Key milestones for MGC Pharmaceuticals Ltd (AX:MXC) in 2019 include the launch of CannEpil sales in Australia, finalising contracts for the construction of a cannabis production and cultivation facility in Malta, and initiation of a Phase II study of CogniCann in dementia. The company has completed the sale of MGC Derma to CannaGlobal, which was announced in September. The transaction was restructured in November, which sees us reduce our valuation of the consideration to A$7.5m (vs A$12.5m). We adjust our valuation to A$135m (vs A$140m) due to the lower transaction valuation.

Regulatory approval for CogniCann dementia trial

The TGA (regulator) has granted formal approval for the company’s Phase II study of its GMP-certified CogniCann medicinal cannabis product. The study will evaluate the impact of CogniCann on behaviour (including agitation and aggression), quality of life, discomfort and pain in dementia patients in residential aged care facilities.

CannEpil available for sale in Australia

The first shipment of CannEpil produced at the company’s GMP-certified facility in Slovenia arrived in Australia in December. CannEpil, the company’s high-CBD cannabis extract, can be sold as an investigational medicinal product under the Authorised Prescriber Scheme in Australia to treat refractory epilepsy and other conditions. MGC plans to develop CannEpil as a registered pharmaceutical drug.

Design completed for Malta production facility

MGC has completed all architectural plans for its GMP-certified medicinal cannabis production and cultivation facility in Malta, under an agreement reached with the government in April 2018. The next step will be the execution of a long-term lease agreement, followed by the commencement of construction.

Sale of MGC Derma cosmetics business completed

The sale of MGC Derma to the private Canadian cannabis investment company CannaGlobal was completed on 29 January. Consideration was revised in November to be 10% of the equity in CannaGlobal, giving MGC a greater equity holding in CannaGlobal compared to the original binding term sheet, which comprised upfront and milestone equity payments that MGC valued at C$12.5m, plus repayment of a C$2.5m loan – total value up to C$15m (A$16m). It is difficult to ascertain the value of this 10% of CannaGlobal as the shares will not be listed.

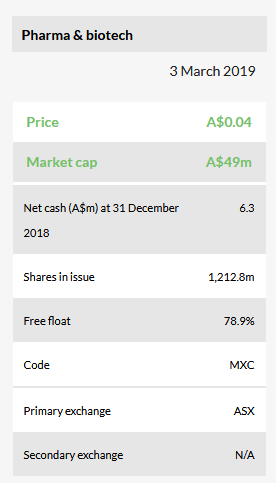

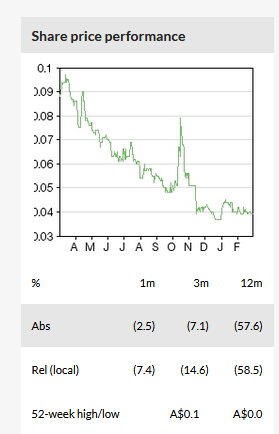

Valuation: A$135m or A$0.11 per share

We adjust our valuation to A$135m or A$0.11/share (vs A$140m or A$0.11 per share). CannaGlobal has shelved plans for a stock exchange listing, which leads us to discount our previous valuation of the MGC Derma transaction by 40%, to A$7.5m (vs A$12.5m). Cash of A$6.3m should support operations into FY20.

Business description

MGC Pharmaceuticals (ASX: MXC) is an Australia-headquartered specialist medical cannabis biopharma company, which has most of its operations based in Europe. Management has many years of technical, clinical and commercial experience in the medical cannabis industry.

CannEpil available for supply in Australia

MGC has received a permit from the Slovenian Ministry of Health granting it permission to extract phytocannabinoids at its GMP-certified Manufacturing Facility in Ljubljana (including THC, CBD and other phytocannabinoids), and to develop new phytocannabinoid formulations. The first shipment of CannEpil manufactured at the facility arrived in Australia in December.

The CannEpil product is available for sale as an investigational medicinal product (IMP) under the Therapeutic Goods Administration’s (TGA) Authorised Prescriber Scheme. The scheme allows authorised doctors to prescribe investigational cannabis-based medicines for use by patients. The authorisation by the TGA follows endorsement by the Human Research Ethics Committee at St Vincent’s Hospital Melbourne of the use of CannEpil in adult patients with treatment-resistant epilepsy. MGC has appointed HL Pharma to distribute CannEpil in Australia.

CannEpil will also be produced at the Ljubljana facility for sale into eligible European markets.

Architectural plans completed for Maltese facility

MGC has completed all architectural plans for its GMP-certified medicinal cannabis production and cultivation facility in Malta, following the release by the Maltese Medical Authority of guidelines on the manufacturing and cultivation of cannabis for medicinal and research purposes. Formal contracts with Maltese government authorities for a long-term lease are expected to be signed in the coming weeks, following by the commencement of construction. The lease negotiations are the next step in the process that began when MGC signed a binding letter of intent with the Maltese government in April 2018 for the establishment of a 4,000m2 medicinal cannabis facility.

The company expects to be able to leverage the key expertise that it developed as it obtained EU GMP certification for its Slovenian medical cannabis manufacturing and production facility in order to expedite development in Malta.

Thanks to its warm climate, the Maltese facility is expected to produce high-yielding cannabis crops at a relatively low cost. Once operational, it will become the hub of the company’s seed-to-pharma operations focused on supplying key markets in Europe, the UK and internationally.

Sale of MGC Derma completed

On 29 January MGC completed the sale of its MGC Derma cosmetic business to the unlisted Canadian cannabis investment company CannaGlobal, after announcing it to the market on 27 September 2018. CannaGlobal, founded by Canadian cannabis industry leader Lorne Gertner, is a diversified, growth-focused, Toronto-based holding company, with a global portfolio of cannabis assets.

The total consideration for the sale was a single upfront payment of 10% of the equity in CannaGlobal, plus a five-year CBD and cosmetic materials supply agreement, as outlined in the definitive sales agreement announced on 13 November. MGC has received cleared funds for the C$0.5m payment for the first order of CBD materials under the agreement.

The consideration was revised compared to the initial terms announced in September, which was to comprise C$9m in ordinary shares in CannaGlobal at settlement, C$3.5m of shares payable on the achievement of certain revenue milestones, plus the future repayment of an existing C$2.5m working capital loan owed to MGC by MGC Derma.

The valuation of the equity consideration disclosed in MGC’s 27 September announcement of the deal was based on CannaGlobal’s intention to seek a listing on one of the Canadian stock exchanges. However, Canadian cannabis stocks experienced a sharp sell-off after recreational cannabis became legal in mid-October, following a strong run-up in the preceding two months. As a result, the Canadian Marijuana Index has fallen by 17% since the MGC Derma transaction was announced, declining from 780 on 27 September 2018 to 650 on 15 February, after reaching a low of 422 on 21 December.

Given the change in the investment environment, and due to the terms of the new financing arrangements with its major shareholder, CannaGlobal no longer intends to seek a stock market listing.

We have taken a conservative approach to valuing the 10% CannaGlobal shareholding. Firstly, in our initiation report published in October 2018, we excluded the C$3.5m of shares that were contingent on MGC Derma achieving certain revenue milestones, when we valued the total consideration at A$12.5m. With the intention now being for CannaGlobal to remain private, we apply a somewhat arbitrary 40% private company discount to our previous valuation of MGC Derma, which further reduces the valuation of the consideration from A$12.5m to A$7.5m. We will review this valuation of the 10% CannaGlobal shareholding when we have more visibility as to CannaGlobal’s operational performance.

The definitive sales agreement also stipulates that if, within 12 months of completion, MGC enters into a transaction with a third party introduced by CannaGlobal or any of its directors, which results in a takeover of MGC or the sale of its assets, the company must pay CannaGlobal an introduction fee of 5% of the transaction value.

TGA approves CogniCann dementia study

The TGA has granted formal approval under the Clinical Trials Notification Scheme (CTN) for the company to conduct a Phase II trial into the benefits of CogniCann in dementia and Alzheimer’s disease patients. The CTN approval is the final regulatory step required to initiate the study, which is expected to get underway in H119. The trial leverages IP secured through the company’s Medical Advisory Board, led by Professor Uri Kramer, which is based on experience gained through the use of medicinal cannabis products in Israel.

The study will be conducted in partnership with the Institute for Health Research at the University of Notre Dame in Western Australia, which has already granted ethics approval. The 16-week trial will use a randomised, double-blind, crossover, placebo-control design to evaluate behavioural changes, quality of life, level of discomfort and pain in 50 dementia patients aged 65 years and older living in residential aged care facilities.

GMP CannEpil now available for a Phase II epilepsy study

In February 2017 MGC announced that it intended to undertake a Phase II safety and efficacy study of CannEpil in children and adolescents with treatment-resistant epilepsy, and had received ethics approval to conduct the study at the University Children’s Hospital Ljubljana, Slovenia. The trial was to be a Phase IIa crossover study to compare the response following six weeks of treatment with CannEpil to treatment of the same individuals with a pure synthetic CBD that has already been studied at the hospital. The primary endpoint of the study was to be a reduction in the frequency of seizures.

Now that the company is able to manufacture GMP-grade CannEpil product, we expect it to move forward with a clinical trial in epilepsy patients. While it has not yet laid out a timeline for moving forward with the study, we believe that such a study would be an important step towards MGC’s goal of developing CannEpil as a registered medicine for the treatment of refractory epilepsy.

Research collaborations to support longer-term growth

MGC has established a number of research collaborations as it seeks to better understand the potential applications of medicinal cannabis, in order to develop new products and improved production processes.

For example, it has established CannaHub in collaboration with RMIT University in Melbourne, Australia, and the Hebrew University of Jerusalem. CannaHub will be an international shared library containing research, data and analytical information on medicinal cannabis and its potential uses. While all findings will remain the property of the CannaHub partners, MGC will have the first right to use or acquire any data or findings from the hub for commercial purposes.

In another example, at the University of Ljubljana, genetic research into cannabis strains has succeeded in producing flowers with varying levels of THC (tetrahydrocannabinol) and CBD (cannabidiol) content. The research aims to develop high THC and high CBD strains for the treatment of specific disease symptoms.

MGC has formally partnered with Epilepsy Action Australia (EAA) and created an online platform dedicated to providing education and information on medicinal cannabis and epilepsy, including information on how to access medicinal cannabis as a patient.

SME certification brings cost savings and improved access

MGC recently became the first Australian Medical cannabis company to obtain SME (small and medium-sized enterprise) qualification from the European Medicines Agency (EMA). This qualification allows the company to apply for scientific advice and assistance with drug evaluation and registration of CannEpil, CogniCann and all of the company’s cannabis-based medicines currently under development. It also gives the opportunity to obtain fee reductions of up to 100% during the evaluation and registration process of priority medicines which address an unmet need, and up to 90% for other medicines.

Valuation

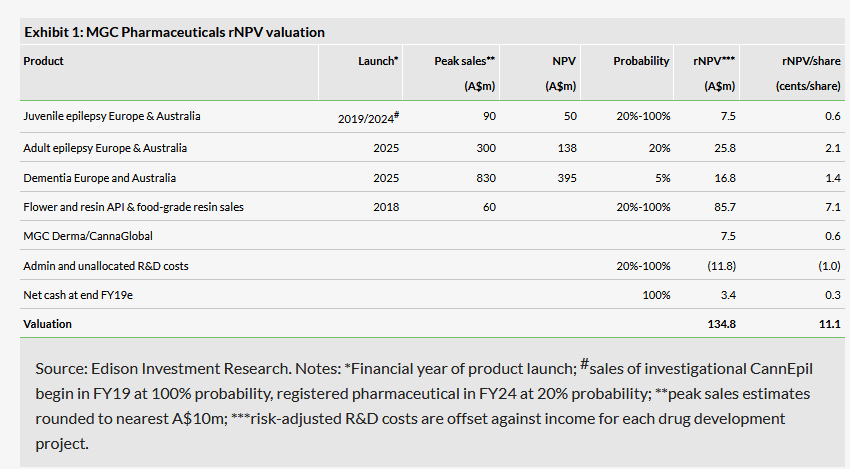

We adjust our valuation to A$135m from A$140m, due to the 40% private company discount applied to the MGC Derma sale consideration. Our valuation is based on a 15-year, sum-of-the-parts risked DCF valuation model of the company’s CannEpil product for epilepsy and CogniCann for dementia in Europe and Australia, as well as API sales of cannabis flowers and resin. We assume 3% annual market growth, but do not include any terminal value. Taking into account the 1,213m shares in issue, our valuation is equivalent to A$0.11 per share (we have removed the 100m performance shares that expired on 15 February 2019 from our valuation model). On a fully diluted basis, our valuation is also A$0.11 per share, after taking into account 95m options and performance rights that would be in-the-money if the stock traded in line with our basic valuation. Exhibit 1 summarises the key assumptions and constituent parts of our valuation. We use a 12.5% discount rate and apply an average tax rate of 10% from 2022 onwards. The company does not currently have patent protection for its product pipeline.

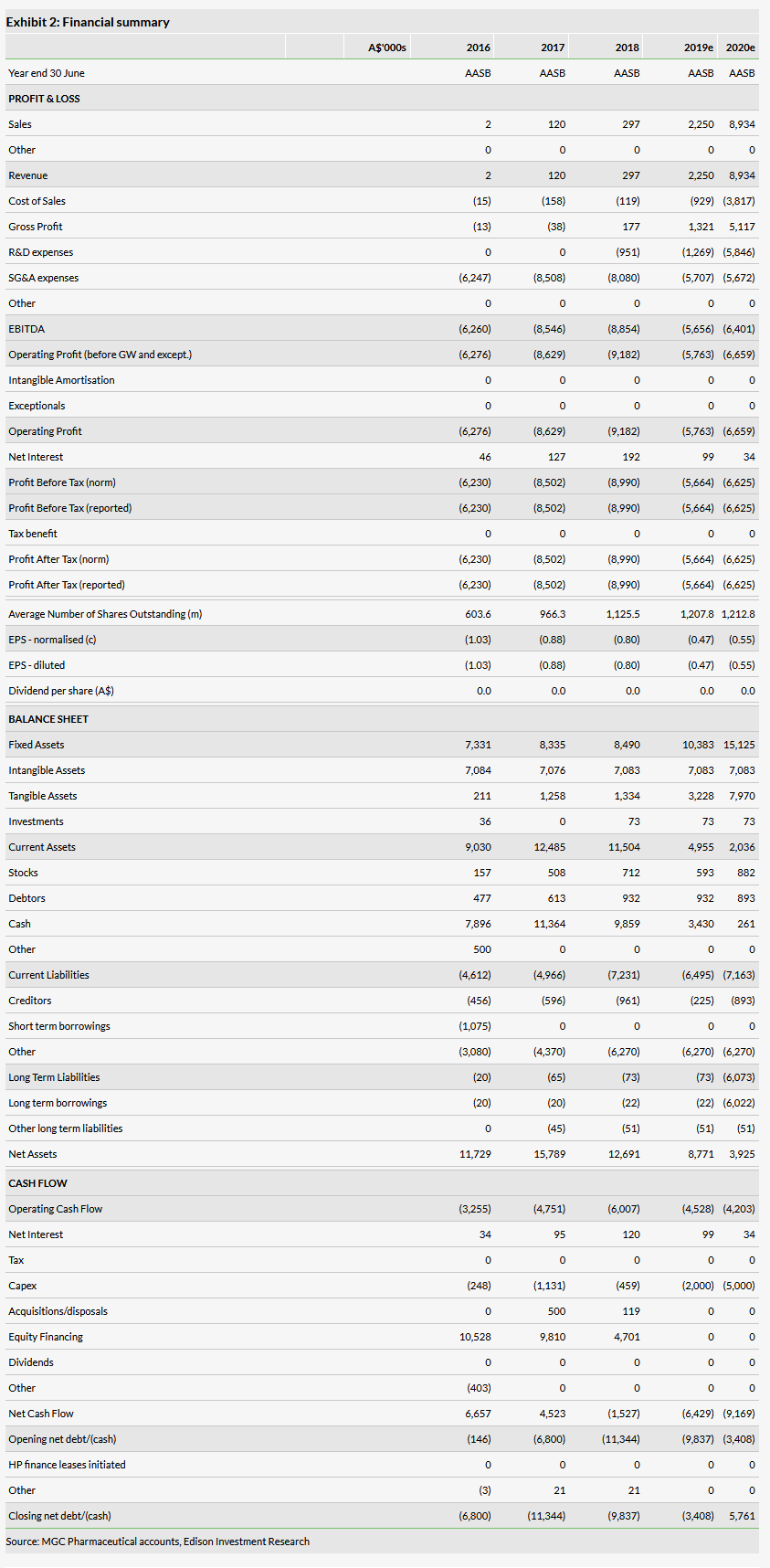

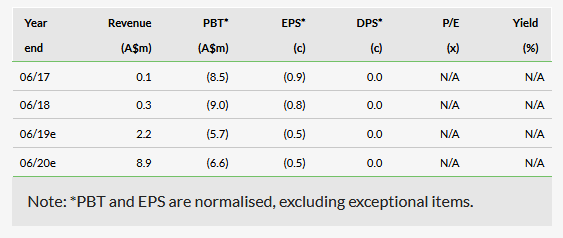

Financials

MGC has been loss making since listing in February 2016, reporting losses of A$6.2m in FY16, A$8.5m in FY17 and A$9.0m in FY18. We forecast smaller PBT losses of A$5.7m and A$6.6m in FY19 and FY20 respectively, as it commences commercial sales of API in Europe and of CannEpil as an Investigational Medicinal Product in Australia. We forecast R&D expenses of A$1.3m in FY19 and A$5.8m in FY20.

We assume that expansion of cannabis-growing and API extraction capacity to support 10,000m2 of greenhouse space by 2021 will require capital expenditure of A$10m. The company raised net proceeds of A$10.5m from stock issues in FY16, A$9.8m in FY17 and A$4.7m in FY18. The current cash balance of A$6.3m should be sufficient to support operations into FY20. We estimate that additional funds of A$6m will be required in FY20 to support construction of the new facilities in Malta, which we model as indicative long-term debt.