Lincoln Electric Holdings, Inc. (NASDAQ:LECO) delivered adjusted earnings of $1.29 per share in fourth-quarter 2018, surging 28% year over year. The reported figure also surpassed the Zacks Consensus Estimate of $1.20.

Lincoln Electric Holdings, Inc. (LECO): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Free Stock Analysis Report

Enersys (ENS): Free Stock Analysis Report

Axon Enterprise, Inc (AAXN): Free Stock Analysis Report

Original post

Zacks Investment Research

Including one-time items, earnings in the reported quarter came in at $1.35 compared with 36 cents recorded in the prior-year quarter.

Total revenues dipped 0.4% year over year to $744 million. Organic sales growth was 1.6% in the reported quarter. Sales missed the Zacks Consensus Estimate of $793 million.

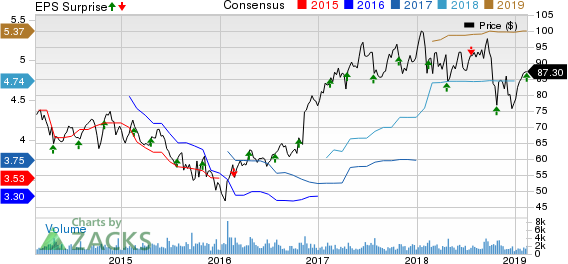

Lincoln Electric Holdings, Inc. Price, Consensus and EPS Surprise

Cost of goods sold decreased 3% year over year to $494 million. Gross profit advanced 5% year over year to $250 million. Gross margin contracted 180 basis points (bps) year over year to 33.47%.

Selling, general and administrative expenses inched up 0.7% to $154 million from the year-earlier quarter. Adjusted operating profit rose 7% year over year to $97 million in the reported quarter. Operating margin expanded 90 bps year over year to 13%.

Financial Update

Lincoln Electric had cash and cash equivalents of $359 million at the end of 2018 with $327 million recorded at the end of 2017. The company recorded cash flow from operations of $329 million in 2018 compared with $3354 million recorded in prior year.

2018 Results

Lincoln Electric reported adjusted earnings per share of $4.82 in 2018, up 27% from $3.79 in the prior year. Earnings beat the Zacks Consensus Estimate of $4.74. Including one-time items, earnings in the stood at $4.37 compared with $3.71 in the prior year.

Sales increased 15% year over year to $3.03 billion. The top line missed the Zacks Consensus Estimate of $3.05 billion.

Share Price Performance

Shares of the company have fallen around 7% in a year, compared with the industry’s decline of 15%.

Zacks Rank & Key Picks

Lincoln Electric currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Axon Enterprise, Inc (NASDAQ:AAXN) , Alarm.com Holdings, Inc. (NASDAQ:ALRM) and EnerSys (NYSE:ENS) . While Axon and Alarm.com currently flaunt a Zacks Rank #1 (Strong Buy), EnerSys carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axon has an expected earnings growth rate of 14.5% for 2019. The company’s shares have rallied 105.9% in the past year.

Alarm.com has an expected earnings growth rate of 7.8% for 2019. The stock has climbed 84% in a year’s time.

EnerSys has an expected earnings growth rate of 9.5% for 2019. Its shares have gained 25.5% in the past year.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

Lincoln Electric Holdings, Inc. (LECO): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Free Stock Analysis Report

Enersys (ENS): Free Stock Analysis Report

Axon Enterprise, Inc (AAXN): Free Stock Analysis Report

Original post

Zacks Investment Research