Mattel, Inc. (NASDAQ:MAT) has reported mixed fourth-quarter 2019 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. The bottom line beat the consensus estimate for the sixth straight quarter. Following the results, the company’s shares gained 2.7% in after-hour trading session on Feb 13.

The company reported adjusted earnings of 11 cents, which surpassed the Zacks Consensus Estimate of break-even earnings. In the prior-year quarter, the company had reported adjusted earnings of 3 cents. The company’s earnings benefited from cost-cutting measures.

Sales Discussion

Net sales of $1,473.7 million missed the Zacks Consensus Estimate of $1,489 million and declined 3% year over year. On a constant-currency basis, sales also declined 3% from the prior-year quarter. Decline in sales can primarily be attributed to dismal performance of American Girl and Fisher-Price brands.

In North America, gross sales declined 1%, both as reported and at constant currency. This was primarily due to decrease in Dolls (including Barbie and owned brands) and Infant, Toddler and Preschool (including Fisher-Price Friends, and Fisher-Price and Thomas & Friends).

Meanwhile, in the International region, gross sales were down 1% (as reported), driven by growth in Infant, Toddler and Preschool (including Fisher-Price Friends, and Fisher-Price and Thomas & Friends) and Vehicles (including CARS and Jurassic World vehicles marginally overshadowed by rise in sales of Hot Wheels). However, gross sales were flat in constant currency.

Brand-Wise Worldwide Sales

Mattel, through its subsidiaries, sells a broad range of toys. These items are grouped under four wide categories — Mattel Girls & Boys Brands, Fisher-Price Brands, American Girl Brands, and Construction and Arts & Crafts Brands.

As reported, worldwide gross sales at Mattel Power Brands were down 3% to $1,665.3 million year over year. The metric declined 2% on a constant-currency basis.

However, the Barbie brand witnessed 2% growth as reported and 3% in constant currency, driven by positive POS momentum. Gross sales at the Hot Wheels brand improved 7% on a reported basis and 8% in constant currency. However, gross sales were down 3% as reported and 3% in constant currency at the Fisher-Price and Thomas & Friends brands. Gross sales at Other declined 9% as reported and 9% in constant currency.

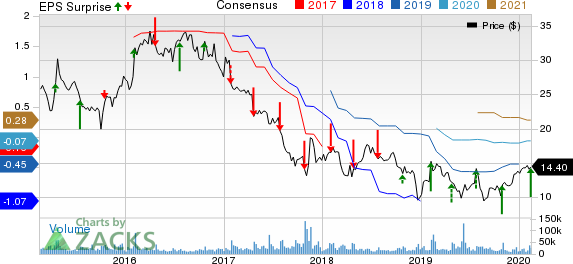

Mattel, Inc. Price, Consensus and EPS Surprise

Operating Results

Adjusted gross margin expanded 230 basis points to 48.9%, driven by savings from the Structural Simplification program and lower foreign exchange.

Adjusted other selling and administrative expenses decreased 2% to $383.8 million. The increase was primarily driven asset impairment expenses.

Balance Sheet

As of Dec 31, 2019, the company’s cash and equivalents were $630 million compared with $594.5 million as of Dec 31, 2018. Total inventories as of the end of the fourth quarter declined 8.7% year over year to $495.5 million.

The company’s long-term debt amounted to $2,846.8 million as of Dec 31, 2019, higher than $ 2,851.7 million as of Dec 31, 2018. Shareholder’s equity was $491.7 million.

2020 Guidance

The company’s guidance excludes any potential impact of coronavirus. The company expect 2020 gross sales to increase in the range of 1% to 2.5%, which include a minor foreign exchange impact. Sales are likely to be driven by mid-single digit growth in the company’s own brands, marginally offset by decrease in licensed brand. The company continues to expect growth in Doll category.

Margin is anticipated to increase in 2020 owing to benefits from structural simplification and capital light programs. Adjusted EBITDA is anticipated to be in the range of $575 million to $600 million.

Mattel, which shares space with Hasbro (NASDAQ:HAS) , Electronic Arts (NASDAQ:EA) and Take-Two Interactive Software (NASDAQ:TTWO) , currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Mattel, Inc. (MAT): Free Stock Analysis Report

Take-Two Interactive Software, Inc. (TTWO): Free Stock Analysis Report

Hasbro, Inc. (HAS): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Original post

Zacks Investment Research