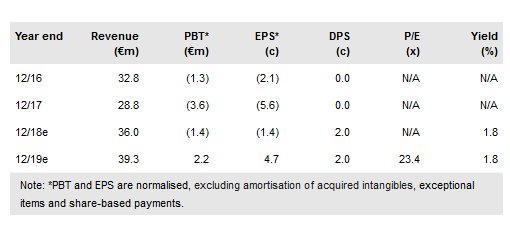

Medserv's (MT:MDS) strategy to expand its geographic reach and range of services is bearing fruit. FY17 was affected by lower than expected demand and project delays, but Q118 results show strong progress and the order backlog underpins future revenue performance. A change of management and key shareholders at an early stage to source a strategic purchaser have also been announced. We reduce our FY18 estimates on the lower run rate out of FY17 and introduce FY19 estimates.

FY17 affected by demand but Q118 shows progress

Reported FY17 revenues of €28.78m (FY16 €32.82m) were slightly up against our estimate of €28.2m. However, a slowdown in end-market demand and drilling delays prompted the company to lower expectations as the year progressed. Tougher trading conditions than expected also affected profitability, with company reported adjusted EBITDA down at €4.43m (FY16 €5.40m). The reported regulatory EPS loss of 13.8c (FY16 5.9c) and no dividend were as expected. Q118 revenues of €8.3m (Q117 €7.0m) indicated a strong bounceback at Integrated Logistic Support Services (ILSS) (up 75% on Q117), although Oil Country Tubular Goods (OCTG) had a slightly weaker start (down 20% on Q117). Overall, we believe recent wins building the current order book support FY18 expectations of group revenue of €36.7m and group EBITDA of €6.8m.

To read the entire report Please click on the pdf File Below: