Medigene has a solid base to embark on a new phase of development, focused on progressing RhuDex to proof-of-concept data in primary biliary cirrhosis (PBC), a potentially lucrative orphan drug market. A robust Phase II trial design and regulatory approvals in 2013 should help to support the partnering and/or fresh financing required to complete the study. Veregen (genital warts) sales, which could increase significantly over the next few years, and new development/partnering progress for EndoTAG-1 (breast cancer) in 2013, are also important valuation drivers.

RhuDex An Attractive Proposition For PBC

Medigene’s decision to switch development plans for RhuDex (CD80 inhibitor) for PBC, an autoimmune disorder of the liver, from prior progress in rheumatoid arthritis (RA), was a shrewd move to fast track development in an attractive orphan drug market. A Phase II study is scheduled to start in H114 and complete by end-2015, with a robust trial design that could ultimately make RhuDex a valuable and attractive asset to support partnering and/or fresh financing.

Veregen Poised For Growth

Veregen (topical ointment for genital warts) is licensed globally to 16 partners and Medigene receives supply chain revenues, royalties and milestones (€3.4m Veregen revenues received in FY12 based on €12m in-market sales). Already marketed in the US, Germany, Austria, Spain, Switzerland and Serbia, multiple new country launches (particularly in Europe) are planned for 2013, providing a platform for potentially significant sales growth in 2014 and beyond (peak sales est $100m).

EndoTAG-1 Still In Play

Medigene made overdue partnering progress on EndoTAG-1 in 2012 by securing SynCore Bio as a partner to help conduct a pivotal Phase III study in triple negative breast cancer (TNBC). SynCore will cover 50% of the cost and patient recruitment (mostly in Asia, Australia and New Zealand) into the study, with Medigene still seeking a partner(s) for EU/US development and commercialisation rights.

Valuation: €75m Represents Clear Upside

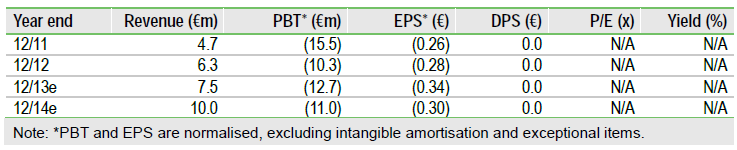

We value Medigene at €75m, or €2.03 per share, based on a total rNPV of its products (Veregen, EndoTAG-1 and RhuDex) at €55m and €20m in net cash as of end-2012. This represents clear upside to Medigene’s €31m market capitalisation and €0.84 share price. With cash reserves estimated at c €9.5m by the end of 2013, Medigene is funded through to the end of 2014, but in reality is likely to require fresh funds in H214. A financing initiative ahead of the start of the Phase II RhuDex study cannot be ruled out.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Medigene A Fresh Start In PBC

Published 04/26/2013, 08:01 AM

Updated 07/09/2023, 06:31 AM

Medigene A Fresh Start In PBC

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.