Maxim Integrated Products, Inc. (NASDAQ:MXIM) reported second-quarter fiscal 2020 adjusted earnings of 56 cents per share, which surpassed the Zacks Consensus Estimate by 3 cents. Notably, the figure declined 6.7% year over year but increased 7.7% on a sequential basis.

Revenues of $551.07 million surpassed the Zacks Consensus Estimate of $545.07 million and came within the company’s guided range of $525-$565 million. The figure declined 4.5% year over year but increased 3.4% on a sequential basis.

The sequential increase can be attributed to the company’s improving end-market performance in industrial, automotive and communications, and data center markets.

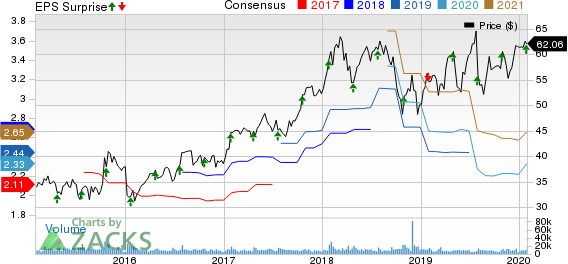

Maxim Integrated Products, Inc. Price, Consensus and EPS Surprise

End Market in Detail

Industrial: The company generated 30% of total revenues from this market during the reported quarter. Revenues in this market improved 7% from the fiscal first quarter, driven by factory automation and automated test equipment markets.

Automotive: This market accounted for 26% of the company’s revenues during the fiscal second quarter. Revenues were up 5% on a sequential basis, primarily driven by double-digit growth in secular growth areas of BMS and driver assistance systems.

Going forward, the company expects growth in ADAS applications in power management and point-to-point serial link data communication products.

Consumer: Maxim generated 24% of revenues from this market. Revenues in this market declined 15% sequentially due to sluggishness in the smartphone market and seasonal decline in other customer electronics.

Communications and Data Center: Revenues from this market, which now includes computing, accounted for 20% of total revenues, up 25% from the fiscal first quarter. This was driven by strong ramp in the demand for 25G optical products for base stations and 100G optical products for data center applications.

Operating Details

Non-GAAP gross margin was 66%, expanding 10 basis points (bps) from the year-ago quarter.

Non-GAAP operating expenses of $187.9 million decreased 0.1% year over year. However, as a percentage of revenues, the figure expanded 150 bps from the prior-year quarter.

Per the company, operating margin came in at 30.7%, down from 31.6% in the year-ago quarter.

Balance Sheet & Cash Flow

At the end of the fiscal second quarter, cash, cash equivalents and short-term investments were $1.78 billion, down $10 million from the prior quarter.

Further, long-term debt was $993.3 million at the end of fiscal second quarter compared with $992.9 million at fiscal first quarter-end.

During the quarter under review, cash flow from operations was $237.5 million, up from $141.3 million in the previous quarter. The company utilized $13.7 million for capital expenditure during the fiscal second quarter.

Maxim spent $108 million in repurchasing shares and made dividend payment of $130 million (48 cents per share).

Guidance

For third-quarter fiscal 2020, earnings per share are expected in the range of 57-65 cents on an adjusted basis. The Zacks Consensus Estimate for the same is pegged at 56 cents per share.

Further, Maxim expects revenues in the range of $555-$595 million. The Zacks Consensus Estimate for revenues is pegged at $556.28 million.

Non-GAAP gross margin is expected within 65.5-67.5%.

Management expects the industrial market to exhibit seasonal sequential and year-over-year growth in the fiscal third quarter.

Further, the automotive market is expected to improve from the fiscal second quarter, backed by growth in driver assistance and the infotainment business.

Maxim expects to experience sequential growth in revenues from the communications and data center market. Further, the company is likely to witness solid demand for 100G and 25G optical products, which are essential for 4G and 5G base station applications.

However, revenues from the consumer market are anticipated to be flat sequentially in the fiscal third quarter.

Zacks Rank & Other Key Picks

Maxim currently has a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Splunk Inc. (NASDAQ:SPLK) , Itron, Inc. (NASDAQ:ITRI) and Waters Corporation (NYSE:WAT) . While Splunk and Itron sport a Zacks Rank #1 (Strong Buy), Waters Corp carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Splunk, Itron and Waters Corp is currently projected at 31.2%, 25% and 9.5%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Splunk Inc. (SPLK): Free Stock Analysis Report

Waters Corporation (WAT): Free Stock Analysis Report

Maxim Integrated Products, Inc. (MXIM): Free Stock Analysis Report

Itron, Inc. (ITRI): Free Stock Analysis Report

Original post