Milacron Holdings Corp. (NYSE:MCRN) delivered adjusted earnings per share of 34 cents in second-quarter 2019, surpassing the Zacks Consensus Estimate of 32 cents. However, the bottom line declined 26% on a year-over-year basis.

Including one-time items, the company reported earnings per share of 7 cents in the second quarter, down 68% from the year-ago quarter’s figure of 22 cents.

Operational Update

Milacron’s revenues fell 10.6% year over year to $271.40 million during the second quarter. The top line missed the Zacks Consensus Estimate of $283 million. Excluding unfavorable impact of currency movements, revenues decreased 8.3% from the prior-year quarter figure. New orders in the reported quarter declined 26.4% year over year to $235.7 million.

Milacron Holdings Corp. Price, Consensus and EPS Surprise

Selling, general and administrative expenses fell 5% year over year to $58 million. Adjusted EBITDA went down 19% to $49.1 million in the reported quarter from $60.6 million in the prior-year quarter. Adjusted EBITDA margin contracted 190 bps to 18.1% in the quarter.

Segmental Results

Advanced Plastic Processing Technologies: Net sales declined 6% year over year to $138 million. Excluding $1.6 million of unfavorable impact of currency movements, sales declined 4.4% from the prior-year quarter. Adjusted EBITDA was up 2.6% year over year to $20 million.

Melt Delivery and Control Systems: Net sales declined 16% year over year to $104 million. Excluding unfavorable impact of currency movements of $4.3 million, sales decreased 12.8% from the prior-year period. Adjusted EBITDA slumped 27.4% year over year to $29 million.

Fluid Technologies: Sales for the reported quarter fell 11.9% year over year to $30 million. Sales dropped 8.3% from the year-ago period, excluding $1.2 million of unfavorable currency-movement impact. Adjusted EBITDA was $6 million, down from the prior year’s $8 million.

Financial Update

Milacron reported cash and cash equivalents of $152 million at the end of the second quarter, down from $184 million reported at the end of 2018. Net cash provided from operating activities were $1.1 million during the six-month period ended Jun 30, 2019, compared with $31.1 million reported in the comparable period last year. Long-term debt was $825 million as of Jun 30, 2019, compared with $829 million as of Dec 31, 2018.

Merger Update

As announced on Jul 12, 2019, Milacron entered into an agreement with Hillenbrand, Inc. (NYSE:HI) , per which Hillenbrand will acquire Milacron in a cash-and-stock transaction, valued at $2 billion. The deal includes Milacron’s net debt of $686 million as of Mar 31, 2019. The transaction is expected to close in the first calendar quarter of 2020.

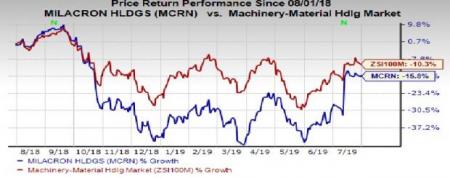

Shares of Milacron have fallen 15.8% in the past year compared with the industry’s decline of 10.3%.

Zacks Rank and Key Picks

Milacron currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are CECO Environmental Corp. (NASDAQ:CECE) and UFP Technologies, Inc. (NASDAQ:UFPT) , both of which carry a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

CECO Environmental has a projected earnings growth rate of 82.8% for the ongoing year. The company’s shares have rallied 35% over the past year.

UFP Technologies has a projected earnings growth rate of 5.71% for the ongoing year. The company’s shares have rallied 33% over the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

UFP Technologies, Inc. (UFPT): Free Stock Analysis Report

Hillenbrand Inc (HI): Free Stock Analysis Report

Milacron Holdings Corp. (MCRN): Free Stock Analysis Report

CECO Environmental Corp. (CECE): Free Stock Analysis Report

Original post

Zacks Investment Research