Natural Gas: Investors continue to focus on temperature patterns to understand the fuel’s economic dynamics. As it is, natural gas fundamentals look uninspiring with supplies remaining ample in the face of underwhelming demand. In fact, it is expected to take many years for the commodity’s demand to match supply in the face of newer projects.

Coming to last week, natural gas stayed flat, as a massive decrease in supplies was offset by forecasts of a break in cold weather conditions.

The EIA's weekly inventory release showed that natural gas stockpiles held in underground storage in the lower 48 states fell by 285 billion cubic feet (Bcf) for the week ended Dec 13, higher than the guided range (of 260–264 Bcf drawdown). Moreover, the decrease was significantly higher than both last year’s withdrawal of 70 Bcf and the 5-year average reduction of 133 Bcf for the reported week.

However, milder weather forecasts – in the central and eastern regions over the next few days – are likely to limit the commodity’s demand for heating.

Influenced by these factors, natural gas spot prices ended Friday at $4.42 per million Btu (MMBtu), essentially flat over the week.

Energy Week That Was:

The week’s energy coverage was dominated by the following news:

XOM Shares Hit 52-Week High

Shares of Exxon Mobil Corp. hit a 52-week high of $99.95 on Dec 18. In fact, the Irving, TX-based energy behemoth has seen its stock price climb some 12% during the past three months. This price appreciation can be attributed to its strong operational and financial position on the back of solid business portfolio and prudent investment approach.

Exxon Mobil is the world’s best run integrated oil company given its track record of superior return on capital employed and has long been a core holding for investors seeking a defensive name with continued dividend growth.

BP Hits Oil in GoM Since '10 Blowout

Oil major BP plc along with its partner ConocoPhillips, (COP) made a huge find at its Gila prospect, in the deepwater U.S. Gulf of Mexico (GoM).

The discovery represents the first major find by BP since the massive rig outburst that caused the worst environmental tragedy in the U.S. history. After the Macondo well blowout, the U.S. regulators lifted a five-month ban on deepwater drilling in 2010. The latest find is the third discovery in recent years in the emerging Paleogene trend in the Gulf. The previous finds were Kaskida in 2006 and Tiber in 2009.

BP hit oil at depths of around 9,150 meters (30,000 feet) in the Gila prospect by an exploration well on Keathley Canyon Block 93, about 300 miles southwest of New Orleans, in around 4,900 feet of water.

Hess Anticipates Lukewarm 4Q

Hess Corporation, (HES) Corp. has slashed its production guidance for the first two months of the fourth quarter of 2013 and overall guidance for the same quarter. The cascading trend in global oil prices prompted the cut.

Hess reduced its fourth quarter daily production guidance to 310,000 barrels of oil equivalent per day (BOE/d) from 320,000 BOE/d guided previously. The decrease reflects the closure of sale of its interest in the Natuna A Field in Indonesia and higher production downtime due to maintenance activities.

At the same time, having faced a global slump in realized selling prices for crude oil during the first two months of the fourth quarter, the company anticipates sequentially lower earnings.

COG Revises '13 Output Growth Outlook

Independent oil and gas exploration company Cabot Oil & Gas Corp. (COG) reported that it has revised its 2013 production growth outlook.

The Houston, TX-based upstream operator has set its new production growth guidance at 50% to 55%, up from the previous outlook of 44% to 54%. Cabot added that recently it has produced roughly 1.5 billion cubic feet per day of natural gas from Marcellus shale operations, reflecting a year-over-year hike of 50%. This record production has encouraged the company to lift its 2013 production growth outlook. However, Cabot has retained its production growth guidance for 2014 at 30% to 50%.

Encana, SBM Offshore Sign Contract

Canadian natural gas producer Encana Corporation, (ECA) reported that it has entered into an agreement with SBM Offshore, a marine service provider. Per the contract, SBM Offshore will operate the Deep Panuke platform on behalf of Encana. The platform is located in the Deep Panuke natural gas field, offshore Nova Scotia, Canada. The field consists of four operating wells. Encana reveals that the platform has been constructed for producing roughly 300.0 million cubic feet of natural gas from the wells every day.

Encana added that the natural gas produced from the Deep Panuke development will likely be sold to Spanish oil and gas company, Repsol SA.

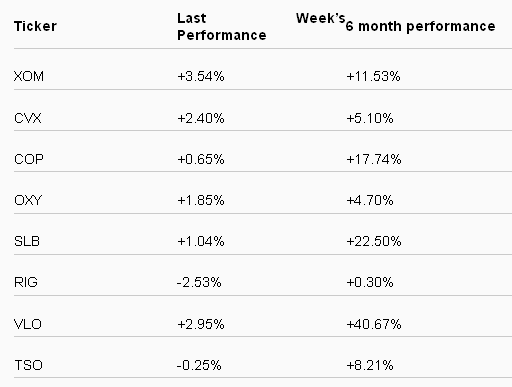

Performance Chart of Some Major Companies:

The following table shows the price movement of the major oil and gas players over the past week and during the last 6 months.

Other Headline News on Energy:

Comstock to Invest $450M in 2014

Domestic energy explorer Comstock Resources Inc, (CRK) has allocated roughly $450 million for drilling and completion operations in 2014. The earmarked capital will, however, not be utilized for drilling natural gas wells. A further $28 million will go towards leasing activities.

Out of the total budget, the Frisco, Texas-based upstream operator is expected to invest $80.0 million to complete the drilling of 29 wells in the South Texas-based Eagle Ford shale and $264 million to drill 59 wells at South Texas located Eagle Ford shale. Another $50 million will be used for drilling 10 wells at East Texas-based Eagle Ford shale. Additionally, $27 million will likely be spent to drill 2 wells at the Tuscaloosa Marine shale. The remaining $29 million will be utilized for other capital developments.

Petrobras Confirms Moita Bonita Find

Brazilian state-run energy giant, Petroleo Brasileiro SA, or Petrobras has confirmed the presence of gas and light oil in the extension well, 3-BRSA-1194-SES, commonly known as Moita Bonita -1.

The ultra-deepwater well is located in the Sergipe-Alagoas Basin, in the Moita Bonita area, in the state of Sergipe. It is located 7 km from 1-BRSA-1088-SES or the Moita Bonita discovery well at a water depth of 2,800 meters on the concession BM-SEAL-10. Petrobras has a 100% holding in BM-SEAL-10 and also acts as its operator.

Patterson-UTI to Incur $37.8M Cost

Onshore contract driller Patterson-UTI Energy Inc. reported that it might bear a significant cost for its mechanically powered rig fleet. The Houston, TX-based company has estimated the pre-tax non-cash expenses of roughly $37.8 million.

Out of the total charge, $7.9 million can be attributed to the retirement of Patterson-UTI’s 48 mechanical drilling rigs during the current quarter. The rigs – having capacity of roughly 731 horsepower – are not expected to work again due to lower demand in the international market. The company reveals that a portion of the parts of those rigs will likely be auctioned, while the major remaining components will be utilized for maintaining other rigs. The residual $29.9 million will be borne by the company, as presently 55 mechanical rigs are out of contract.

This Week’s Outlook:

Apart from the usual releases – the U.S. government data on oil and natural gas – market participants will be closely tracking key data on durable goods orders, new home sales numbers and jobless claims.

Original post