Medifast, Inc. (NYSE:MED) is scheduled to release first-quarter 2019 results on May 1, after market close. The company’s earnings have surpassed the Zacks Consensus Estimate in three out of the trailing four quarters, the average positive surprise being 10.5%. Let’s discuss the factors that are likely to make an impact on the upcoming quarterly results.

Strong Brands & Other Growth Measures

Medifast gains from consistent growth in OPTAVIA-branded products. In fact, these products contribute a major portion to the consumable unit’s sales. We note that growth in active earning coaches is boosting the OPTAVIA banner. Additionally, prudent marketing efforts are helping these brands to augment customer reach. These factors are likely to drive revenues in the quarter to be reported.

Further, the company’s investments in technological upgrades are driving growth in the United States as well as internationally. In sync with this, the company is widening its cloud-based solutions to support the e-commerce platform as well as resource planning system. The company has also undertaken partnerships to augment logistics and distribution capabilities. Gains from these efforts are also likely to reflect in the upcoming quarterly announcement.

Rising Costs a Worry

Rising freight costs have been weighing upon Medifast’s gross margin. Moreover, the company’s selling, general and administrative expenses have been rising due to higher commissions as well as investments in certain projects. Consistent rise in these cost elements are likely to drag the company’s upcoming results. Nevertheless, we expect the company to cushion these hurdles on the back of sturdy growth in the OPTAVIA banner, rising earnings coaches as well as progress in the digital realm.

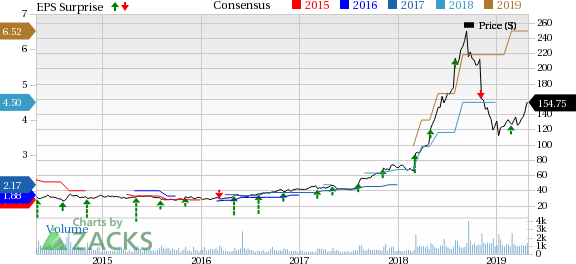

MEDIFAST INC Price, Consensus and EPS Surprise

Estimates Unveil Bright Prospects

The Zacks Consensus Estimate for first-quarter earnings is currently pegged at $1.52 per share, which suggests a rise of almost 50.5% from the prior-year quarter’s reported figure. The current estimate has been stable in the past 30 days.

Further, the consensus mark for revenues is pegged at $151.7 million, calling for a rise of nearly 53.9% from the year-ago quarter’s figure.

What Does the Zacks Model Predict?

Our proven model doesn’t show that Medifast can beat bottom-line estimates in the quarter to be reported. For this to happen, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Although Medifast carries a Zacks Rank #3, its Earnings ESP of 0.00% makes us less confident about an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks Poised to Beat Earnings Estimates

Here are a few companies you may want to consider as our model shows that they have the right combination of elements to beat earnings.

Church & Dwight (NYSE:CHD) has an Earnings ESP of +1.06% and a Zacks Rank #2.

Inter Parfums (NASDAQ:IPAR) has an Earnings ESP of +0.30% and a Zacks Rank #2.

Campbell Soup (NYSE:CPB) has an Earnings ESP of +1.80% and a Zacks Rank #3.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

MEDIFAST INC (MED): Free Stock Analysis Report

Campbell Soup Company (CPB): Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD): Free Stock Analysis Report

Original post

Zacks Investment Research