Actionable ideas for the busy trader delivered daily right up front

- Monday higher, low confidence.

- ES pivot 1510.42. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

There were a few reversal signs last Thursday night but most of the technicals seemed at least mildly bullish so I called Friday higher and that's what we got - a 49 point advance in the Dow. That was the good news. The bad news is that we remain stuck in what is now a 10 day trading range. When will it all end? Or more to the point, how will it all end? Read on...

The technicals (daily)

The Dow: The Dow continues its down-up-down-up yo-yo-ing. The only discernible trend, if you can call ti that is that its been making higher lows for the last three days. But we remain stalled in the face of strong resistance just above 14K. The indicators have actually come off overbought in the past week so there might be some room to run - if Mr. Market can ever find first gear. Bottom line, there's still no direction on this chart. But if we don't get moving soon, it's beginning to look more like a topping process than simple consolidation.

The VIX: The VIX gapped down on Friday to finish just above 13, breaking six month support and remaining in a descending RTC. With no further support til 12.50, a lower BB at 12.14, and indicators still not yet oversold, I'd guess that we might move lower again on Monday.

Market index futures:Tonight all three futures are barely up at 1:03 AM EST with YM and NQ both up just 0.04% and ES dead flat. This follows the recent pattern.and feels more like the dog days of August than the middle of winter. We did however put in a strong showing on Friday to keep ES at the upper end of its rising RTC. And with indicators still not yet overbought and the upper BB continuing to run away, now at 1522.46, logic would seem to indicate that there's still more upside possible here on Monday. ES (and SPX) seems to be gearing up for a run at the all-time ES high of 1576 from October 2007.

ES daily pivot: Tonight the pivot rises from 1503.58 to 1510.42. Despite this, we remain above the new number, though just by two points. But as long as we don't break under, it's bullish.

Dollar index:After a big gain last Thursday, the dollar tacked on another 0.07% to touch its upper BB and move to overbought levels. .The dollar hasn't really been respecting its upper BB too well lately, so while the caution flag is out, it's still to early to call a move lower. I'll be looking to Monday for some clarification.

Euro: The euro continued its recent plunge on Friday, contrary to my expectations. But I might have been just a day early as it is up 0.11% in the Sunday overnight trade. Still, there's no definitive sign yet that the euro slump is over - the indicators still aren't even oversold yet.

Transportation:The trans have now retraced all of their losses and then some from that one big down day January 30th, establishing a new rising RTC. However, Friday's 0.41% gain drove them into overbought territory. There's still no reversal sign in the candles though so it's too early to call a top here - more upside possible Monday.

Tonight the technicals are looking a lot like they were last Thursday night - some reversal warnings but no strong pull either up or down. It's also an op-ex week and a pre-holiday one at that, with all the usual brou-ha that implies. But I guess the logical course is the same as last Thursday - in the absence of clear bearish signs, the thing to do is keep following the trend and call Monday higher. I'd be more comfortable if I had a better reason for saying that, but you gotta play the hand you're dealt.

ES Fantasy Trader

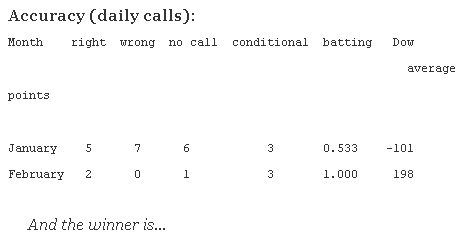

Portfolio stats: the account remains at $98,750 after 5 trades (4 for 5 total, 1 for 1 longs, 3 for 4 short) starting from $100,000 on 1/1/13. Tonight with no clear direction we're going to stand aside once again and will continue to do so until I see a trend developing one way or the other.