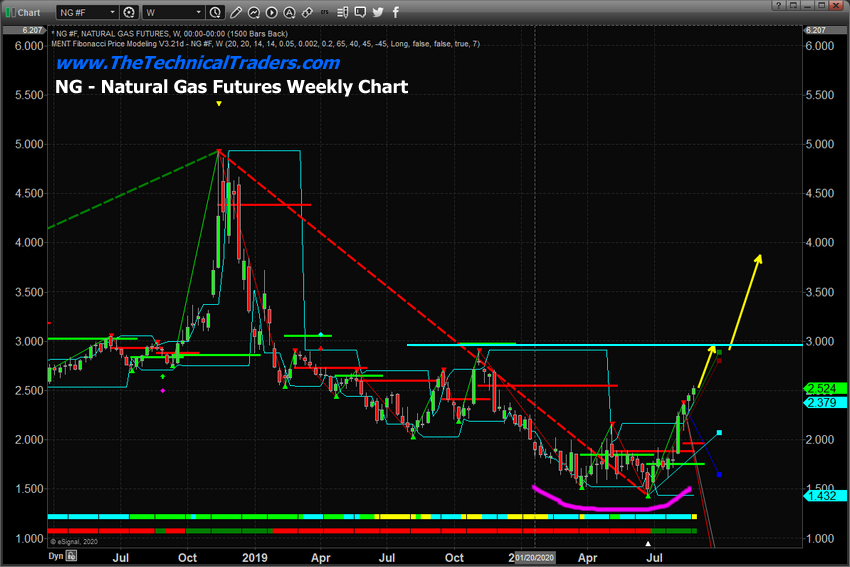

Quietly, as we've been focused on gold, silver and other symbols, natural gas has rallied above the $2.00 level and is starting to break higher again, targeting the $2.95 level. The very deep “rounded bottom” pattern that set up in early 2020 presented a very real opportunity for skilled technical traders by setting up multiple, very deep entry points. We wrote about these setups in a May article when Natural Gas broke $2.00 and again a few weeks ago when NG started its upside breakout move.

The current rally as seen in the chart below appears to be stalling near the $2.50~$2.55 level, which goes all the way back to the Fibonacci Predictive Modelling System trigger levels from April 2020 and October 2020 (see the RED LINES on the chart). We believe any stalling price levels near the $2.55 level will break out to the upside with a further rally attempting to target the $2.95 level. After that level is reached, there is a potential that a further upside price move may take place, but we would urge skilled traders to consider the $2.85 to $2.95 level as the “pull profit” level. Any further leg higher may, or may not, actually happen.

This move from the low $1.50 to $1.65 level in natural gas has resulted in a tremendous 70% upside price rally. Another $0.50 rally from current levels would represent a nearly 95% to 100% upside price rally from the ultimate lows near $1.43.

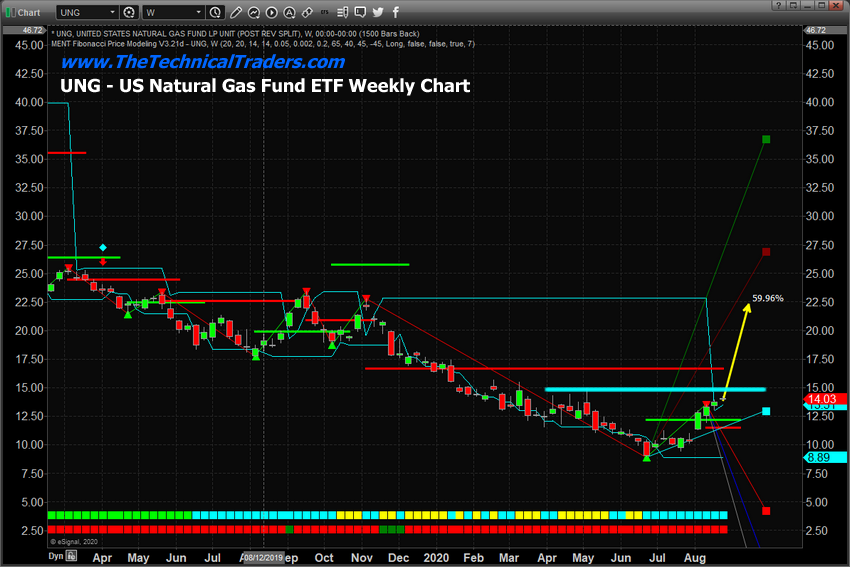

This last breakout rally may represent a solid 35% to 55% upside price opportunity for skilled technical traders in the United States Natural Gas Fund (NYSE:UNG). When looking at the UNG chart below, we believe that once UNG crosses the $15.00 price level, it will quickly attempt to target the $20 to $22 level if NG rallies to levels near $3.00. It should also be noted UNG has not rallied at a similar percentage price level to NG during this bottom/rally. As such, a breakout move in NG could prompt UNG to rally 70% or more – possibly targeting $22 or higher.