Logitech’s (NASDAQ:LOGI) brand, Logitech G, recently launched the Logitech G604 LIGHTSPEED Wireless Gaming Mouse, designed especially for gamers. The new mouse, priced at $99.99, is expected to hit the shelves in fall 2019.

The next generation wireless mouse is based on Logitech G’s LIGHTSPEED Wireless technology for smooth connectivity, and flaunts a strong battery life. Reportedly, the versatile mouse will make toggling among various tasks easier with six thumb buttons.

How Logitech is Placed in the Gaming Market

Logitech is focused on boosting its gaming business. The company expects the Gaming business to offer multiple scope for growth in the future.

Notably, the gradual shift in consumer preference from mobile gaming to a more professional gaming experience is a major positive for the company.

Per Transparency Market Research, the PC peripherals industry is expected to hit $627.29 billion by 2026. Moreover, launch of advanced gaming devices and growing popularity of e-sports leagues are expected to boost the industry.

To tap the growing opportunities, last month, it introduced two new high-performance gaming keyboards — the Logitech G915 LIGHTSPEED Wireless Mechanical Gaming Keyboard and the Logitech G815 LIGHTSYNC RGB Mechanical Gaming Keyboard — both based on the LIGHTSPEED wireless technology.

Moreover, the ASTRO Gaming brand is helping Logitech carve a deeper niche in the gaming peripheral market. This acquisition was a strategic move on the company’s part to make headway in the console market, as it has historically targeted PCs, tablets and phones.

Reportedly, Logitech's gaming mouse business, which got a boost from the launch of a wireless version of the company's G502 gaming mouse in May this year, is gaining market share.

Moreover, the revamped version of Logitech's Blue Microphones unit’s G Pro headset for eSports players is also doing well.

Competition Remains an Overhang

The market where Logitech operates is highly competitive and characterized by constant new product introductions, rapidly changing technology, evolving customer demands and aggressive promotional and pricing practices.

In the Gaming products market, Logitech faces significant competition from Turtle Beach Corporation (NASDAQ:HEAR) .

Per the 2019 Video Game Sale Statistics by NPD Group, Turtle Beach has been the market leader in gaming headsets by units shipped for the past seven consecutive years, with more than 12 million more headsets sold life-to-date compared with its nearest competitor. The company has also achieved the distinction of being the leading player in the industry by revenues for the past nine consecutive years.

However, with a strong portfolio of gaming equipment, Logitech seems to be well poised to take on the competition and maintain its stronghold in the market.

Zacks Rank and Other Key Picks

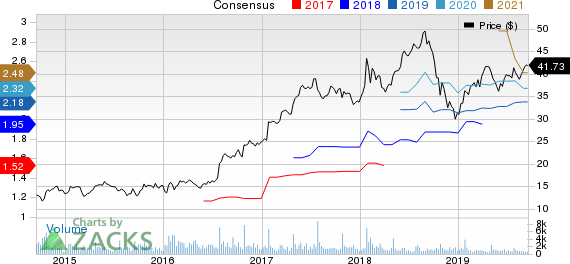

Logitech currently carries a Zacks Rank #2 (Buy). A couple of other top-ranked stocks in the broader technology sector are LogMeIn (NASDAQ:LOGM) and Anixter International (NYSE:AXE) , each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for LogMeIn and Anixter is currently pegged at 5% and 8%, respectively.

5 Stocks Set to Double

Zacks experts released their picks to gain +100% or more in 2020. One is a famous cutting-edge food company that is “hiding in plain sight.” Swamped with competitors and ignored by Wall Street, its stock price floundered. Now, suddenly, it acquired a company that gives it an advantage none of its peers have.

Today, see all 5 stocks with extreme growth potential >>

Turtle Beach Corporation (HEAR): Free Stock Analysis Report

Logitech International S.A. (LOGI): Free Stock Analysis Report

LogMein, Inc. (LOGM): Free Stock Analysis Report

Anixter International Inc. (AXE): Free Stock Analysis Report

Original post

Zacks Investment Research