Lionsgate Entertainment LGF.A reported fourth-quarter fiscal 2019 adjusted earnings of 11 cents per share, which missed the Zacks Consensus Estimate of 18 cents and plunged 56% from the year-ago quarter.

Revenues declined 12.2% year over year to $913.7 million and lagged the Zacks Consensus Estimate of $939 million. Decline in Motion Picture and Television Production revenues negatively impacted the top line.

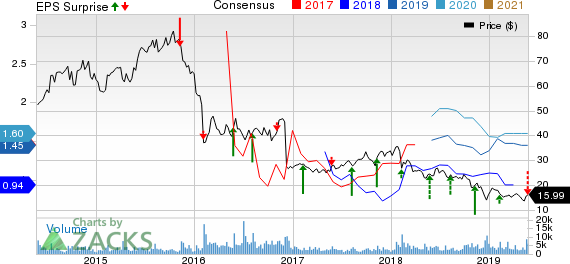

Lions Gate Entertainment Corp. Price, Consensus and EPS Surprise

Lions Gate Entertainment Corp. price-consensus-eps-surprise-chart | Lions Gate Entertainment Corp. Quote

Segment Details

Motion Pictures (39.1% of revenues) revenues declined 15.8% year over year to $357.6 million. The segment logged profit of $20.9 million, down 28.4% from the year-ago quarter due to “the timing of pre-release PNA spend on first-quarter titles.”

However, Lionsgate noted that its recently released movie, John Wick 3, did really well as it opened as the number one movie globally.

Television Production (29.9% of revenues) revenues were down 7.4% year over year to $272.8 million as the release of a few episodes were pushed beyond fiscal 2019. Segment profits totaled $19.5 million compared with $21.8 million in the prior-year quarter.

However, Lionsgate is ramping up its television content slate to become the primary content provider to streaming platforms. In a first deal, the company’s romantic comedy, Love Life, will be made available on AT&T’s (NYSE:T) Warner Media’s streaming platform.

The Media Networks segment (39.6% of total revenues), formed after the acquisition of Starz, reported revenues of $362 million, up 2.4% year over year driven by over-the-top (OTT) subscriber growth. However, segment profit was $90.9 million, down 20.7% due to the ongoing investments in STARZPLAY.

Starz Networks revenues (98% of media revenues) increased 1.2% year over year to $354.8 million.

Domestic subscribers grew 1.2 million year over year, taking the total domestic subscriber count to 24.7 million at the end of the fourth quarter owing to sequential growth in OTT subscribers (4 million). Notably, growth in OTT subscribers was driven by solid performance of American Gods and Now Apocalypse. Moreover, Lionsgate’s total international subscribers came at 3 million in the reported quarter.

STARZPLAY International revenues summed $1.2 million in the reported quarter. Notably, STARZPLAY has subscribers from 42 countries, courtesy of the company’s international expansion strategy.

Strength in Starz premium content along with international launches on strong platforms like Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) Prime helped Lionsgate accelerate international growth. Additionally, management noted that the count will increase to 51 countries by Jul 1, 2019.

While management anticipates the international subscription video on-demand market to be about $45 billion, it expects to on board 15-25 million new subscribers by 2025.

Streaming services (1.7%) surged 106.9% year over year to $6 million.

Operating Details

Adjusted OIBDA plunged 24% from the year-ago quarter to $103.3 million. Adjusted OIBDA margin contracted 180 basis points (bps) to 11.3%.

Operating loss was $34 million in the reported quarter against the operating income of $48.4 million in the year-ago period.

Balance Sheet & Cash Flow

As of Mar 31, 2019 cash and cash equivalents were $184.3 million compared with $106.2 million as of Dec 31, 2018. Total film obligations and production loans amounted to $512.6 million compared with $441.2 million in the prior quarter.

Net cash flow from operating activities was $171.8 million in the reported quarter, much higher than $17 million in the year-ago quarter.

Adjusted free cash flow was $150.8 million against the free cash outflow of $46 million in the year-ago quarter.

Fiscal 2020 Guidance

Management expects three-year CAGR of “mid-to-high single digits.” Adjusted OIBDA is anticipated to be $250-$700 million, excluding the losses relating to STARZPLAY. Notably, Lionsgate expects STARZPLAY international losses to be about $125-$150 million.

Management anticipates STARZPLAY to become profitable by 2023.

Currently, Lionsgate carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Lions Gate Entertainment Corp. (LGF.A): Free Stock Analysis Report

Original post