Japan's leading steel manufacturer, Nippon Steel Corporation, has revealed plans to acquire its American counterpart, United States Steel Corporation (NYSE:X). The proposed purchase price is $55 per share in cash, giving the transaction an estimated total worth of approximately $14.9 billion including the assumption of debt. This offer represents a notable 40% premium on U.S. Steel's closing share price as of December 15, 2023. Following this announcement, U.S. Steel’s shares topped $49.50 (up 22% for the week).

Nippon Steel, the globe's fourth largest steel manufacturer, has set its sights on achieving a worldwide crude steel capacity of 100 million metric tons. This ambition could well be in reach with the acquisition of U.S. Steel. An expansion of this magnitude into U.S. production is thought to be timely, with steel prices predicted to take an upward trajectory. This price increase is largely due to automaker companies intensifying their output following the successful termination of labor union strikes via recent agreements.

Both companies' boards have unanimously approved the negotiated agreement. The predicted timeline suggests the transition could be finalized within the second or third financial quarter of 2024.

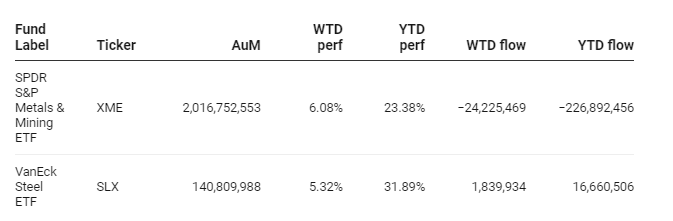

With an allocation of 6.84% to U.S. Steel, the SPDR S&P Metals & Mining ETF (XME) gained 6.08% over the week, bringing its year-to-date performance to 23.38%.

Funds Specific Data