Since February 25, we have been operating on a “sell” signal that was generated by our rule-based market timing system. That same market timing strategy has been used by us internally since 2006, and has always done a pretty good job of keeping us in line with the intermediate-term trend of the broad market.

Although stocks have actually moved slightly higher since our most recent sell signal was triggered, it’s important to understand the market does not always need to immediately break down in order for the timing model to have value.

Sometimes a sell signal is generated and the market immediately rolls over, but other stock market timing sell signals lead to an initial short-term bounce before the market moves substantially lower.

Obviously, we can never know in advance what will happen immediately following a new sell signal. Still, we always respect a bearish market timing signal by moving to cash and/or tightening up stops on long positions and waiting for conditions to improve before establishing new long positions. A new sell signal also allows us to selectively short sell stocks and ETFs with relative weakness.

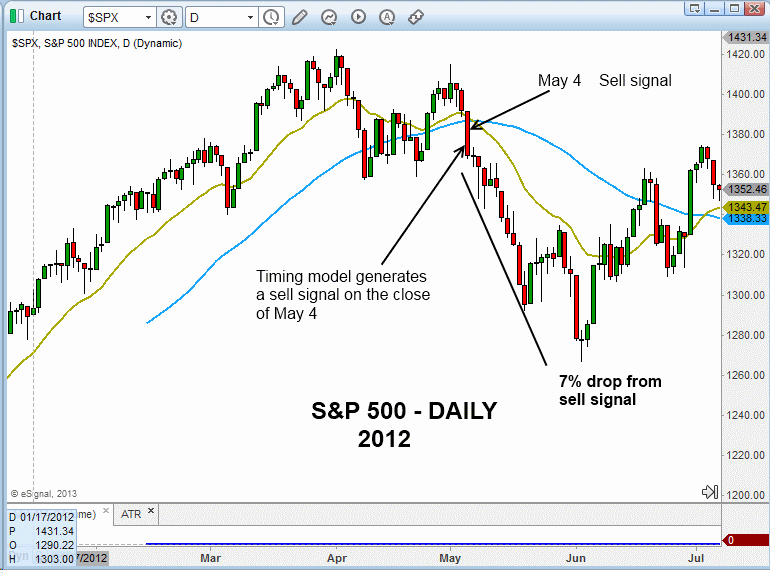

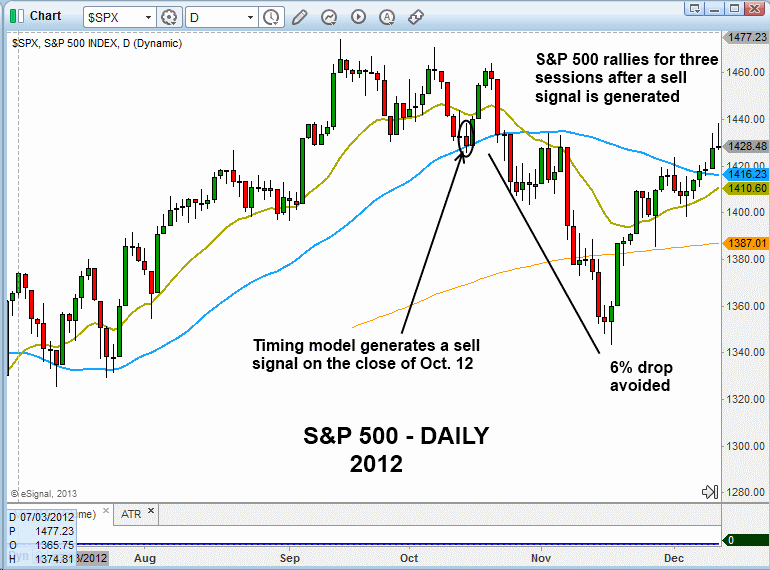

To clearly illustrate the different ways a market can behave after receiving a sell signal from our market timing model, the charts below detail the subsequent price action of two different intermediate-term sell signals generated by our market timing strategy in 2012:

After a decent rally in early 2012, the distribution days began piling up in late April and early May, forcing us out of several long positions by May 3 and generating a 100% sell signal on the close of May 4 (as annotated on the chart above). In this case, the timing of the signal was perfect, as the market plunged 7% over the next 10 sessions.

Following a very short-lived rally in August/September of 2012, the number of distribution days once again began increasing within a short period of time; leading individual stocks began falling apart as well. These are two of the main components (along with a few proprietary tweaks) that determine when our market timing model issues a new sell signal.

Given the bearish action described above, our market timing strategy generated a sell signal on the close of October 12, 2012. Although this prompted us to quickly exit our long positions, the stock market did not immediately come unglued this time.

Instead, there was a short-lived bounce that inevitably attracted some “late to the party” Charlies who were not paying attention to the bearish volume patterns. Nevertheless, after one day of stalling on October 18, the market sold off sharply, erasing all of its gains from August and September:

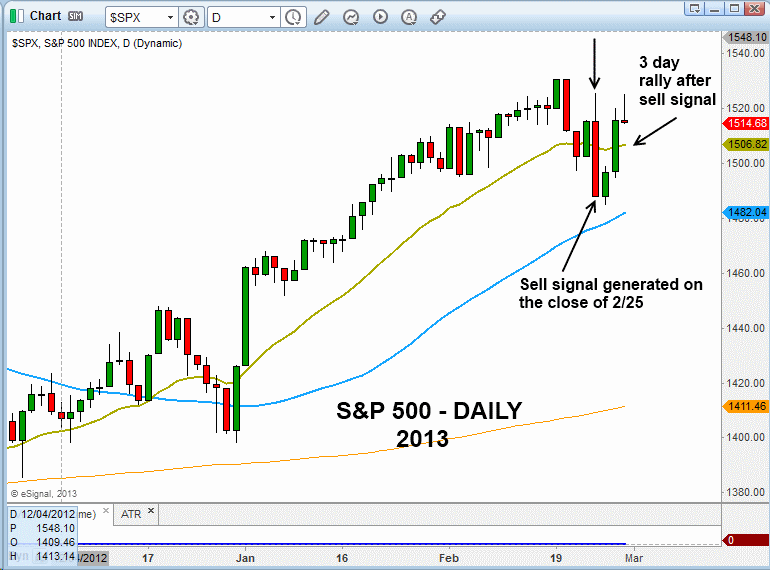

Finally, let’s look at our most recent sell signal that was issued on February 25, 2013 (just four days ago). Much like the price action that followed the most recent sell signal from October of 2012, stocks did not sell off right away. Rather, the broad market bounced higher for a few days:

As we are not prophets, we don’t know if the market will sell off sharply over the next few weeks. Nevertheless, we have not been willing to establish new long positions over the past few days (though we entered a few new short positions), because experience has shown us exactly what can happen when the volume patterns in the market suddenly turn bearish.

Although the market pushed higher on February 26 and 27, it did so on lighter volume. This followed three out of four big declines on higher volume. Yesterday (February 28), the market stalled, which reinforced the sell signal generated by our stock market timing model on February 25.

Quite a few supposed “gurus” claim that market timing doesn’t work, but those who believe this are clearly not following the right indicators. Broad market volume patterns, combined with poor performance by leading individual stocks, always play a crucial role in identifying significant market tops and bottoms.

Many investors make the mistake of focusing purely on price patterns or percentage gains of a broad-based index, while paying little or no attention to the market’s volume patterns.

When volatility increases, trading becomes quite emotional, which can easily lead to bad decisions and a ton of regret. The best way to remove (or at least minimize) emotions from trading is to follow a well-defined and disciplined trading strategy at all times.

Our proven system for market timing allows us to operate with confidence during stressful periods in the market. Are we wrong sometimes? Of course! But successful trading isn’t about being right or wrong (ego); rather, it’s about doing the right thing. When traders consistently do the right thing, the money eventually follows.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Navigating Volatile Stock Markets Through Rough Market Timing Seas

Published 03/03/2013, 03:11 AM

Updated 07/09/2023, 06:31 AM

Navigating Volatile Stock Markets Through Rough Market Timing Seas

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.