Nanoco Group Plc (LON:NANON) H1 results reflect the slow commercialisation cycle in display although H2 should improve significantly as the first payments from the company’s large, US-listed corporate partner boost revenues and cash flows. While visibility is still limited, the scale of investment and additional capacity being added indicate that the potential from this partnership is significant. Progress in lighting and medical imaging also remind us of the potential of Nanoco’s IP and expertise across a range of applications.

H1 results reflect slow progress in display

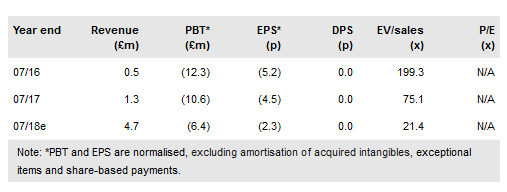

H1 results reflect the slow commercialisation cycle in display. The decline in revenues from £0.68m in H117 to £0.20m reflect primarily the absence of service and licence revenue. The loss before tax was £4.8m (£6.4m in H117), while net cash was £8.7m vs £5.7m at Y/E17, boosted by the £8.0m placing in November.

To read the entire report Please click on the pdf File Below: