John Laing Group's (LON:JLG) pre-close statement maintained guidance for FY18 investment commitments and realisations at £250m. The investment pipeline and the market for secondary assets are reported to be “strong” and the portfolio continues to become increasingly diversified geographically. With a strong market background and the financial strength to exploit market opportunities, we see scope for JLG to close the valuation gap to NAV and its peers.

Guidance maintained

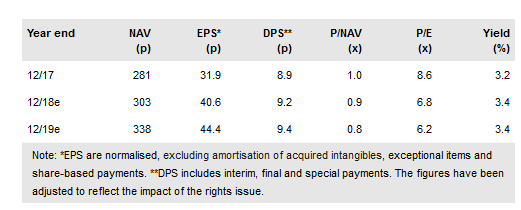

JLG’s pre-close statement maintained guidance for FY18 investment commitments and realisations at £250m. Realisations are well on the way to achieving this total and have so far totalled £241.5m (including £232.0m for IEP Phase 1). Commitments have been running at a slower pace in H1, but JLG maintains a strong investment pipeline and expects a pick-up in H2. Encouragingly, the market for secondary assets also remains strong. The deficit on the pension fund (according to IAS19), which stood £35.2m at the year-end, had moved to a surplus of £19.8m by 31 May 2018, thanks to a reduction in the discount rate used (linked to yield on corporate bonds) and a contribution of £26.5m (Edison FY18e: -£7.4m). Future contributions, which are based on the actuarial deficit and are currently scheduled to run at a similar level over the next few years, will only be revisited in light of the next actuarial valuation due next March. Our forecasts remain unchanged.

To read the entire report Please click on the pdf File Below: