Although Nanoco's (LON:NANON) major US client will not progress to volume production in the foreseeable future, commissioning work continues on the new production capacity, which is scheduled to complete by December. Once that is completed, the facility will be able to produce high-quality infra-red nanomaterials for use in a number of electronics applications. It could therefore be used to service future demand from the US customer or potential new customers in the electronics or display industries with which Nanoco is in the early stages of discussion. The current market capitalisation appears to assign little value to these assets at a time when there appears to be renewed market interest in quantum dots.

FY19 performance reflects work for US customer

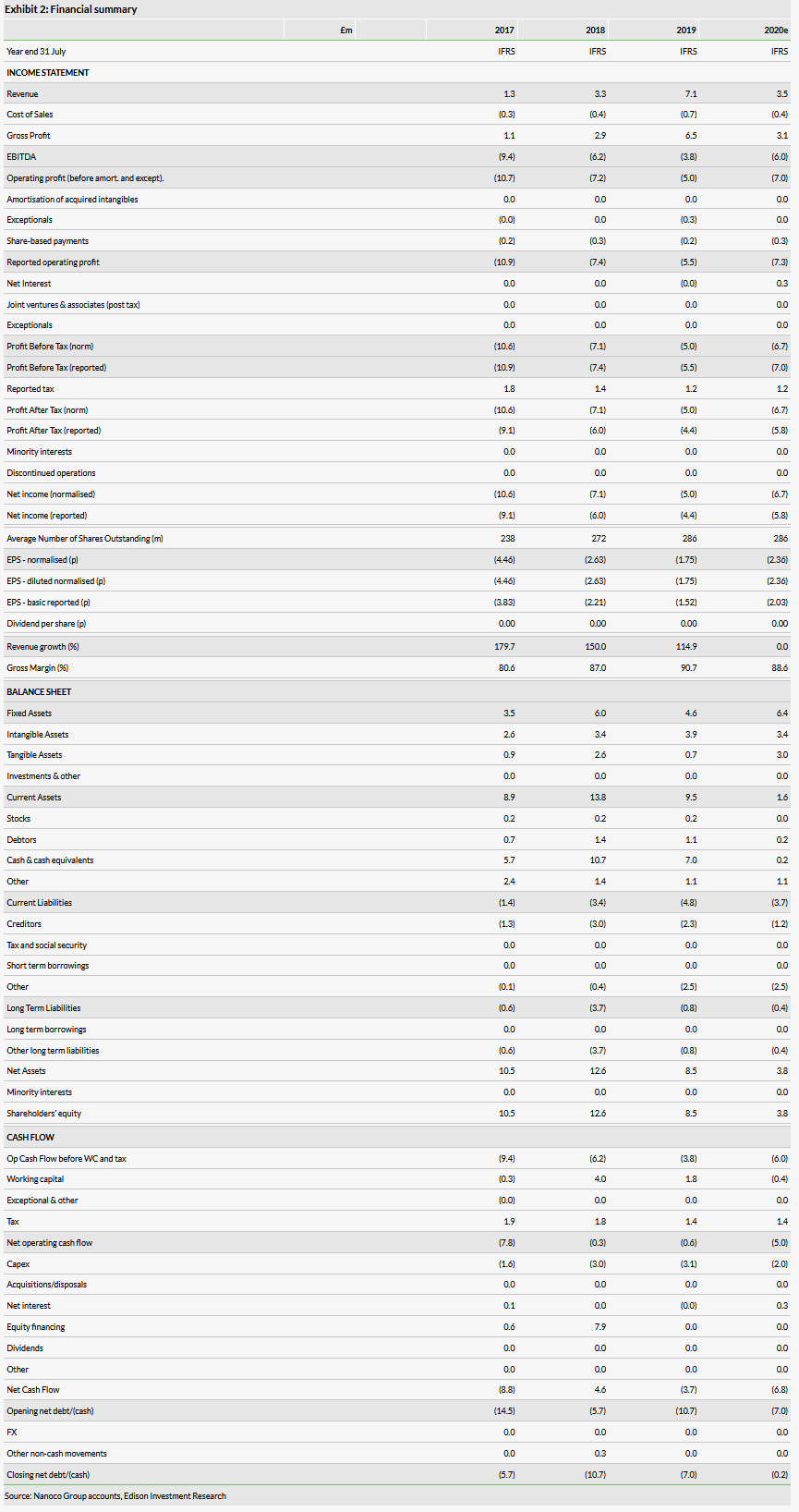

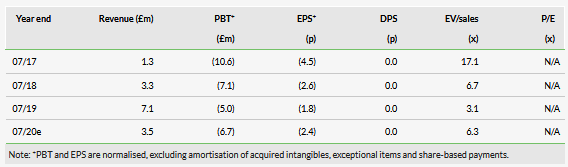

As flagged in the post-close trading update, Nanoco generated £7.1m revenues in FY19. This was more than double FY18’s level and slightly ahead of consensus because of the early delivery of some revenue under the major services contract. FY19 billings totalled £9.6m, including £2.4m as the final sum payable to complete the new Runcorn production facility. Operating losses, adjusted for exceptionals and share-based payments, narrowed from £7.2m to £5.0m. Cash at end FY19 was £7.0m, an increase of £0.8m since end January 2019.

FY20 estimates underpinned by contracts

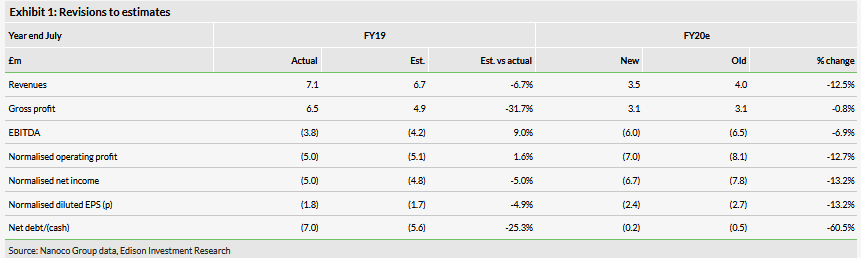

Our FY20 revenue estimate is backed by contracts, primarily from the major US partner, and has been revised downwards to reflect some revenues moving forward into FY19 (see Exhibit 1). With a fixed cash cost base of c £9m, management expects cash balances to be c £6m at end December 2019. On this basis, we estimate that current cash balances will last until summer next year, giving the company headroom to explore commercial and strategic options. We will release FY21 estimates when there is more visibility regarding execution.

Valuation: Share price fall does not reflect IP value

The share price is one-third of the level before the major US customer announced it would not continue when the current contract expires in December 2019. However, development activity in quantum dots appears to be accelerating across a number of applications and Nanoco is the largest IP holder in this field with c 750 patents. Moreover, it has a new, nearly fully commissioned manufacturing facility able to output significant volumes of nanomaterials. We believe that the current market capitalisation of £29m ascribes little value to this IP and asset base.

Share price performance

Business description

Nanoco Group is a global leader in the development and manufacture of cadmium-free quantum dots and other nanomaterials. Its platform includes c 750 patents and specialist manufacturing lines. Focus applications are advanced electronics, displays, lighting and bio-imaging.

Changes to estimates

We revise our FY20 estimates to reflect:

Valuation

As a reference point for the potential value of the assets, which include c 750 granted and pending patents as well as the fabrication facilities for quantum dots and sensor materials, we note that Samsung (KS:005930) acquired the IP of quantum dot competitor QD Vision (with a reported 250 patents) for $70m in 2016. Prior to the acquisition, QD Vision had been struggling with its products not gaining acceptance. We believe that Nanoco’s current market capitalisation of £29m takes little recognition of the company’s IP and asset base.