USD/JPY squirted higher still overnight and could keep on going on a strong US employment report. Resistance may not lie far from here, however, as the speed of the move will generate strong rhetorical intervention soon ahead of G20.

US employment report and USD/JPY / EUR/USD

USD/JPY took out another figure overnight, trading at new highs snice early 2010 (the highest level that year was 95.00 on the nose) as US Treasuries settled weaker yesterday, keeping yields elevated and carry traders/JPY sellers happy for now. As I mentioned recently, a strong US payrolls report and/or drop in the unemployment rate could see a deeper sell-off in Treasuries and yet another boost to this USD/JPY move, but the fact that it has moved so aggressively before the actual employment report raises the risk that considerable good employment news is already in the price, i.e., the bar has been raised considerably for the upside surprise.

So we likely have a binary situation - either another big jump or a slight jump and a large reversal or simply a large reversal (note that all of the recent Fridays have seen USD/JPY ending with another flourish higher with consolidation coming early the next week - this pattern may have become too easy...) An ugly report or even one that is just a bit weaker than expectations could see a pop in the bond market and finally kick off a volatile correction sequence in USD/JPY and EUR/USD (with EUR/JPY the highest-beta play as usual of late). I expect a stronger than consensus payrolls level, but not sure I have a feel for how the market is positioned. A drop of 0.1% in the unemployment rate would be interesting as well, as would be a 0.1% rise (all possible due to participation rate effects and the volatile household employment survey in the US.)

Manufacturing surveys out today as well

Don’t forget that we have the other manufacturing surveys out today (note the weak Chinese manufacturing survey out overnight!), including the final Euro Zone and the UK surveys this morning and the US ISM survey up 90 minutes after the employment report. The Chicago PMI threw a wrench in the expectations for an exceptionally weak ISM, but stay tuned.

Footnote from yesterday: it appears the massive US personal income bump in December was due to large dividend payouts in December that were timed in anticipation of new higher taxes this year. Don’t expect a repeat.

USD pair levels

EUR/USD first support is 1.3590, with 1.3500 a bigger line in the sand and near the first (0.382) Fibo of note. USD/CAD needs to find support very soon above 0.9950 and rally strongly again if the rally is to remain alive – bulls really need 1.0060+ to reinvigorate hopes there. AUD/USD likewise needs risk off and fresh lows below 1.0380 to reinvigorate the bearish argument. For GBP/USD, the focus is on whether the 200-day moving average holds as resistance (just below 1.5900).

ECB and then G20

Don’t forget that we have the ECB meeting next week that will also see the market increasingly nervous about pushing EUR/JPY higher ahead of a possible rate cut from the ECB or the beginnings of verbal intervention against the move or a change in language on how the ECB might use the OMT or similar. Beyond that, the G20 meeting set for February 15 is the most important event risk in the calendar as we will get a test of how global leaders are dealing with the entire issue of competitive devaluation, a.k.a., the global currency wars.

Commodity dollar smackdown

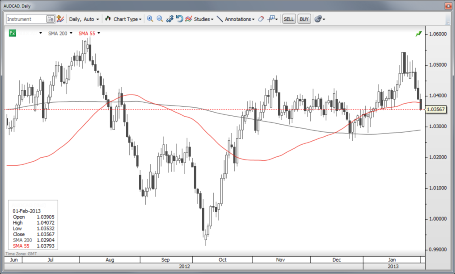

The weakness in Aussie is very noteworthy here if we look at not only conditions in general, but its commodity dollar comrades, the kiwi and the loonie. AUD/CAD features compelling technical arguments for bears to get active again, as the entire sequence that took the pair up above 1.0400 recently has been wiped away. The problem there is that we have merely seen mean reversion in the parity to 1.0500+ range for the almost two years as no new real trend has developed. I have long expected for a new bear trend to get underway there that takes the pair well below parity. Will 2013 finally be the year? Speaking of mean reversion, for those looking at the exotic extremes of the G8 currencies, NZD/CAD is poised for fresh 7-year+ highs. There may be some more room to move to the upside, but that pair should eventually mean revert over the next 12-24 months, as it has since the mid 1980’s.

Chart: AUD/CAD

The latest AUD/CAD false start saw the pair taking out resistance, but failing again to latch onto a new trend. Bears might find good arguments here for driving the pair further back into the range, with 1.0450/1.0500 acting as resistance. The bigger structural question is whether or when we will take out parity and get a real new trend going. AUD/USD" title="AUD/USD" width="455" height="274">

AUD/USD" title="AUD/USD" width="455" height="274">

Economic Data Highlights

- Australia AiG Performance of Manufacturing Index out at 40.2 vs. 44.3 in Dec.

- Japan Dec. Jobless Rate rose to 4.2% vs. 4.1% expected and 4.1% in Nov.

- China Jan. Manufacturing PMI fell to 50.4 vs. 51.0 expected and 50.6 in Dec.

- China Jan. HSBC Manufacturing Survey out at 52.3 vs. 52.0 expected and 51.5 in Dec.

- Sweden Jan. Swedbank PMI out at 49.2 vs. 46.1 expected and 44.6 in Dec.

- Norway Jan. PMI out at 50.5 vs. 50.4 expected and 50.0 in Dec.

- Spain Jan. Manufacturing PMI out at 46.1 vs. 45.5 expected and 44.6 in Dec.

- Switzerland Jan. PMI out at 52.5 vs. 50.5 expected and 49.2 in Dec.

- Italy Jan. PMI Manufacturing (0845)

- Germany Jan. Final PMI Manufacturing (0855)

- Euro Zone Jan. Final PMI Manufacturing (0900)

- Norway Jan. Unemployment Rate (0900)

- UK Jan. PMI Manufacturing (0930)

- Euro Zone Jan. CPI Estimate (1000)

- Euro Zone Dec. Unemployment Rate (1000)

- US Jan. Unemployment Rate (1330)

- US Jan. Nonfarm Payrolls (1330)

- US Jan. Average Hourly Earnings/Average Weekly Hours (1330)

- US Jan. Final University of Michigan Confidence (1455)

- US Dec. Construction Spending (1500)

- US Jan. ISM Manufacturing (1500)

- China Jan. Non-manufacturing PMI (Sun 0100)