FX News

U.S. reports: China and Twaian were leading Asian markets higher after returning from holidays. Elsewhere gains were more muted and the Hang Seng is slightly in the red, as investors eye the Trump-Xi meeting. Bets on potential gains from the development of a so-called economic zone in Hebei province helped to lift China, while benchmarks in Japan and Australia fluctuated as currency advances weighted on exporters FTSE 100 futures are higher, but U.S. futures are in the red.

Oil prices are up on the front end WTI future is trading at USD 51.38 per barrel. Released overnight the UK BRC shop price index was in line with expectations. The European data calendar still has final services PMI readings for the Eurozone, as well as the UK services PMI. Eurozone officials are once again trying to hammer out a deal with Greece that will allow the payment of the next aid tranche.

U.S. reports: revealed stronger than expected trade deficit data and factory goods figures that closely tracked assumptions, leaving a net boost to our Q1 GDP growth estimate to 1.5% from 1.2%, after Q4 growth of 2.1%. For the trade deficit, we saw a February narrowing to $43.6 bln from a 5-year high of $48.2 bln, leaving a gap that was $1.4 bln narrower than indicated by the “advance” trade report after a $0.3 bln narrowing in January.

For factory goods, the data matched estimates with lean February nondurable increases of 0.2% for shipments and orders and 0.1% for inventories. We saw only tiny tweaks in the durables data for orders, shipments, equipment and inventories that slightly lifted most levels.

ECB’s Liikanen: Strong monetary support still needed. The Governing Council member told Germany’s Handelsblatt, that “strong monetary support is still needed”, as the improvements seen so far are not big enough to “fundamentall” change the central bank’s guidance. Liikanen admitted that there were discussions at the last meeting and “there are a lot of opinions in the Governing Council”, adding that the statement did notice some improvements and tweaked some parts of the forward guidance, but added that the ECB “emphasized that interest rates will remain low beyond the end of asset purchases”. According to Liikanen that was “undisputed” although “there were discussions about what is meant by the words ‘current or lower levels’. The comments highlight the increasingly divergent views at the ECB as the central bank is starting to think about exit strategies and a phasing out of QE.

Canada: Canada’s February trade puts a damper on the Q1 GDP outlook, which was riding high after the stunning 0.6% m/m surge in January GDP lifted prospects for Q1 GDP to the 3.5% area. But the February trade balance sets up a sizable drag on Q1 growth from net exports. USD/CAD revealed little immediate reaction to the twin Canada/U.S. trade reports, where the U.S. deficit narrowed more than expected, and the expected Canadian surplus turned to a deficit. The pairing has since rallied to new three-week highs of 1.3456 however, even as oil prices move to session highs near $50.70. The Canada trade report has thrown cold water on expectations for Q1 GDP, apparently to the detriment of the CAD.

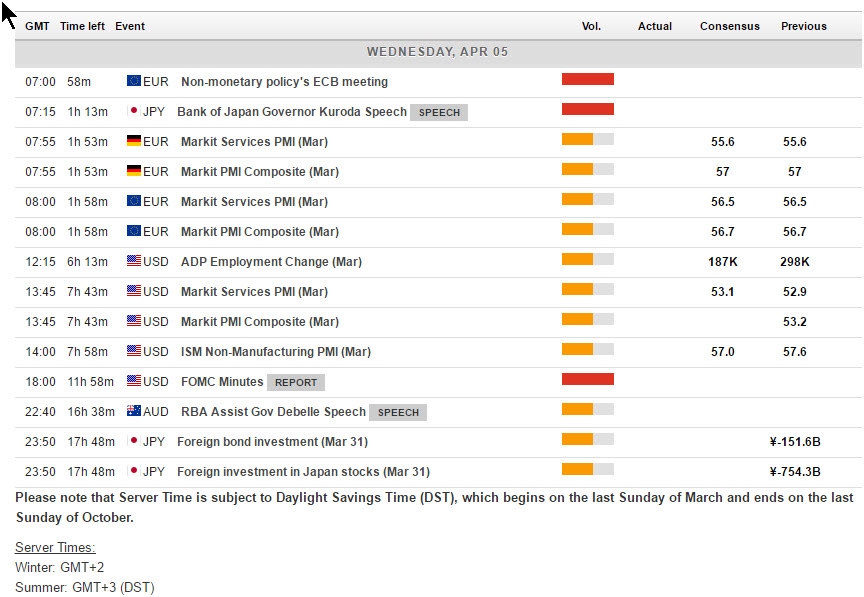

Main Macro Events Today

- FOMC – FOMC minutes are due today from the FOMC’s March 14, 15 meeting that included the first-rate hike of 2017.

- UK Service PMI – The services PMI has us anticipating a near unchanged reading of 53.3 after 53.3 in the month prior.

- EU Service PMI – The Eurozone services PMI expected to stay unchanged at 56.5, while Germany’s expected to stay unchanged as well at 55.6.

- ADP Employment & ISM Non-Manuf. PMI – The MBA mortgage market report will be released today, accompanied by the March ADP employment report, which should post a 187k gain for the month, below the February figure of 298k. Markit services PMI are due, alongside ISM Non-Manufacturing index seen easing to 57.0 in March vs 57.6.