The Q3 earning season is nearing its last leg, and the widely diversified Consumer Discretionary sector has grabbed much of the attention.

According to the latest Earnings Outlook, 54.3% of the Consumer Discretionary companies in the S&P 500 index have reported their results as of Nov 2. The growth rate for earnings and revenues is 11% and 7.9%, respectively. Moreover, the beat ratios for this sector are noteworthy (68.4% for earnings and 47.4% for revenues).

Leisure Stocks in Focus

Turning our focus on the leisure companies from the sector, we note that their performance has been mixed so far this earnings season.

Among the leisure stocks that have reported, Polaris Industries Inc. (NYSE:PII) delivered a better-than-expected performance in the third quarter. However, ClubCorp Holdings, Inc. (NYSE:MYCC) missed both revenue and earnings estimates.

A number of leisure stocks are set to report their third-quarter 2016 results on Nov 7. Let’s take a look at what might be in store for them this quarter:

Marriott International, Inc. (NASDAQ:MAR) posted a positive earnings surprise of 5.10% last quarter. In fact, the company’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, with an average beat of 3.85%.

Notably, our proven model shows that an earnings beat is likely for Marriott this time around. This is because the company has the right combination of the two key ingredients – a Zacks Rank #3 (Hold) or better and a positive Earnings ESP – to increase its odds of an earnings surprise. Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

For the quarter, the company has an Earnings ESP of +1.11% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 90 cents.

Marriott’s earnings have been surpassing the Zacks Consensus Estimate consistently over the past few quarters on the back of solid RevPAR growth as well as strong margins. We expect the trend to continue in Q3. However, lingering global uncertainties coupled with negative currency translation is likely to limit top-line growth (read more: Marriott to Report Q3 Earnings: A Beat in the Cards?).

MGM Resorts International (NYSE:MGM) posted a 23.81% positive earnings surprise in the last reported quarter. In fact, the company surpassed the Zacks Consensus Estimate in three of the trailing four quarters, with an average beat of 83.15%.

For the quarter, we expect MGM Resorts to beat expectations as the company has an Earnings ESP of +25.00% and a Zacks Rank #3. Notably, the Zacks Consensus Estimate for the quarter’s bottom line is pegged at 8 cents.

MGM Resorts’ earnings in the to-be-reported quarter are expected to benefit from higher demand at its properties in Las Vegas. Also, diversification of its resort portfolio and non-gaming options along with the company’s profit growth should further boost profits in Q3. Meanwhile, performance in Macau is also expected to get a boost in the quarter (read more: MGM Resorts: A Beat in the Cards in Q3 Earnings?).

Live Nation Entertainment, Inc. (NYSE:LYV) recorded an 85.71% positive earnings surprise in the last reported quarter. In fact, the company beat estimates in three of the four trailing quarters, with an average beat of 11.90%.

For the quarter, the company has an Earnings ESP of 0.00%, which makes surprise prediction difficult even though the company has a Zacks Rank #3. Notably, the Zacks Consensus Estimate for the quarter’s earnings is pegged at 48 cents.

We expect various digital initiatives undertaken by the company to improve the ticket booking experience to drive third-quarter revenues. However, unfavorable foreign currency translations and sluggishness in the overall macro environment might dent revenues (read more: What's in Store for Live Nation this Earnings Season?).

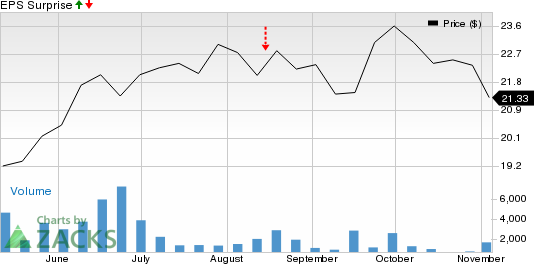

Leisure and recreation services company, AMC Entertainment Holdings, Inc. (NYSE:AMC) , posted a 17.24% negative earnings surprise last quarter. Moreover, the trailing four-quarter average earnings surprise is a negative 2.65%.

Nonetheless, we expect the company to beat expectations this quarter due to the combination of its Zacks Rank #3 and Earnings ESP of +3.57%. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at 28 cents.

AMC Theatres and Dolby Laboratories Inc.’s (NYSE:DLB) strategic tie-up should boost results in the to-be-reported quarter. However, being part of the entertainment industry exposes the company to macro-economic fluctuations (read more: AMC Entertainment Q3 Earnings: A Beat in the Cards?).

Red Rock Resorts, Inc. (NASDAQ:RRR) registered a 40% negative earnings surprise last quarter.

For the quarter, the company has an Earnings ESP of 0.00%, which makes surprise prediction difficult even though the company has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for the quarter’s earnings is pegged at 27 cents.

Stay tuned! Check back on our full write-up on earnings releases of these stocks.

Zacks' Best Investment Ideas for Long-Term Profit

Today you can gain access to long-term trades with double and triple-digit profit potential rarely available to the public. Starting now, you can look inside our stocks under $10, home run and value stock portfolios, plus more. Want a peek at this private information? Click here >>

MGM RESORTS INT (MGM): Free Stock Analysis Report

DOLBY LAB INC-A (DLB): Free Stock Analysis Report

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

POLARIS INDUS (PII): Free Stock Analysis Report

LIVE NATION ENT (LYV): Free Stock Analysis Report

AMC ENTERTAINMT (AMC): Free Stock Analysis Report

CLUBCORP HLDGS (MYCC): Free Stock Analysis Report

RED ROCK RESRTS (RRR): Free Stock Analysis Report

Original post

Zacks Investment Research