Medical is one of the seven sectors in the S&P 500 cohort that is expected to report growth in earnings in the second quarter. The sector is likely to record earnings growth of 5.4% on revenue improvement of 10.5%.

Notably, 317 S&P companies have already disclosed their numbers with 72.9% of the companies beating the EPS estimates and 53.6% recording a revenue beat.

As per the latest Zacks Earnings Trend report, overall second-quarter earnings for S&P 500 companies are expected to be down 3.3% from the year-ago quarter. Also, revenues are estimated to decline 0.9%.

Nursing Home, though a small component of the Medical sector, is expected follow the growth trajectory this earnings season.

Here, we take a look at three nursing home stocks scheduled to report their second-quarter figures on Aug 2:

Team Health Holdings Inc (NYSE:TMH) is a supplier of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the U.S. We believe that increasing patient volume, strategic acquisitions and the implementation of the ‘Bundled Payments for Care Improvement’ (BPCI) program in collaboration with Remedy Partners are key positives.

We also note that the company has recently announced the acquisitions of operations of Tri-City Emergency Medical Group in California and of Lake County Anesthesia Associates in Florida, which are likely to fortify its market position.

However, our proven model does not conclusively show that the company is likely to beat earnings, given the combination of a Zacks Rank #3 (Hold) and Earnings ESP of 0.00%. This is because both the Zacks Consensus Estimate and the Most accurate estimate are currently pegged at 66 cents.

Notably, as per our model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 to beat estimates. Simultaneously, we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

We note that the results of Team Health compared favorably with the Zacks Consensus Estimate in the last four quarters, with an average beat of 1.73%.

Led by the finest caregivers in the U.S. comprising an aggressive team of industry and business veterans, The Ensign Group Inc (NASDAQ:ENSG) provides health care services in the post-acute care continuum, urgent care center and mobile ancillary businesses.

Acquisitions have played a key role in enhancing the company’s growth opportunities. Notably, the recent buyouts of Riverbend Post Acute Rehabilitation in Kansas and 18 skilled nursing facilities from Legend Healthcare in Texas are likely to diversify the company’s portfolio and mark its foray into the emerging markets.

However, our proven model does not conclusively show that the company is likely to beat earnings, given the combination of a Zacks Rank #3 and Earnings ESP of 0.00%. This is because both the Zacks Consensus Estimate and the Most accurate estimate are pegged at 33 cents.

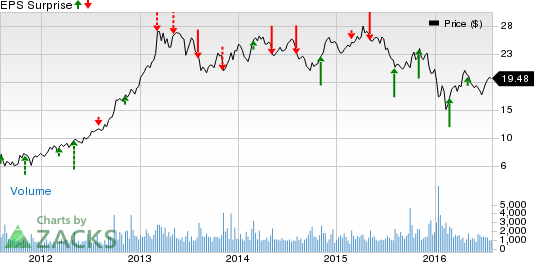

Capital Senior Living Corporation (NYSE:CSU) is one of the largest providers of senior living services in the U.S. The company’s solid occupancy growth, well-organized expense management programs and strategic acquisitions are key growth drivers in our view.

Notably, Capital Senior Living has completed the acquisition of five senior living communities in the first quarter, which expanded its operations in the markets of Wisconsin and Florida.

However, our proven model does not conclusively show that the company is likely to beat earnings, given the combination of a Zacks Rank #3 and Earnings ESP of 0.00%. This is because both the Zacks Consensus Estimate and the Most accurate estimate stands at a penny.

We also note that Capital Senior Living’s results compared favorably with the Zacks Consensus Estimate in the last four quarters, with an average beat of 181.25%.

CAPITAL SR LIVG (CSU): Free Stock Analysis Report

TEAM HEALTH HLD (TMH): Free Stock Analysis Report

ENSIGN GROUP (ENSG): Free Stock Analysis Report

Original post

Zacks Investment Research