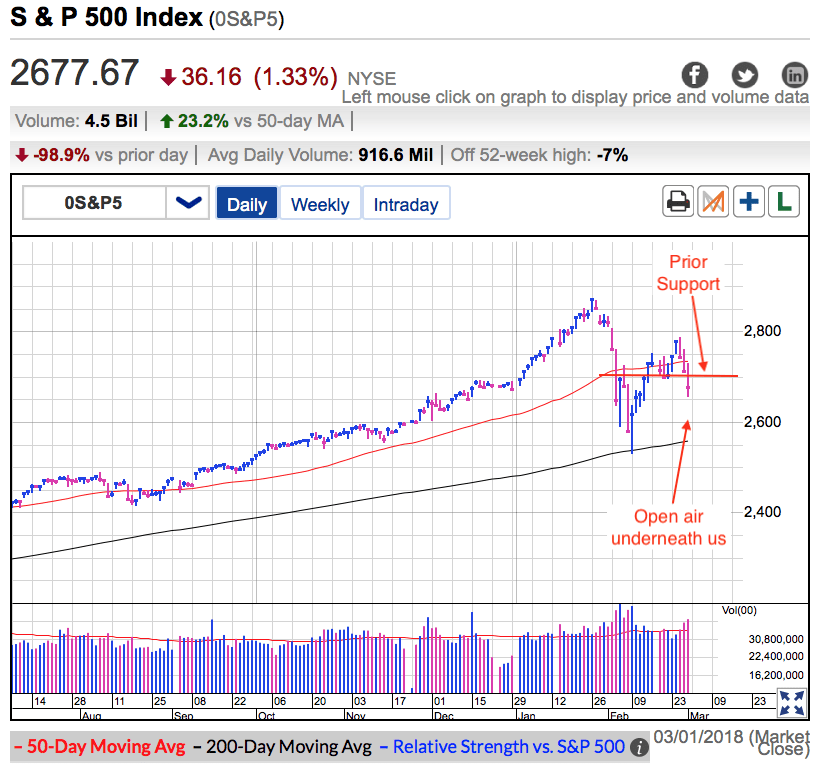

It’s been a rough few days for the S&P 500. First the new Fed chairman hinted at four rate hikes this year versus the previously expected three. Then Trump blindsided the market Thursday by announcing 25% across the board steel tariffs and 10% on aluminum. Those headlines sent us crashing through 2,700 support on the highest volume since February’s big selloff.

Prior to Trump’s announcement, it looked like the market was coming to terms with a fourth rate hike. This story is a close cousin of the inflation concerns that sparked February’s correction. Many of the owners feared that inflation and rate hikes had already bailed out of the market, meaning there were fewer sellers this time. The lack of wider supply likely meant we would have bounce near 2,700 support.

But then Trump’s protectionist stance went far further than most were expecting, both in the size of the tariffs and the universally applied nature of them. While it is true that those mid-west, blue-collar voters are the ones that put him in the White House, this is definitely a case of hurting the many to help a few. The cost of these tariffs will be carried entirely by American consumers through higher prices. Higher prices means lower demand and less discretionary income. All to help the small segment of uncompetitive metal producers. And it doesn’t stop there, many countries will slap retaliatory tariffs on US made goods, decreasing demand for US products, directly affecting a wide swath of manufacturing jobs.

The sad thing is these tariffs won’t even bring steel and aluminum jobs back because anything that can be done with this president’s pen will likely be undone by the next president’s pen. Most steel and aluminum manufacturers know this and is why they won’t do much except crank up their old, dirty, and inefficient plants. They’re not going to invest new money when they know this boon is only fleeting. But common sense has no place in politics and midterm elections are coming up.

Assuming Trump doesn’t back off due to the huge amount of criticism his proposal has gotten, starting trade wars will be bad for American consumers and businesses. That will directly impact earnings, growth, employment, and discretionary income. If Trump follows through and foreign nations retaliate, stock prices will suffer. These proposed tariffs are bigger and more severe than expected and most definitely not priced in. It will take a while for the market to come to terms with these headlines and we could see prices slump further as investors weigh the ramifications.

That said, I don’t think this will be enough to trigger a recession. If it is like any other bill, it will be crafted by special interest groups and have loop-holes large enough to drive a truck through. But it will be significant enough to undo a lot of the economic growth from the tax cuts. If Trump follows through, it could turn this year’s bull market into a sideways market.

At the moment there is no reason to sell long-term positions, but this weakness could persist and give dip-buyers a better entry point over the next few trading sessions. Or Trump could do what Trump does and change his mind. If he takes it all back, prices will surge higher in relief.

Bitcoin prices continue to do well. As I wrote last week, selling pressure over the near-term abated and the path of least resistance was higher. And so far that has been the case with prices now creeping above $11k. Breaking $12k is a no brainer and we will likely surpass $13k and even flirt with $14k over the next few weeks.

But this is a trade, not an investment. Major selloffs like we are in the middle of take 6, 12, even 24 months to bottom. We are still in the early innings of BTC’s correction. While there will be lots of profitable swing-trades along the way, lower lows are still ahead of us. That means take profits when you have them and resist the temptation to hold too long.