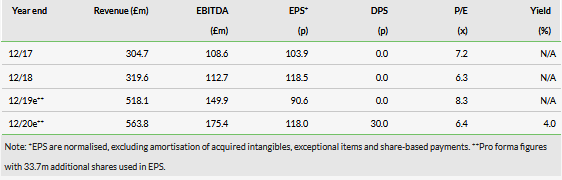

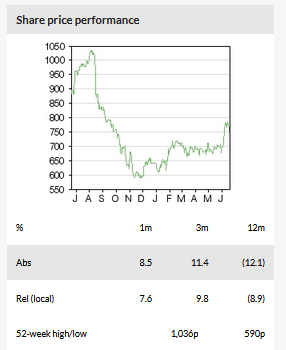

We are updating our forecasts to reflect Jackpotjoy PLC (LON:JPJ)’s £490m proposed acquisition of Gamesys. For FY20, our pro forma adjusted EBITDA is 77% higher than for standalone JPJ and we forecast EPS accretion of 10.5%. The £490m consideration will be split between £250m cash (including £175m of add-on facilities) and £240m in 33.7m new JPJ shares. We forecast net debt/EBITDA of 3.1x at YE19, falling rapidly to 2.0x at YE20. On this basis, we believe the company could start to pay dividends in H220, and would be in a position to consider share buybacks. Assuming the deal completes on these terms, JPJ trades at 7.6x EV/EBITDA and 6.4x P/E for FY20.

Business description

JPJ Group is a leading online gaming operator mainly focused on bingo-led gaming targeting. It has announced the £490m acquisition of Gamesys Group (its platform provider) and completion is expected in Q319. The enlarged group will be renamed Gamesys Group.

Gamesys Group: Entering FTSE 250

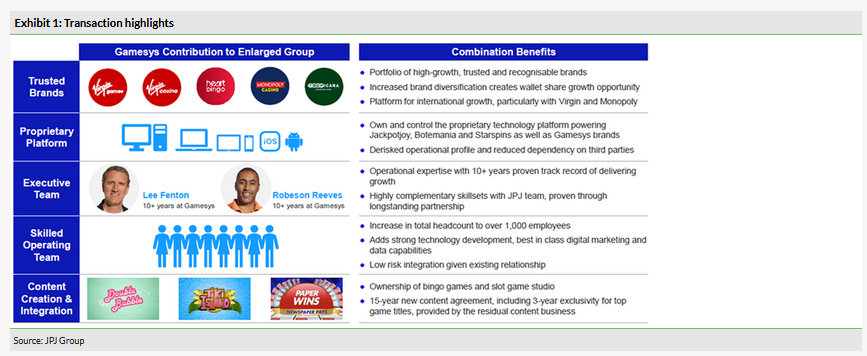

JPJ’s proposed acquisition of Gamesys appears to be a neat solution to gain control of the platform, improve operational performance and accelerate international growth. Gamesys brings a number of high-profile brands (Virgin, Heart Bingo, Monopoly, but not the sports brands), ownership of a bingo and a slots studio, as well as a 15-year new content agreement (for an additional c £8.5m annual fee). Integration risk is low given the longstanding relationship between the two companies and the Gamesys CEO will become the CEO for the enlarged group. The business will be renamed Gamesys Group and we expect the company to enter the FTSE 250 on completion, which is anticipated in Q319.

Deleveraging quickly, possible dividends in H220

The £490m acquisition price is to be split between £250m cash (including £175m of add-on debt facilities and existing cash) and £240m of new JPJ shares. Gamesys revenues and adjusted EBITDA in 2018 were £185m and £67m, respectively, and our new pro forma figures assume an 11% revenue CAGR for Gamesys for 2018–21. We also expect that an additional c £10m of point of consumption tax (POCT) will be broadly offset by cost savings and synergies. Altogether, our FY20 adjusted EBITDA is 77% higher than before and we estimate 10.5% EPS accretion. With strong cash generation, we forecast net debt/EBITDA of 3.1x at YE19, falling rapidly to 2.0x at YE20. This is only slightly higher than our previous YE20 forecast of 1.8x, suggesting that the company could pay a dividend in H220.

Valuation: 6.4x FY20 P/E on pro forma figures

Our new pro forma forecasts indicate 10.5% EPS accretion on the back of this deal and, on this basis, JPJ trades at 7.6x EV/EBITDA and 6.4x P/E for FY20. This remains at the lower end of the peer group and, as the company rapidly deleverages, we expect value to shift from debt to equity.

Gamesys: The enlarged group

Deal rationale: Control and international expansion

JPJ’s proposed acquisition of Gamesys appears to be a neat solution to gain control of the platform, improve operational performance and accelerate international growth. As demonstrated in the chart below, key highlights are:

High-profile brands with international growth potential: Gamesys brings a number of high-profile, complementary brands, including Virgin, Heart Bingo and Monopoly (NB not the sports brands), which JPJ will promote in its international markets. At present, Gamesys derives c 95% of its revenues from the UK, with c 5% from the US. This compares to c 50% UK revenues for standalone JPJ. Following the deal, we estimate that c 70% of revenues will be generated in the UK, with notable international markets including Japan, Germany, Sweden, Spain and the US.

Ownership of bingo/slots studio and 15-year new content agreement: as part of the deal JPJ will own a bingo and a slots studio and it has also signed a 15-year new games content agreement, for which JPJ will pay a licensing fee to the residual Gamesys business. On a pro forma basis, the fee amounted to £8.5m in FY18 and we are assuming a similar level going forward.

Greater operational control through proprietary technology: following the acquisition of the Jackpotjoy brand from Gamesys in 2015, JPJ has continued to use Gamesys as a platform provider. The original intention was for JPJ to ‘internalise’ staff from Gamesys from 2019, as well as pay 25% additional platform fees from April 2020. The acquisition of Gamesys therefore avoids the need for both costs. We forecast total synergies of c £5m, which are in addition to the avoidance of increased platform costs (ie higher margins for the JPJ business).

Low integration risk and aligned management team: we believe that integration risk is low given the longstanding relationship between the two companies and the Gamesys CEO (Lee Fenton) will become the CEO for the enlarged group.

£490m deal; completion expected in Q319

Completion of the deal is expected in Q319 and the enlarged group will be renamed Gamesys Group. At the current share price, the market cap would become c £820m, with the issuance of an additional 33.7m shares. On this basis, the enlarged group should become a constituent of the FTSE 250.

Key terms of the £490m deal include:

- £240m payable in cash on completion.

- £10m payable in cash to Gamesys shareholders 30 months after completion. This is outside our forecast period.

- The issuance of 33.7m new shares (equivalent to £240m) to shareholders of Gamesys, who will hold 31% of the enlarged group (in addition to the 4.5% already held).

- Based on EBITDA of £67m for 2018, the implied EV/EBITDA for the deal is 7.3x. Including the additional £8.5m annual payment to Gamesys for the games licensing agreement, the multiple would be 8.4x, which is in line with JPJ’s standalone current EV/EBITDA multiple. As detailed below, we also note that the increased POCT tax (c £10m) is offset by synergies and the avoidance of increased platform fees.

Pro forma forecasts

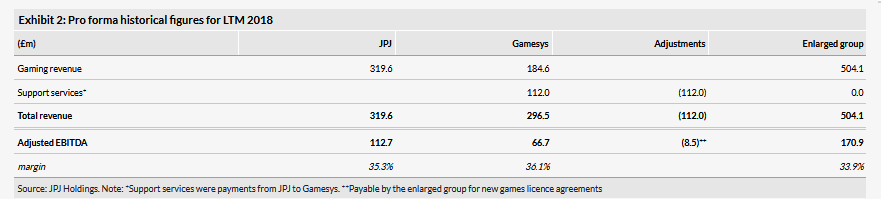

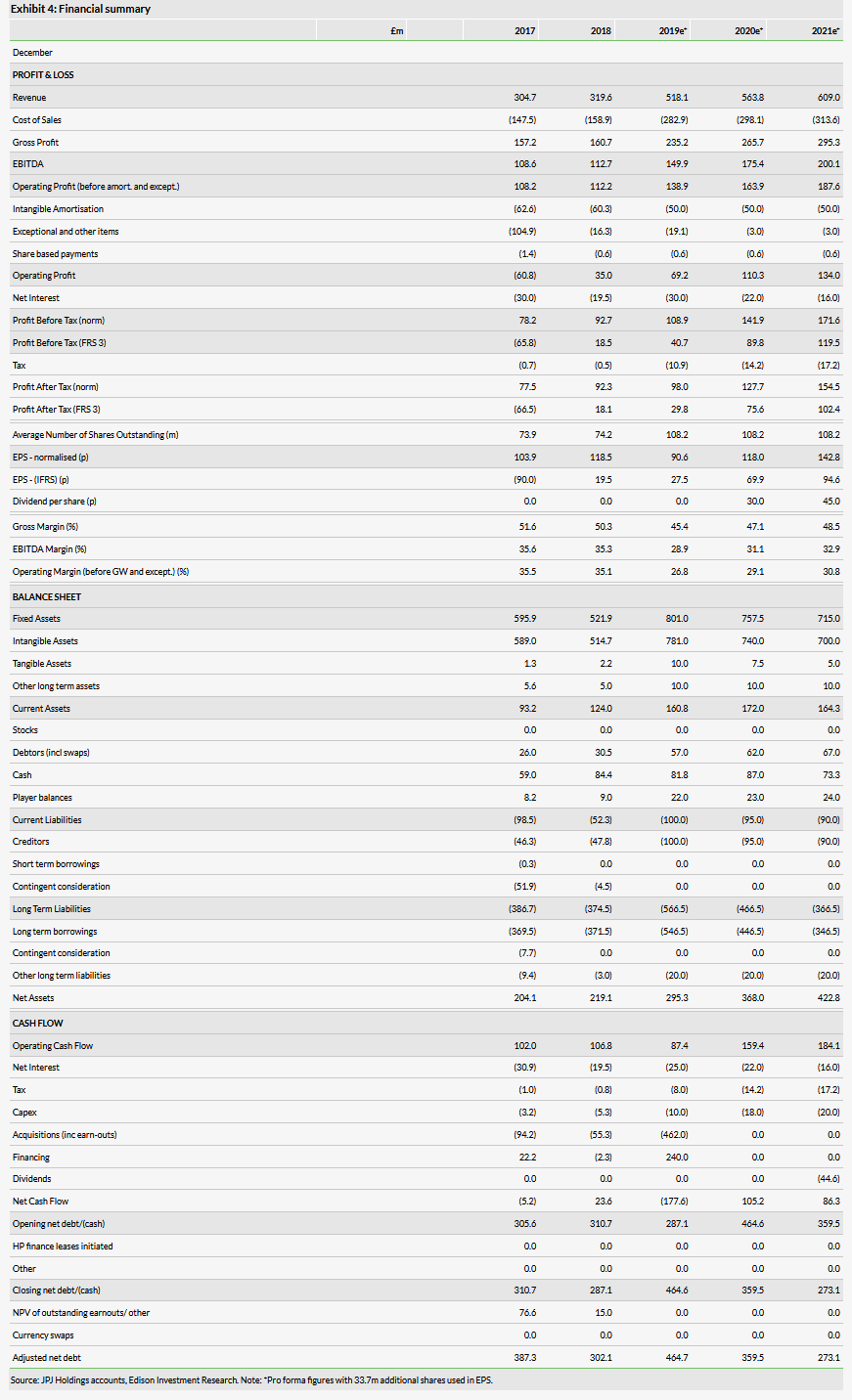

JPJ has provided historical pro forma figures for FY18, which we are using as the basis for our future pro forma forecasts. We include the Gamesys figures as if the business were acquired from January 2019 and summarise the key dynamics here:

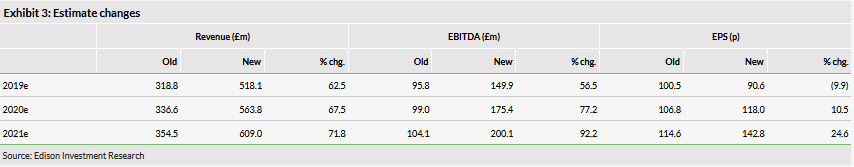

Revenues – c 11% three-year CAGR for Gamesys: in addition to our existing JPJ revenue forecasts, we are assuming an 11% revenue CAGR for Gamesys in 2018–21. This includes slightly lower growth in FY19, due to well-flagged regulatory hurdles in the UK bingo-led sector. In total, our pro forma revenues are now 63% higher in FY19 and 68% higher in FY20, vs our previous forecasts.

EBITDA – POCT offset by cost savings from FY20 onwards: the UK point of consumption tax (POCT) increased from 15% to 21% in April 2019. As a result, the annual impact on Gamesys EBITDA is c £10m. Offsetting this tax increase, our forecasts include synergies of c £5m, as well as the avoidance of increased platform fees. Including an annual c £8.5m games licensing fee, our EBITDA increases from £95.8m to £149.9m in FY19 and from £99.0m to £175.4m in FY20. Beyond the synergies, we believe there could be upside to our forecasts from margin expansion in Gamesys EBITDA from FY20, as the brands are marketed overseas (where there are less or no gaming taxes).

Interest costs – £30m in FY19: we forecast pro forma interest costs of £30m in FY19m, falling to £22m in FY20, as the company deleverages.

10.5% EPS accretion in FY20: with the additional interest costs, and higher tax and depreciation, our pro forma EPS is 90.6p in FY19, 118.0p in FY20 and 142.8p in FY21. As shown in Exhibit 3 below, this is 10.5% accretive in FY20 and 24.6% accretive in FY21.

Dividend could resume one year later: given the higher debt levels, we do not expect JPJ to pay any dividend in FY19, but the company has reiterated that it remains committed to returning cash to shareholders once net debt/EBITDA falls comfortably below 2.5x. We estimate a ratio of 2.0x at YE20 and have therefore included a small dividend for H220, payable in FY21. This is essentially one year later than our previous forecasts.

Balance sheet – additional £326m goodwill: our pro forma balance sheet is based on the FY18 pro forma figures provided by JPJ. Apart from the £175m increase in long-term debt, the most notable item is that goodwill has increased by £326m.

Net debt to decline rapidly in FY20: our net debt figure for FY19 increases from £224.4m to £464.7m, which is basically related to the acquisition (£240m cash payment and transaction fees), and allows for one quarter of Gamesys cash flow. Our forecast net debt for FY20 is £359.5m, up from £182.6m.