Laboratory Corporation of America Holdings (NYSE:LH) , or LabCorp, reported fourth-quarter 2018 adjusted earnings per share (EPS) of $2.52, up 11% from the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate by 1.6%.

On a reported basis, net earnings came in at $1.56 per share as compared with $6.63 a year ago.

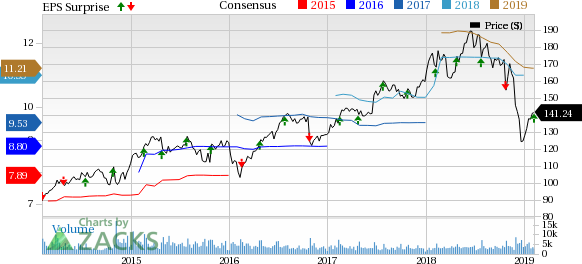

Adjusted EPS in 2018 came in at $11.02, up 19.8% year over year. The figure also surpassed the Zacks Consensus Estimate of $11 by a slight margin.

Revenues in the quarter under review increased 1.6% year over year to $2.79 billion. The year-over-year rise was backed by 0.7% growth from acquisitions and organic growth of 2.9%, partially offset by a 1.6% negative impact from the disposition of businesses and a 40-basis point (bps) impact of foreign currency translation. The top line beat the Zacks Consensus Estimate by 0.2%.

Laboratory Corporation of America Holdings Price, Consensus and EPS Surprise

Revenues in 2018 came in at $11.33 billion, up 9.9% year over year. The figure was in line with the Zacks Consensus Estimate.

Quarter Under Review

LabCorp reports under two operating segments: LabCorp Diagnostics and Covance Drug Development.

In the fourth quarter, LabCorp Diagnostics reported revenues of $1.69 billion, a 2.8% drop year over year. While revenues were fueled by tuck-in acquisitions, a favorable mix and organic volume (measured by requisitions), this was offset by the negative impact from the disposition of businesses and the implementation of the Protecting Access to Medicare Act (PAMA). In addition, foreign currency translation reduced revenue by approximately 0.2%.

Excluding the disposition of businesses, the company reported a 0.3% rise in total volume (measured by requisition) and a 0.4% decline in revenue per requisition in the quarter under review.

Covance Drug Development reported a 9.6% rise in revenues to $1.10 billion in the fourth quarter. The upside was primarily driven by acquisitions and organic growth, partially offset by the adverse impact of foreign currency translation of nearly 90 bps.

Gross margin deteriorated 210 bps to 27.7% in the reported quarter. Adjusted operating income was down 6.1% year over year to $375.5 million. Also, adjusted operating margin contracted 110 bps from the year-ago quarter to 13.5%.

LabCorp exited 2018 with cash and cash equivalents of $426.8 million compared with $316.6 million at the end of 2017. In 2018, operating cash flow was $1.31 billion, down from $1.50 billion in the year-ago period. Free cash flow came in at $925.6 million in this period, down from $1.19 billion a year ago.

During the quarter under discussion, the company returned $400 million to shareholders via share repurchases. LabCorp informed that the company’s existing share repurchase plan has been replaced with a new plan authorizing repurchase of up to $1.25 billion.

Outlook

LabCorp has provided its 2019 guidance.

Revenue growth is expected in the band of 0.5-2.5% from 2018. This includes the adverse impact from the disposition of businesses of around 1% and foreign currency translation of roughly 0.4%. The Zacks Consensus Estimate for current-year revenues is pegged at $11.51 billion.

Adjusted EPS for 2019 is projected in the range of $11 to $11.40. The consensus mark of $11.21 for the metric is within the guided range.

Free cash flow is projected in the band of $950 million-$1.05 billion.

Our Take

LabCorp exited the fourth quarter on a promising note. While increasing acquisitions and a favorable mix positively contributed to LabCorp’s Diagnostics business in the quarter, the disposition of certain businesses and the implementation of PAMA dented growth.

Covance Drug Development, however, reported sturdy growth. The strength primarily came from acquisitions and robust organic growth. Nevertheless, adverse currency translation impacted the top line.

Zacks Rank & Key Picks

LabCorp carries a Zacks Rank #4 (Sell).

Some better-ranked MedTech stocks that posted solid quarterly results are Varian Medical Systems (NYSE:VAR) , AngioDynamics (NASDAQ:ANGO) and CONMED Corporation (NASDAQ:CNMD) .

Varian reported fiscal first-quarter adjusted EPS of $1.06, in line with the Zacks Consensus Estimate. Revenues of $741 million outpaced the consensus mark of $717.9 million. The stock has a Zacks Rank #2 (Buy).

AngioDynamics’ fiscal second-quarter adjusted EPS of 22 cents exceeded the Zacks Consensus Estimate by a penny. Revenues totaled $91.5 million, which surpassed the consensus estimate by 2.9%. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CONMED delivered fourth-quarter adjusted EPS of 73 cents, in line with the Zacks Consensus Estimate. Revenues of $242.4 million beat the Zacks Consensus Estimate of $229.2 million. The stock carries a Zacks Rank of 2.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

AngioDynamics, Inc. (ANGO): Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH): Free Stock Analysis Report

CONMED Corporation (CNMD): Free Stock Analysis Report

Original post