Crude prices weakened on Iran nuke deal, while natural gas rocketed higher on weather forecasts.

Crude Oil:

Crude prices declined last week, responding to the landmark Iran nuclear deal that seeks to arrest the West Asian country’s alleged march towards nuclear power, while possibly bringing more of its oil to global markets.

On Nov 24, Iran reached a temporary accord with six world powers – the U.S., Great Britain, France, Russia, China and Germany – to restrict its nuclear activities in return for Tehran’s relief from international sanctions on oil, auto parts, gold and precious metals. Though Iranian oil export is not expected to rise significantly and flood international markets, the groundbreaking agreement will surely go a long way in make it easier for the country to sell oil.

Sentiments were further dampened by the Energy Information Administration (EIA) report that showed another big jump in inventories, which remains well above the upper limit of the average for this time of the year.

As per the EIA’s weekly ‘Petroleum Status Report,’ crude inventories climbed by an unexpected 2.95 million barrels for the week ending Nov 22 to 391.42 million barrels. A surge in production – now at their highest level in almost 25 years – led to the stockpile pile-up with the U.S. What’s more, storage at the Cushing terminal in Oklahoma, the key delivery hub for U.S. crude futures traded on the New York Mercantile Exchange, was also up 676,000 barrels, the seventh straight weekly gain.

Concerns that the Fed may taper its $85 billion bond repurchase plan in coming months also held back crude prices. Traders have voiced concerns that Fed’s shift away from the bond buying policy may lead to dollar-denominated oil prices to increase in local-currency terms in emerging markets, thus slowing growth.

As a result of these factors, by close of trade on Friday, West Texas Intermediate (WTI) oil was firmly in the red and settled at $92.72 per barrel, losing 1.9% for the week.

Natural Gas:

Investors continue to focus on temperature patterns to understand the fuel’s economic dynamics. As it is, natural gas fundamentals look uninspiring with supplies remaining ample in the face of underwhelming demand. In fact, it is expected to take many years for the commodity’s demand to match supply in the face of newer projects.

Despite these issues, natural gas rallied last week on the back of a larger-than-expected decrease in natural gas supplies and forecasts of cold weather conditions.

The EIA's weekly inventory release showed that natural gas stockpiles held in underground storage in the lower 48 states fell by 13 billion cubic feet (Bcf) for the week ended Nov 22, higher than the guided range (of 7–11 Bcf drawdown). Chilly weather forecasts – in the key U.S. consuming regions over the next fortnight – are likely to further spur the commodity’s demand for heating.

Influenced by these factors, natural gas spot prices ended Friday at $3.95 per million Btu (MMBtu), up 4.5% over the week.

Energy Week That Was:

The week’s energy coverage was dominated by the following news:

PetroChina Buys Exxon Stake in Iraq

Chinese energy giant PetroChina Co. Ltd. (PTR) has acquired a 25% interest in the West Qurna-1 oilfields in Iraq from U.S. oil major Exxon Mobil (XOM). The deal – whose financial details were not disclosed – should help PetroChina to set a stronger foothold in Iraq and synergize with its other projects in the nation. This should also aid the Chinese government which has become a significant importer of Iraqi crude. With a slowdown in domestic oil output, China is looking at other international oil fields to meet its energy demands.

Weather Hurts Pioneer Texas Biz

Pioneer Natural Resources Company’s (PXD) output and drilling operations in the Spraberry, Wolfcamp, Eagle Ford Shale and Barnett Shale Combo plays were hurt by a severe cold spell in Texas. Shares of the company felt the chill as the price dropped 2.5% and 0.6% in the two trading sessions to touch $177.75 on Friday.

Spraberry and Wolfcamp were the worst hit areas. Intense icing and low temperatures resulted in widespread power outages, facility hindrances, loading curtailment, and restricted access to production and drilling facilities in these plays. A lengthy recovery period is expected and the full impact of the weather condition will be known in a couple of weeks. Pioneer had not accounted for this unforeseen severe weather in its production and financial guidance for the fourth quarter of 2013, which was released along with the company’s third quarter earnings.

ConocoPhillips Divests Algerian Arm

U.S. energy giant ConocoPhillips (COP) has completed the sale of its Algeria business unit to Indonesia’s state owned oil company – PT Pertamina. The sales consideration totaled $1.75 billion. ConocoPhillips’ divestment of its Algerian unit will be value accretive for its shareholders as well as raise funds to concentrate on higher return assets. It will facilitate the company to focus on capital investments that will benefit production and cash margins and enhance returns on capital.

NOV Hives Off Distribution Biz

Global large-cap energy equipment maker National Oilwell Varco Inc. (NOV) is on track with the previously announced spin-off of its Distribution business segment. For this purpose, a new corporation christened NOW Inc. based in Delaware has been formed. This new entity will, in time, operate as an independent, publicly traded company under the proposed name of DistributionNOW.

Weatherford Gains on Settlement News

Shares of oilfield service biggie Weatherford International Ltd. (WFT) rose 1.5% on Tuesday, Nov 26, after it agreed to shell out around $253 million to settle various bribery-related cases with the Department of Justice, the Securities and Exchange Commission, and the Departments of Treasury and Commerce.

Other Headline News on Energy:

SeadrillFallsAfter Profit Misses Estimates

Norwegian oilfield service firm Seadrill Ltd (SDRL) fell to nearly 4-month low following weaker-than-expected third-quarter results. Earnings per share came in at 60 cents, failing to beat the Zacks Consensus Estimate of 67 cents. The miss can be attributed to significant increase in operating costs.

Jones Energy Rallies on Asset Buy Deal

Oil and gas explorer Jones Energy, (JONE) has agreed to acquire certain producing and undeveloped properties in the Anadarko Basin from an undisclosed private seller for $195 million. The market reacted positively to the news, which was announced after market hours on Monday, Nov 25. Shares of the exploration and production company opened at $14.31 on Nov 26 – up 3% from the previous close. The stock price rose further, settling at $14.66, when the market closed yesterday.

Statoil to Keep '14 Spending Flat Y/Y

Norwegian oil major Statoil ASA’s, (STL) share prices surprised with a respective 1.4% and 0.3% drop in the two trading sessions after it announced its intent to keep exploration spending for 2014 close to the 2013 record level. The company also intends to be more selective in choosing exploration targets to lessen risk and control spending. Statoil’s focus will be directed toward areas where it has made recent discoveries. These include Norway, the Gulf of Mexico, Brazil, Canada, Angola and Tanzania.

Lime Energy Drops on Chief Executive Departure

Energy services provider Lime Energy Co, (LIME)terminated the employment of Chief Executive John O’Rourke and promoted Adam Procell – President and Chief Operating Officer – as his replacement. The sudden management shakeup spooked investor sentiment, pulling down the company’s shares by 5.7%.

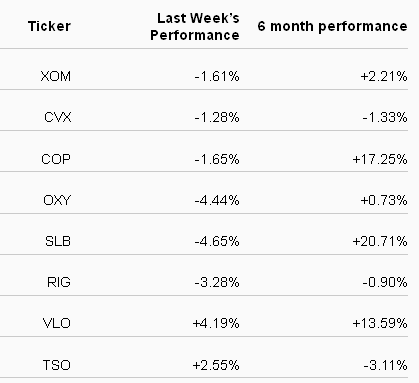

Performance Chart of Some Major Companies:

The following table shows the price movement of the major oil and gas players over the past week and during the last 6 months.

This Week’s Outlook

Apart from the usual suspects – the U.S. government data on oil and natural gas – market participants will be closely tracking Friday’s non-farm payroll report for Nov that will shed further light on the economy’s wellness and the need for the bond buying policy. Energy traders will also be focusing on the OPEC meeting in Vienna on Wednesday.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil and Gas Stock Roundup: Crude Hit by Iran Deal, NatGas Surges

Published 12/04/2013, 12:23 AM

Updated 07/09/2023, 06:31 AM

Oil and Gas Stock Roundup: Crude Hit by Iran Deal, NatGas Surges

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.