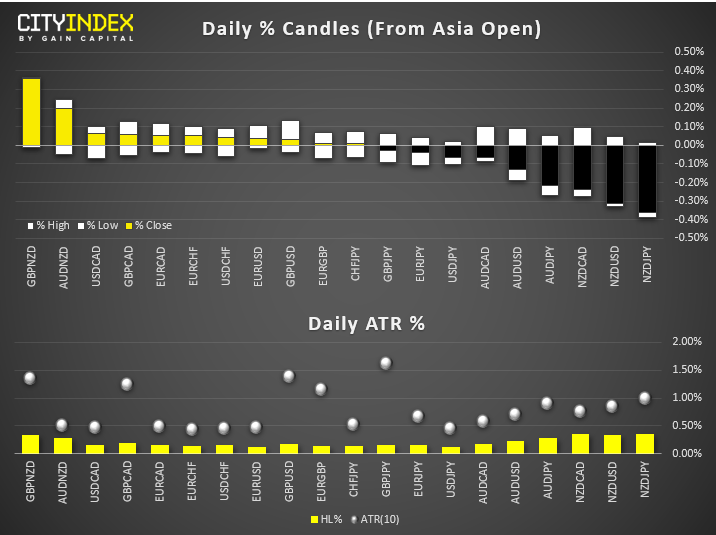

- It was mostly narrow ranges for FX pairs outside of NZD, which is today’s weakest major. GBP/NZD and AUD/NZD are the biggest gainers, whilst NZD/JPY, NZD/USD and NZD/CAD are the most bearish of the session. That said, volatility remains predictably low ahead of today’s ECB meeting, amid a session of slow-moving news.

- All pairs are well below their ATR (overall average of 29% of ATR) with AUD/NZD being the more ‘lively’ cross, at a mere 58% of its ATR.

- Australian manufacturing PMI crept into expansion (above 50) at 50.1 from 49.4 prior. Services PMI softened to 50.8 from 52.5 prior, bringing the PMI composite indicator down to 50.7 from 51.9 prior.

- South Korean Q3 GDP was softer at 0.3% versus 0.5% prior, further fanning fears of a global slowdown. Whilst exports shows mild signs of recovery, domestic spending clouded the outlook.

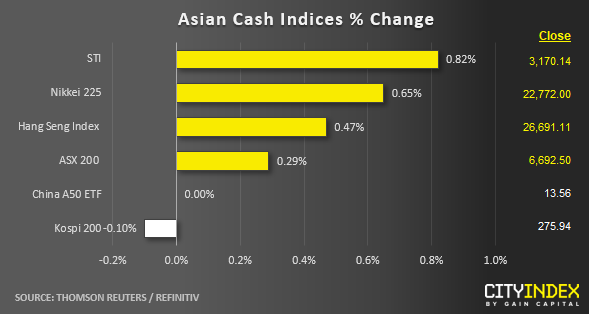

Equity Brief:

- “See-sawing movement” is the theme for Asian stock markets in the past three days as equities oscillate between losses and gains. Asian equities are mostly trading in the black in today’s Asia mid-session after a positive session seen in the U.S. stock market; the S&P 500 has climbed back above the psychological 3000 level to close at 3004.

- Japan’s Nikkei 225 has managed to record a gain of 0.65% despite a weaker than expected preliminary manufacturing PMI data for Oct where manufacturing growth has weakened to 48.5 (below consensus of 48.8) from 48.9 seen in Sep. The latest flash manufacturing PMI has indicated that Japanese manufacturing activities have shrank at the steepest pace since 2016. Today’s performance of the Nikkei 225 has led it to shoot past it previous 52-week high at 22698 led by technology related stocks; Tokyo Electron and Kyocera Corp have rallied by 1.89% and 0.92% respectively.

- Mergers and acquisitions plays have continued to hog the limelight in the Singapore stock market, the Straits Times Index is upped by close to 0.80% where Keppel Corporation has continued to surge up 1.49% today, its share price now just 2% away from its 52-week high of $6.97. State-owned Temasek Holdings has announced earlier this week to increase its stake in Keppel Corporation to 51%

- South Korea’s KOSPI 200 is almost unchanged after it has erased earlier losses where the Index was downed by around -0.30%. SK Hynix, the world’s second largest memory chipmaker has rallied by 2.57% on earnings beat where its Q3 operating profit came in at 473 billion won (the lowest in three years) but above consensus of 418 billion won.

Up Next

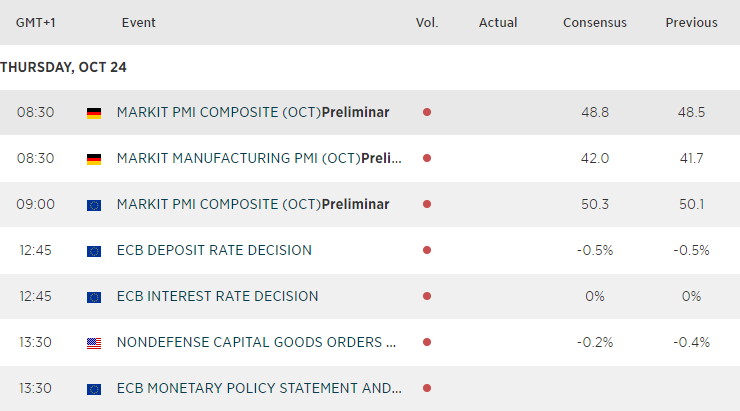

- Today’s main event is Draghi’s last ECB meeting. Given the size of stimulus unveiled last month (dubbed “QE forever”) it’s unlikely we’ll see any changes today. But, then again, it’s Draghi so never say never. EUR/UD will be a core focus and whether it can rally from or break below the 1.1100 level the world is likely watching.

- Markit PMI data EZ, Germany and France are released in a couple of hours, although the ECB meeting will take precedence. Previous data in Sep has indicated that Eurozone manufacturing sector has recorded its steepest contraction and remained below the 50 level since Feb 2019. Continuation weakness in manufacturing may prompt ECB to reinforce its dovish stance and the justification needed to restart its QE programme where ECB officials meet later together with out-going ECB President Mario Draghi, his last chairing of ECB monetary policy meeting.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.