Lincoln Electric Holdings, Inc. (NASDAQ:) reported adjusted earnings of 97 cents per share in second-quarter 2017, up 17% year over year. Earnings also surpassed the Zacks Consensus Estimate of 94 cents.

In the second quarter, the company witnessed sales growth across all three segments as well as in most end markets. Operational initiatives and volume improvements helped counter inflated raw material costs and operating expenses.

Including one-time items, earnings in the reported quarter came in at 92 cents compared with 45 cents recorded in the prior-year quarter. The reported quarter’s earnings per share include acquisition transaction and integration costs of 5 cents per share, related to the proposed acquisition of Air Liquide (PA:) Welding.

Total revenue went up 5.8% year over year to $627 million, driven by 3.2% higher volumes and 2.6% increase in product prices. However, excluding Venezuela from prior-year results due to the deconsolidation of the operation, sales increased 6.9% on the back of 4.2% higher volumes and a 2.7% increase in price. Sales also beat the Zacks Consensus Estimate of $622 million.

Costs and Margins

Cost of goods sold increased 5.1% year over year to $409 million. Gross profit advanced 7% year over year to $217 million. Gross margin expanded 40 basis points (bps) year over year to 34.7%.

Selling, general and administrative expenses flared up 8% to $130 million from $120 million recorded in the prior-year quarter. Adjusted operating profit rose 12% year over year to $92 million in the reported quarter. Operating margin expanded 80 bps year over year to 14.7%.

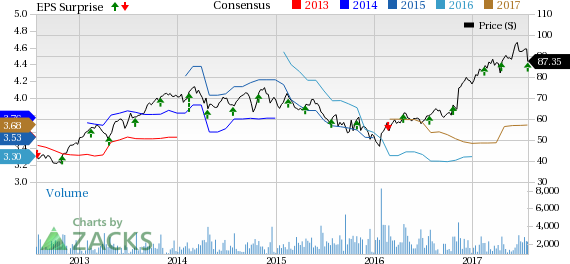

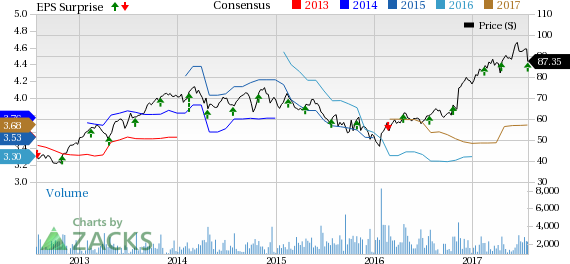

Lincoln Electric Holdings, Inc. Price, Consensus and EPS Surprise

Lincoln Electric Holdings, Inc. Price, Consensus and EPS Surprise | Lincoln Electric Holdings, Inc. Quote

Financial Update

Lincoln Electric had cash and cash equivalents of $396 million at the end of second-quarter 2017 compared with $379 million at the end of 2016. Cash flow from operations came in at $75.4 million in the reported quarter compared with $102 million recorded in the year-ago quarter.

On Apr 27, Lincoln Electric entered into an agreement with Air Liquide to acquire its France-based subsidiary, Air Liquide Welding for $131 million, including the assumption of net debt and working capital adjustments. Air Liquide Welding is an important player in the manufacturing of welding and cutting technologies, and had a turnover of around €350 million ($427 million) in 2016.

Backed by sustained improvement in year-over-year demand, Lincoln Electric expects modest sales and margin growth in 2017.

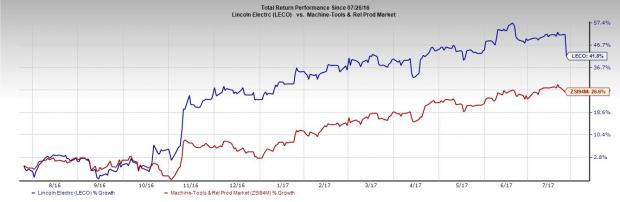

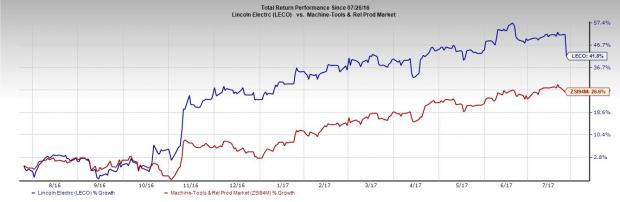

Share Price Performance

In the last one year, Lincoln Electric outperformed the industry with respect to price performance. The stock gained around 41.8%, while the industry lagged behind with growth of 26.6%.

Zacks Rank & Key Picks

Lincoln Electric currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the same sector are AGCO Corporation (NYSE:) , Terex Corporation (NYSE:) and Apogee Enterprise, Inc. (NASDAQ:) . All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an average positive earnings surprise of 40.39% in the trailing four quarters. Terex generated an outstanding average positive earnings surprise of 122.61% in the past four quarters, while Apogee has an average positive earnings surprise of 3.41% in the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis ReportLincoln Electric Holdings, Inc. (LECO): Free Stock Analysis ReportTerex Corporation (TEX): Free Stock Analysis ReportAGCO Corporation (AGCO): Free Stock Analysis ReportOriginal post