalmed ahead of various data points with only some Fed speeches and North Korea rhetoric stirring the otherwise placid waters.

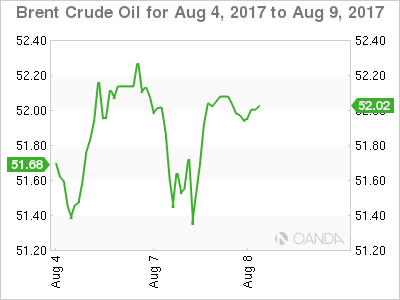

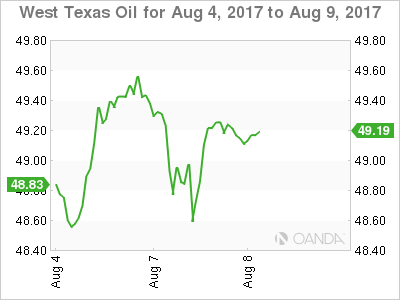

Oil remained locked into choppy range trading overnight as the market awaits the first of the crude inventory numbers of the week from the American Petroleum Institute. Both Brent and WTI spot fell some two percent as Libya announced its biggest oil field was resuming full production. Both contracts however shrugged of this new to make back almost all their losses and close virtually unchanged at 52.05 and 49.25 respectively.

Bulls can take heart from the comeback, but both Brent and WTI’s ranges continue to contract in a quiet news environment, suggesting a breakout is imminent. Assuming that nothing comes from OPEC/Non-OPEC’s technical meeting in Abu Dhabi today, oils near term fate will most likely be determined by the official U.S. Department of Energy inventory data tomorrow evening Asia time.

OIL

Brent spot is trading at 52.075 with its triple top resistance at 52.70 still untested. Some congestion below appears at 51.20 ahead of key support at 50.50, the 1st August low and the 100-day moving average.

WTI spot trades at 49.20, well below its double top at 50.30. Interestingly a triple bottom has formed over the last four sessions around 48.40 providing initial support ahead of 48.00 and then the key 47.70 level, the 100-day moving average.

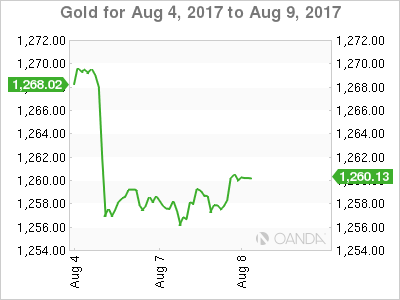

GOLD

Gold consolidated near the bottom of its recent trading range overnight with a lack of new to provide any new price direction. Like many other markets this week, gold appears to be in a holding pattern with the increasing risk that stale long positioning may see traders head for the door until some directional clarity is restored.

Gold traded in a 1255/1260 range overnight and opened at a sleepy 1258.50 level this morning in Asia. Some dovish comments from Fed Governors Kashkari and Bullard along with the day’s daily dose of sabre rattling from North Korea has seen gold drift higher to 1260.00. However, initial daily resistance still lies distantly at 1274.20 with the near term support much closer and likely to be of more concern to traders.

The Friday low and also the 100-day moving average is just below current levels at the 1253.00 regions, followed by the 50% Fibonacci retracement at 1249.20. A daily close below these levels would be a concerning development for gold bulls, suggesting a further test to the 1243 regions and possibly a deeper retracement to the 200-day moving average at 1230.00.