There was much news last week that was positively received by the markets. The most significant news was a surprise announcement made on Wednesday that the U.S. Federal Reserve and five other major central banks would take coordinated action to lower the cost of swap lines. The goal is to facilitate borrowing by banks, which will provide liquidity to the global financial system. You will find a more detailed review of this news in our section on the loonie. With the various political meetings scheduled this week in the eurozone, Europe faces a pivotal week. The market which reacts in exaggerated fashion to news coming out of the eurozone, we can expect a week where the volatility will be at the forefront. Here are some highlights of the economic news expected this week.

Canada

In Canada this week, on Tuesday the Bank of Canada will announce whether it will maintain, raise or lower its key interest rate. Also on Tuesday, data will be released on the Ivey Purchasing Managers’ Index for the month of November. Then on Thursday we will have the housing starts figures for November. Given that the data on Canadian GDP released last week were better than expected, the data on housing starts may also be good. On Thursday, the Bank of Canada will release its very important biannual publication on financial system developments and the direction that will be taken for tax measures in the financial sector.

U.S.

Little major news is expected in the U.S. this week. The release of economic data begins on Monday with statistics on factory orders. Monday will also see the release of data on the ISM non-manufacturing business activity index for November. On Friday we will receive trade balance figures. Finally, on Friday the University of Michigan will release its Consumer Sentiment Index for the month of December. We are expecting it to be 63.

International

This will be a busy week in international economic news. On Monday we can expect annualized results on retail sales in the eurozone. Also on Monday, Australia will be the first to reveal its decision on its key interest rate. Tuesday, annualized data will be released on the euro zone’s GDP for the third quarter, and on Wednesday Australia will announce its GDP for the same period. We are anxious to hear the European Central Bank’s rate decision, which is due on Thursday. With the European economy in such a precarious state, it will be interesting to see if the ECB has decided to set aside its fear of inflation and move to stimulate the economy. Also on Thursday, Australia will publish unemployment data, Japan will announce its GDP for the third quarter and China will reveal its inflation figure. On Friday, the European leaders will meet in Brussels for a summit. Have a good week!

The Loonie

“Go as far as you can see; when you get there, you’ll be able to see farther.”

We seem to be just feeling our way along, stumbling around in the dark as we try to find a bit of light that could direct us through our geopolitical maze. The confusion surrounding the debates of elected officials has reached new heights, and the proposed solutions look like a high-wire act of trial and error. Considering only the Occupy Wall Street movement, the failure of the congressional super committee, and the focus in the U.S. presidential election campaign on national debt and tax reform, there is clearly a struggle to find an effective solution to the economic problems and political failures. This is why the markets enthusiastically endorsed coordinated action from the Fed, the ECB and the central banks of Canada, England, Japan and Switzerland on November 30 to lower funding costs for banks that are having trouble securing short-term loans of U.S. dollars in the middle of the debt crisis. Under the agreement, on December 5 they will lower the dollar swap rate by 50 bps until February 2013. Stated in more technical terms, the ECB is making a swap with the U.S. Federal Reserve (the Fed) by borrowing dollars and depositing euros as collateral, while paying a premium. The cost of borrowing is based on the OIS (overnight indexed swap) Index plus a premium, which, under the agreement, has fallen from 100 bps to 50bps. This will allow the ECB to more easily provide liquidity to commercial banks seeking foreign currencies, particularly dollars, and provide it at a better rate. Furthermore, the central banks announced a bilateral agreement under which they will be able to more easily exchange currencies other than the U.S. dollar. For example, the Bank of Japan could provide euros to Asian financial institutions.

Despite the temporary nature of this measure, it will play an important role in rebuilding confidence in leaders and will reassure investors. In a recent interview with the Wall Street Journal, Tony Blair, the former Prime Minister of Great Britain, said that European officials must fully support Europe’s monetary system or else it could fail. In terms of market psychology, as long as European officials do not make this clear long-term commitment, investors in the eurozone will continue to drive up bond yields. The ECB will meet on December 8, to be followed by a meeting of the European Union on December 9. This weekend we will know whether history will repeat itself, with the events of October 13, 2008 (shown in the graph) being played out again. In 2008, the market responded very positively, but the effect was fleeting. The economy must get out of the doldrums and bounce back!

Last Week at a Glance

Canada – In November, total employment declined again (-18.6K) following a marked deterioration in October (-54.0K). Losses were observed in part-time jobs (-53.3K) while full-time jobs registered an advance (+34.6K). The goods-producing sector added 25.2K jobs after shedding 51.9K the previous month. Within this sector, construction (+19.6K) and natural resources (+9.9K) were the top contributors. The service-producing sector posted a steep drop of 43.9K, with losses occurring mostly in trade (-34.1K) and business, building and other support services (-29.2K). Six of the provinces were in the red on the month with Quebec (-30.5K) turning in the worst showing by far. The unemployment rate notched up to 7.4% from 7.3% the month before. Generally speaking, the labour situation in Canada has darkened in recent months. Total employment has now fallen three times in the past four months. For the manufacturing sector, November marked a third straight drop in this regard. The month’s report reflected a definitely lacklustre performance, all the more so that it came on the heels of a 54K loss in October. Luckily, the 34K gain in full-time jobs brightened matters somewhat; this made for a cumulative gain in this segment of 26K over the past three months. The pick up in full-time employment more than offset the negative impact of the losses in part-time jobs and thus boosted total hours worked on the month by 0.3%. However, so far in the quarter, total hours worked remained negative (-0.8%), which is consistent with the moderation in GDP in Q4. In 2011Q3, Canadian GDP bounced back sharply, growing a consensus-topping 3.5% annualized after contracting slightly in Q2. The first and second quarters were each revised downward a tick. Having largely overcome supply-chain problems (a major factor in Q2), trade turned abruptly from drag to thrust in Q3. Exports sprang an annualized 14.4%, the largest quarterly gain since 2004Q2. Domestic demand moderated a bit after a strong Q2, rising only 0.9% annualized. The slowdown was due to a 3.6% annualized drop in business fixed investment after a hot Q2. Helping support domestic demand, however, was consumption spending, which progressed 1.2% annualized despite a drop in disposable income on the quarter. Residential construction grew 10.9% annualized, its best quarterly performance since 2010Q1. Inventories, for their part, detracted from GDP.

United States – In November, U.S. non-farm payrolls showed a 120K increase, just shy of the 125K expected by consensus. In addition, the numbers for the previous two months were revised up a cumulative 72K. The private sector added 140K jobs, with gains coming mostly in service sectors. Government continued to shed jobs, particularly at the state and municipal levels. Average hourly earnings sagged 0.1%, while hours worked per week were flat at 34.3. Aggregate hours worked, however, edged up 0.1%. The Household Survey showed 278K new jobs were created after 277K were added the preceding month. These job gains, combined with a two-tick drop in the participation rate to 64%, lowered the unemployment rate four ticks to 8.6%. The upward revisions made this report better than expected. Thanks to the increase in aggregate hours worked, Q4 is now on track for a 1.6% annualized gain, which marks an acceleration from Q3 when hours held steady essentially. Again in November, the ISM Manufacturing Index climbed 1.9 points to 52.7. Both the production and new orders components showed solid gains on the month, suggesting the manufacturing sector is building up momentum in Q4. The production index jumped 6.5 points to 56.6 and new orders rose 4.3 points to 56.7. In both cases, these were the highest readings in 7 months. Still in November, the Conference Board Consumer Confidence Index vaulted 15.1 points to 56. Americans were more optimistic than a month earlier about the future, as this component of the survey flew 17.8 points higher to 60.8. On the employment front, the percentage of respondents who reported jobs were hard to find slipped 4.8 points to 42.1%, its lowest mark since January 2009. In October, construction spending was up for a third consecutive month, rising 0.8% to $798.5 billion. New-home sales picked up the pace 1.3% to 307000 units. This compares well against the 12-month moving average of 303000 units. September’s figure was revised down 10000 to 303000 units. Finally, seasonally adjusted annualized sales of cars and light trucks totalled 13.59 million in November, up 2.9% month over month and 11.1% year over year.

Technical Analysis: USDCAD and CRB

USDCAD: The stop-losses suggested for sellers last week were probably activated. The move below 1.0265 is not good news, and the H&S structure needs to be reviewed.

However, the hammer pattern seen on Friday shows that USD buyers have yet to throw in the towel.

A review of the CRB commodities index presented a few weeks ago revealed something interesting: despite the recent “good” news, commodity prices have continued their decline along a channel that began in Q2 2011. The long-term moving average (the blue line) is now falling, and the long-term trend (the green line) may be tested again, with negative consequences for the CAD.

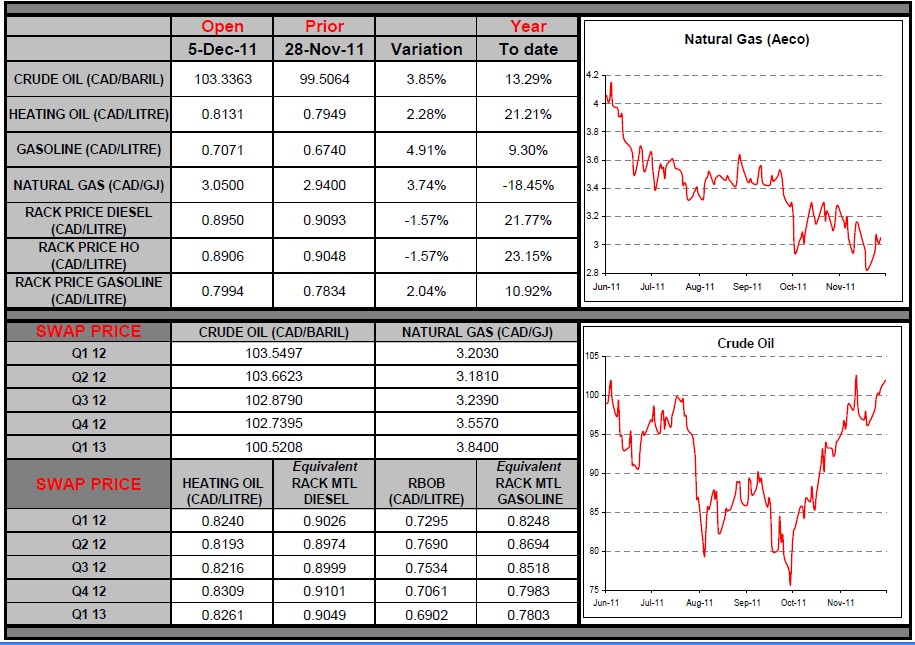

Commodities

Crude oil prices rose in response to good job creation figures from the U.S. as well as international tensions over Iran. WTI is now trading at just slightly over $100/barrel, while North Sea Brent is selling at close to $110. Although the U.S. and the main European countries are increasing sanctions against Iran, the slightest interruption in Iranian exports could drive up the price of oil to much higher levels. Iran is the world’s fourth largest producer of crude oil, producing over 4 million barrels per day. Given Iran’s lack of economic and political power, threatening to interrupt exports represents its main weapon in its negotiations with Western countries, which are concerned over the impact that rising oil prices could have on their economies. Should such a scenario occur, any company that has a solid hedging strategy would be at a significant competitive advantage. Have a great week!

Fixed Income

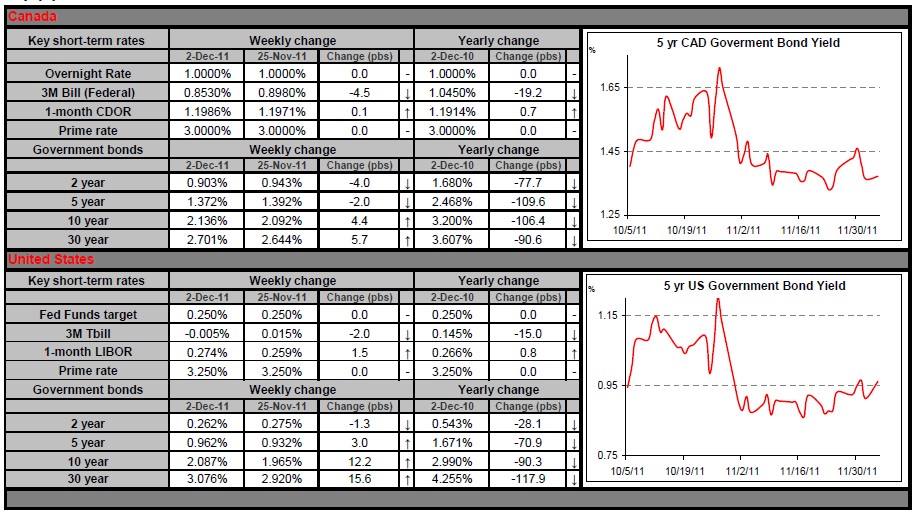

Canadian yields rose early last week, following a few successful bond auctions in Europe and a major rally in equities on Wednesday, but rates ended the week unchanged compared to the previous, as employment data failed to meet economists’ expectations.

On Wednesday, six central banks including the Bank of Canada (BoC) announced they had agreed to lower the rate they charge each other to swap currencies. The move was intended to ease funding pressures on the interbank market, by reducing the cost to provide foreign currencies to private banks during emergencies. Stocks, commodities and bond yields increased sharply, and on Thursday the 3-month LIBOR went down for the first time since July 25th.

On Friday, Statistics Canada announced Canadian payrolls fell last month, and the unemployment rate rose for a second month in a row. At market close, we were back to square one: investors were still concerned by European’ indebtedness and the weakness of the job sector so many of them had lost most of their appetite for risk.

For the week ahead, we expect a lot of action in Italy and Greece, as both countries address their ambitious austerity plans on Monday and Tuesday respectively. On this side of the ocean, the BoC is setting its overnight rate on Tuesday; the market is pricing a 10% rate-cut probability.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major News this Week: Canada, US and International Markets

Published 12/06/2011, 08:51 AM

Updated 05/14/2017, 06:45 AM

Major News this Week: Canada, US and International Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.