Yesterday, my colleague Ken Odeluga highlighted that falling interest rates (and the associated drop in lending revenues) would be a major theme as big US banks reported this quarter’s earnings.

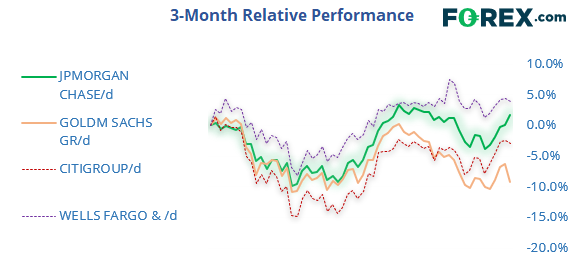

Today, those fears were borne out in the reports of Goldman Sachs (NYSE:GS) and Wells Fargo (NYSE:WFC), though JPMorgan (NYSE:JPM) and Citigroup (NYSE:C) were able to navigate the headwinds successfully:

- Goldman Sachs (NYSE:GS) reported EPS of $4.79, below estimates of $4.86, as the company works to transition away from proprietary trading to a more traditional retail bank.

- Wells Fargo (NYSE:WFC) also missed estimates at $1.07 in EPS vs. $1.14 expected in the first report after naming Charles Scharf as its new CEO. In a clear example of negative impact of falling interest rates, the consumer-focused bank reported worse-than-anticipated Net Interest Income despite 2% growth in total loans.

- JP Morgan beat estimates, reporting $2.68 in EPS vs. $2.46 eyed. The company also beat revenue estimates on the back of decent results from its investment banking division.

- Citigroup (NYSE:C) narrowly outperformed analysts’ expectations, with $1.97 in EPS vs. $19.5 eyed. Solid trading revenue figures helped the firm beat headline revenue expectations as well.

For traders anticipating the worst, this morning’s bank earnings onslaught was not as bad as feared. At the open, major indices are edging higher and the big banks are trading roughly in line with their earnings results:

- Goldman Sachs (NYSE:GS) is trading down more than -3%.

- Wells Fargo (NYSE:WFC) is dipping less than -1%

- JP Morgan (JPM) is tacking on nearly 2%.

- Citigroup (NYSE:C) is essentially flat.

Looking ahead, the Federal Reserve appears likely to cut interest rates further this quarter, with futures traders pricing in an 80% chance of at least one interest rate cut by the end of the year and about a 25% probability of two cuts. If interest rates more broadly continue to trend lower, Wells Fargo’s large mortgage business could be a casuality.

Market volatility will also play a key role in the banks’ trading revenue; with geopolitical tensions on the rise, Brexit looming, and lingering concerns about the state of play between the US and China, a spike in volatility could benefit banks in Q4.

In addition to falling interest rates and market volatility, one key factor to watch moving forward will be buybacks. According to Barclays (LON:BARC), large banks have reduced their outstanding shares by 2% over the last quarter, and after the Fed approved a record $173B in buybacks and dividends for the banks, this may be just the tip of the proverbial buyback iceberg. Citigroup (NYSE:C) alone reduced its share count by 11% over the past year!

While the broader economy may prefer banks to grow revenues through more traditional means, big banks’ investors will no doubt benefit from the firms returning capital to their shareholders.