Egypt and the United States have brokered a cease fire between Israel and Hamas after more than a week of air strikes and missile attacks. The announcement was made at a press conference by the Egyptian Foreign Minister and U.S. Secretary of State Hillary Clinton. Air strikes by Israel have left more than 150 people dead in Gaza while rocket attacks on Israel have claimed at least 5 lives.

The ceasefire states “Israel shall stop all hostilities on the Gaza Strip, land, sea and air, including in-cursions and targeting of individuals” and “all Palestinian factions shall stop all hostilities from the Gaza Strip against Israel, including rocket attacks and attacks along the border.”

The announcement of the cease fire was aided by U.S. economic data to support a rise in investor sentiment. Jobless claims fell last week by 41,000 to 410,000 while consumer confidence as measured by the University of Michigan's final index of consumer sentiment remained at a five year high. However, the index of leading economic indicators rose at a slower pace than forecasted by analysts.

U.S. Treasurys fell for the third consecutive day. Meanwhile in Europe, policy makers have failed to come up with any agreement on a debt reduction package for Greece after creditors led by Germany refused to put any more money on the table. Talks are now set to resume on November 26th.

U.S. equity markets have gained for the fourth day after Israeli Prime Minister Benjamin Netanyahu said that he has agreed to an Egyptian cease fire proposal and the release of generally positive economic news in the United States. Salesforce gained more than 8% on sales and profit that were consistent with analyst forecasts while the world's largest agricultural equipment maker, Deere & Co., fell after missing analysts forecasts. The S&P 500 has closed 0.23% higher at 1,391. Earlier in Europe, bourses managed modest gains with the DAX gaining 0.16% while the FTSE rose 0.07%.

Commodity prices were relatively stable with the major commodity indexes relatively unmoved. After having fallen on the cease fire agreement between Israel and Hamas, WTI crude has stabilised at $87.30 after the release of figures by the Energy Department that showed that inventories fell for the first time in three weeks. Precious metals have managed modest gains with gold rising 0.3% to $1,729 while silver gained 1.2% to $33.30. Agricultural commodities were mixed with grains record-ing losses while softs gained. Copper is down 0.5%.

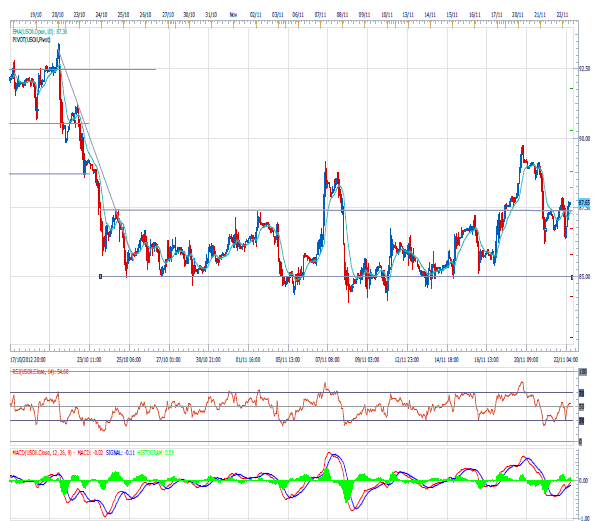

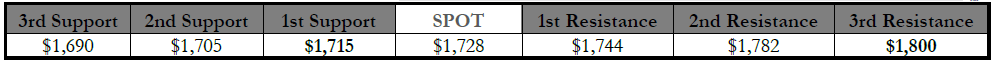

GOLD continues to consolidate and trade in its recent ranges Overnight, the price was supported by data released by the International Monetary Fund that countries from Brazil to Kazakhstan and Russian added to their gold reserves last week. Brazil added more than 17 tonnes of gold to its reserve last month. Gold traded in a $1,721 to $1,731 range. Meanwhile, physical demand out of China and India is showing some strength despite having fallen for the third quarter from last year.

Tensions in the Middle East have also seen gold's safe haven appeal come into play as its metal heads towards it 12th consecutive annual gain. We maintain our bullish outlook in both the short and medium-term. The long positions we established at below $1,680 remain in place with stop loss orders in place at $1,705 to lock in profits. We continue to target levels above $1,800 before the end of the year.

Compass Direction

Short-Term Medium-Term

BULLISH BULLISH

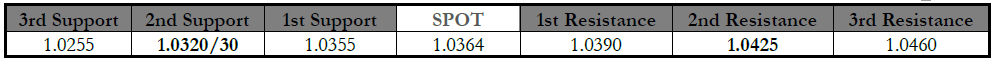

AUD/USD drifted off the 1.0385 opening level as the market continues to tire over the news reports about the fiscal cliffs and Greek debt woes. With the price sitting at 1.0375, weaker than expected Japanese imports caused a dip below 1.0350 as continued fears of global demand for our raw commodities took hold. However, with the lack of drive in the markets and all the uncertainty the price recovered in to 1.0375 during the choppy European session.

AUD seemed to shrug off the fall in the euro with the price just drifting off ever so slightly and not making a new low until way into the US session. It looks that without the S&P500 staying in the black that the AUD would have fallen more but without this link happening the AUD bounced back towards 1.0370 to close out the day. With the US Thanksgiving holiday and no major data releases in Australia for Thursday we can not see any major movements for the AUD. We see solid buying between 1.0320/30 as a solid floor whilst range traders will jump on moves to 1.0425 if seen.

Compass Direction

Short-Term Medium-Term

NEUTRAL BEARISH AUD/USD" title="AUD/USD" width="601" height="540">

AUD/USD" title="AUD/USD" width="601" height="540">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Israel-Gaza Cease Fire Aids Rise In Investor Sentiment

Published 11/22/2012, 04:39 AM

Updated 07/09/2023, 06:31 AM

Israel-Gaza Cease Fire Aids Rise In Investor Sentiment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.