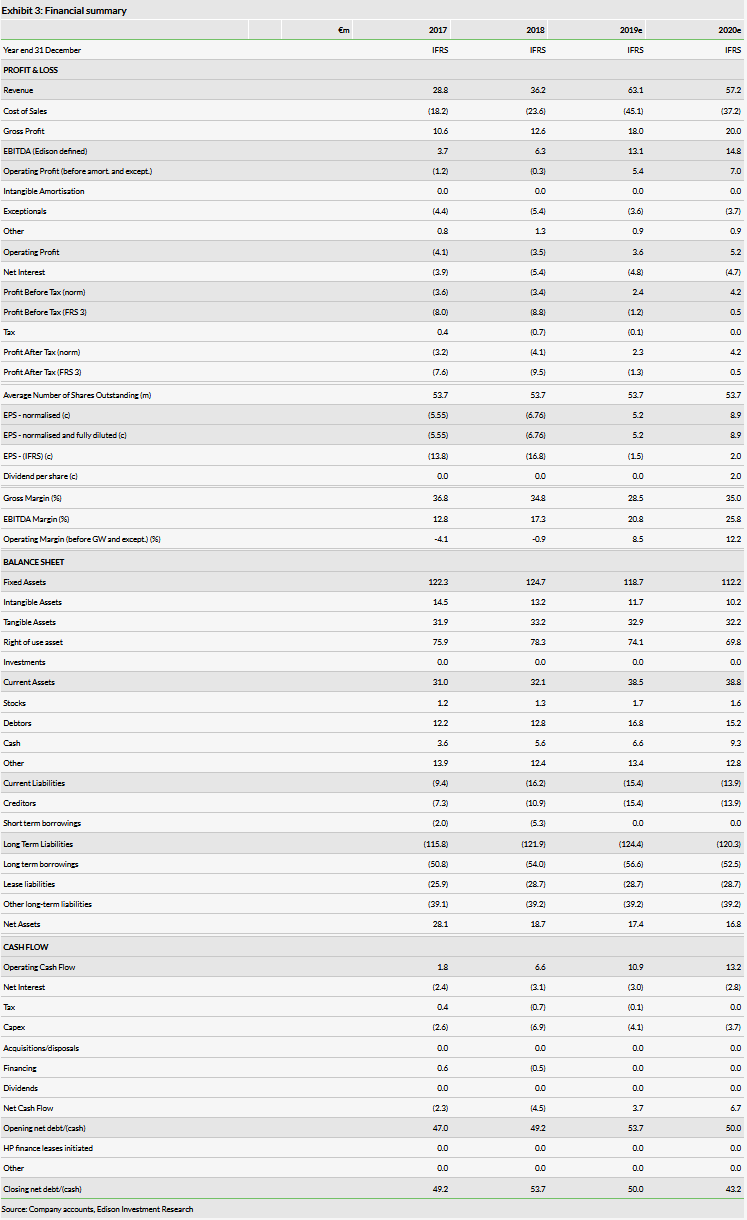

With a strong revenue and profit contribution from the Suriname contract, H119 group performance was excellent. The timing of the project should mean there is a stronger H219 performance, although FY20 group revenue prospects are impaired by the anticipated end to activity early in the year. Existing prospects in Cyprus, Egypt and elsewhere support our FY20 estimates and should be augmented by several major new projects that could be captured in the coming months for both the ILSS and OCTG divisions. Medserv’s international expansion with an increasing number of IOCs is spreading the risk, and for the time being we expect the company to deliver progressively improving profitability and cash flows.

H119 trading improves significantly

H119 trading was strong, with revenues up 65% to €29.9m, largely as a result of the start of the Suriname contract, as well as increased activity in Egypt for the ILSS (integrated logistics and support services) segment. OCTG (oil country tubular goods) saw a more modest increase aided by better returns in Iraq. Adjusted group EBITDA rose 81% to €6.2m (H119: €3.4m) with all business units contributing positively. Group operating profit swung from a loss of €1.0m in H118 to a profit of €1.5m. After finance and tax, the company still recorded a net loss for the period and there was a modest cash outflow resulting from an increase in receivables. Adjusted net debt (excluding lease liabilities) rose €0.9m to €54.6m.

Improving contract supports profit growth

Medserv PLC (MT:MDS) expects to deliver against its Financial Analysis Summary (FAS) forecast published in May (FY19 sales €64.2m, EBITDA €14.1m). Suriname should increase its contribution, as should other ILSS operations in Cyprus and Egypt and OCTG. We expect the Suriname contract to end in March 2020, with a €20m lower FY20 revenue contribution partially offset by growth of other existing contracts. Medserv has significant opportunities to expand its contract portfolio in both ILSS and OCTG. Some major awards should be made in H219, which may be incremental to our FY20 estimates. Some of the receivables have already unwound, and with improved earnings we expect a fall in adjusted net debt by the year end.

Valuation: Undemanding rating as earnings recover

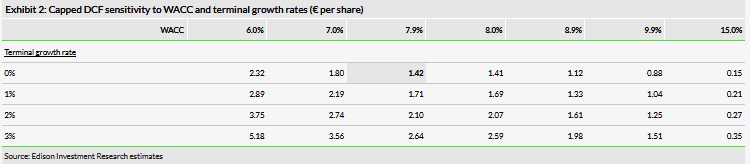

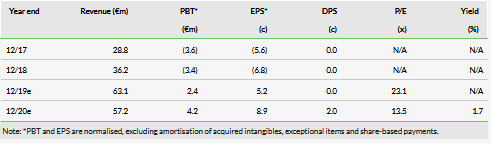

Our estimates are unchanged, and we continue to forecast progressive EBITDA growth. We envisage potential upside if incremental long-term contracts are won in H219. An FY20e P/E ratio of 13.5x remains undemanding. Our capped DCF returns a value of €1.42 per share (previously €1.33) due to a lower calculated WACC.

Business description

Medserv is a Malta-based provider of integrated offshore logistics and services in support of drilling operations in the Mediterranean, MENA and South America. The acquisition of the METS companies in February 2016 diversified the company into onshore steel tube stockholding and servicing for countries in the Middle East and beyond.

H119 results

Medserv’s H119 trading produced a strong advance in revenues and profits, allowing management to reaffirm expectations for the full year. These appear to mark a step change in performance compared to the challenging market conditions experienced over the last few years. The key highlights were:

Revenues of €29.9m (H118: €18.1m) were up 65%, supportive of anticipated growth for the year as a whole. The bulk of the increase was accounted for by the initial contribution from the $30.6m 15-month Suriname contract, where drilling activity commenced in Q219 after mobilisation in Q119.

Gross profit more than trebled to €3.8m (H118: €1.2m), a margin of 12.6% compared to 6.4% in H118. The improvement is despite the lower-margin nature of much of the initial work being undertaken in Suriname, for example vessel chartering.

Company adjusted EBITDA increased 81% to €6.2m (H118: €3.4m), which compares to an FY18 EBITDA of €7.3m.

A reported operating profit of €1.5m (H118: loss €1.0m) was also a sign of improving returns and on an adjusted basis (ignoring PPA and contract cost amortisation) the company generated an operating profit of €2.4m compared to break even in the prior year.

The major cash flow feature was an increase in trade receivables, which relates to two main factors. One is the structure of the payment terms in the Suriname contract, which as a reminder is the first service management contract Medserv has undertaken. In addition, there were some outstanding invoice payments in Malta, which we believe have now been settled.

Net debt at the end of the period had risen modestly to €54.6m (FY18: €53.7m). Absent of the receivables factors, net debt would have declined at the half year and as some of the increase has already unwound in H219 this gives us confidence in our net debt reduction for FY19 overall.

Outlook

Our estimates remain unchanged at present following the positive first-half performance. Indeed, in the commentary accompanying the results, management expects the FAS forecast for FY19 sales of €64.2m and adjusted EBITDA of €14.1m to be met. Allowing for non-inclusion of other operating income in our EBITDA definition, our estimates remain slightly below the company’s forecast.

In ILSS, we expect existing contractual activity in Cyprus and Egypt to expand into 2020 as drilling activity increases following recent major discoveries. Malta workload for offshore Libya is underpinned by two new major structure projects in the Bahr Essalam gasfield. OCTG should benefit from consistency in its Oman operation. The recovery of the Iraqi operation, which were profitable in H119, should continue as it is seeing an increase in potential projects, with growth now anticipated by management into 2020.

Encouragingly, the prospective new business opportunities for each segment continue to look positive. In ILSS, additional tenders for shore-based management are being sought in Egypt, and the neighbouring offshore markets appear to be opening up. While the current contract in Suriname is scheduled to end in March 2020, as we reflect in our estimates, management is working hard to extend the company’s presence there, as well as in adjacent territories. There is a potential for cross selling of tube services in this region for OCTG.

OCTG also appears well positioned to benefit from the recent award by the Abu Dhabi National Oil Company (ADNOC) for the provision of significant casing and tubing volumes spread over several years to three tube manufacturers: Tenaris, Marubeni and Vallourec. Management’s target is to try to secure supply chain management contracts similar to the agreement with Sumitomo in Oman. Volumes overall would be larger than in Oman but scale of activity for Medserv will depend on the success of discussions and contract negotiations.

The potential for a new machine shop in Uganda also remains live, and is awaiting final government approval of the investment in the pipeline project.

While an ending to the activity in Suriname may impair revenue growth in FY20, we feel the proliferation of new projects and expansion of existing base support and tube services activity should drive a higher-margin performance for the group.

Update on strategic shareholding process

Following on from the 20 May 2019 update, Medserv gave a brief update in the interim statement on the search for a strategic purchaser for the holdings of the two major shareholders, Anthony Diacono and Malampaya Investments, which total 65.5% of the share capital. The company indicates that the due diligence process is ongoing and that it will provide further information to the market when appropriate to do so.

Valuation

In terms of progress, we feel that Medserv has turned a corner in terms of scale and financial performance, which allows a lower risk attribution to the group’s prospects. As such, we have reduced our cost of equity to 10% from 11% previously, which reduces our calculated WACC to 7.9% from 8.1%. As a result, our DCF valuation increases to €1.42 per share from €1.33 previously.