Microchip Technology Inc. (NASDAQ:MCHP) recently provided an update on fourth-quarter fiscal 2020 outlook.

The company now anticipates fiscal fourth-quarter consolidated net sales growth to be flat sequentially compared with the previous guidance of 2-9% sequential growth.

Per the press release, management is revising the range of revenues due to high demand in Asia, especially China, as a result of the coronavirus outbreak.

Further, the company notes that customers are returning to work at a slower pace than expected. Also, Microchip’s supply chain is taking a lot longer to normalize than the company initially expected.

Notably, the revised guidance indicates a decline of 3.2% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for revenues is pegged at $1.36 billion, which indicates year-over-year growth of 2.1%.

Markedly, shares of the company dropped approximately 1.01% in the pre-market, following the guidance revision.

Other Notable Point

The company provided no other updates on the remaining financial metrics. Per the previous guidance provided in the last earnings call, non-GAAP earnings per share were projected in the range of $1.32-$1.20 per share (mid-point $1.26). The projected figure indicated a decline from $1.48 reported in the prior-year quarter.

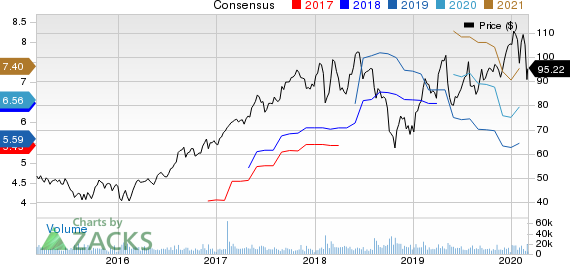

In the past 30 days, the Zacks Consensus Estimate for fiscal fourth-quarter earnings moved up 3.6% to $1.43 per share. The consensus mark indicates a decline of 3.4% from the year-ago quarter’s figure.

Q3 at a Glance

Microchip reported third-quarter fiscal 2020 non-GAAP earnings of $1.32 per share, which beat the Zacks Consensus Estimate by 4.8%. Net sales of $1.29 billion (on a non-GAAP basis) beat the Zacks Consensus Estimate by 1.06%.

Wrapping Up

Despite headwinds in China, strong demand in the United States and Europe bodes well for the company.

Microchip is also benefiting from robust demand for 8-bit, 16-bit and 32-bit microcontrollers. The company is well poised to gain from strong demand for memory and analog as well as interface products.

Moreover, the company is well poised to capitalize on synergies from accretive Microsemi and Amtel acquisitions as well as expand total addressable market.

Further, Microchip expects design wins for its latest PolarFire solutions to boost FPGA revenues in the upcoming days. The company is also optimistic about the growing clout of microcontrollers, primarily the latest Bluetooth 5.0 dual-mode audio solutions.

Zacks Rank & Other Stocks to Consider

Currently, Microchip sports a Zacks Rank #1 (Strong Buy).

Few top-ranked stocks in the broader technology sector are Applied Materials, Inc. (NASDAQ:AMAT) , Garmin Ltd. (NASDAQ:GRMN) and Microsoft Corp. (NASDAQ:MSFT) . All the three stocks sport a Zacks Rank #1, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Applied Materials, Garmin and Microsoft is currently pegged at 9.9%, 7.4% and 13.2%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Microchip Technology Incorporated (MCHP): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Original post

Zacks Investment Research