- Markets react with disappointment after Draghi fails to deliver immediate action

- Focus on US data today – will the stalling jobs data force Bernanke into QE3?

The main message from yesterday’s ECB press conference was that the ECB probably will support European Financial Stability Facility (EFSF)/European Stability Mechanism (ESM) intervention by activating the Securities Market Programme (SMP) (in some form), if the political leaders at some point endorse EFSF support to Italy and Spain. It was also clear the ECB will not intervene before Italy and Spain have requested EFSF intervention. Mariano Rajoy and Mario Monti did not give signals on when this could happen at their joint afternoon press conference but neither did they rule out such a move.

Draghi stated that detail on how the ECB could intervene would be worked out over the coming weeks but made it clear that purchases of government bonds would be in shorter maturities. He also said ‘concerns of private investors about seniority will be addressed’ without providing any details. The ECB president did not hint at any additional rate cuts and it appears that the discussion on cutting the deposit rate to negative is a little premature. We expect the ECB to keep rates unchanged at these levels for a long time. For details see Flash Comment: Draghi opening the door for politicians, 2 August.

US stocks fell yesterday after Draghi failed to reassure investors on immediate stimulus measures. The S&P500 index ended 0.7% lower in a relatively busy trading session, the fourth consecutive day with losses. Knight Capital Group, a finance investment company, plunged 63% after announcing higher trading losses than expected. Alcoa, JPM and Dupont were among the companies losing the most. Data showed that factory orders fell 0.5% in June and initial jobless claims increased slightly, albeit less than expected.

Asian stocks have also fallen overnight and Nikkei and Hang Seng are down 1.2% and 0.9%, respectively. Mixed Chinese data have been released overnight showing nonmanufacturing PMI falling 1.1 to 55.6 in July, while HSBC Service PMI increased 0.9 to 53.1.

In FX markets, EUR/USD was on a rollercoaster ride yesterday starting out around 1.2250 before the rate announcement, briefly touching 1.24 at the beginning of the press conference, plunging to 1.2150 in disappointment, before stabilising around 1.2175. EUR/SEK and EUR/NOK continue to decline as investors seek alternatives to the euro.

No big moves in US bond yields with the 10-year benchmark yield little changed at 1.47%, some 9bp above the lowest level set on 25 July. Bloomberg reports that investors are stockpiling corporate debt rather than trading as banks retreat from bond brokering, with daily trading volumes in the US slumping to the slowest July in four years even as offerings reached a record.

Global Daily

Focus today: While ECB president Mario Draghi yesterday outlined a strategy for possible resumption of bond purchases by ECB, it is clear that the first critical step will be that either Spain or Italy ask EFSF/ESM for activation of their bond purchase programme. Hence, there could be some focus on a government meeting in Spain at 10:00 CET today. The agenda of the meeting is unknown but it has been announced that there will be a press conference afterwards. As Spain has already made commitments in connection with the ‘memorandum of understanding’ agreed upon in connection with the aid for recapitalization of its banks, it should not be a big step for Spain to ask for activation of EFSF/ESM bond purchases.

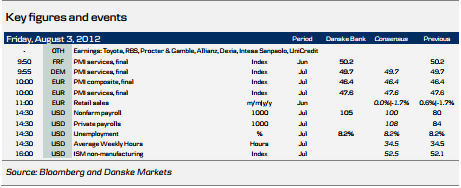

The big event today is the labour market data in the US that will be decisive input for the Fed’s decision about possible additional QE at its next meeting in September. Recent labour market data have been a bit more encouraging with the ADP employment report and initial unemployment claims in the past two weeks coming in better than expected. Consensus is that non-farm payrolls have increased 100K in July but we probably need a number substantially higher than 100K to ease expectations of additional QE by the Fed in September. ISM non-manufacturing released later in the afternoon will also be an important indication for the current strength of the US economy.

Fixed income markets: Following the ECB press conference yesterday the Italian and the Spanish sovereign curves saw a major counter-directional steepening. With Draghi hinting that any future bond purchases would focus on the short end, Italian and Spanish 10yr yields jumped back above 6% and 7%, while 2yr bonds gained. Safe-haven flows reintensified, which led to a bullish curve flattening in the core markets. We believe that the renewed market stress could continue to build in the days ahead.

Draghi stated that a necessary condition for resuming the sovereign bond purchases is that a country needing help must activate the EFSF/ESM to enter under strict conditionality. However, it is not clear when Spain and Italy will seek help and how much pressure on their bond markets it will take for them to do so. We believe the market is going to explore this in the coming days. Hence, both Danish and German bond yields could test the previous lows.

Elsewhere focus will be on the payrolls report today. But given the situation in Europe, the report should have limited impact, unless we see a major surprise in either direction.

FX markets: It was an initial disappointment that the ECB did not deliver yesterday but it does in our view not mean that EUR/USD will fall as a stone over the coming weeks. Draghi was fairly clear that the ECB could (and most likely would) reactivate its bond purchases in the secondary market if one or several countries ask the EFSF to buy its government bonds. It appears more likely that this will happen than not in our view. No action will most likely lead to a gradual fall in EUR/USD with new lows to come but astrong and coordinated policy response will push EUR/USD higher. The market is not yet fully priced for this and positioning remains stretched (EUR shorts remain significant). If coupled with FOMC action (e.g. QE3) at its next meeting, the effect on EUR/USD would be even greater.

Scandi Daily

In Norway data for the unemployment rate in July will be released. We believe the jobless rate will increase 0.3pp to 2.7%, slightly more than consensus. Service PMI for Sweden will also be released. No data releases from Denmark.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank")

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the

Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated

using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without

limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not

undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S.

Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.