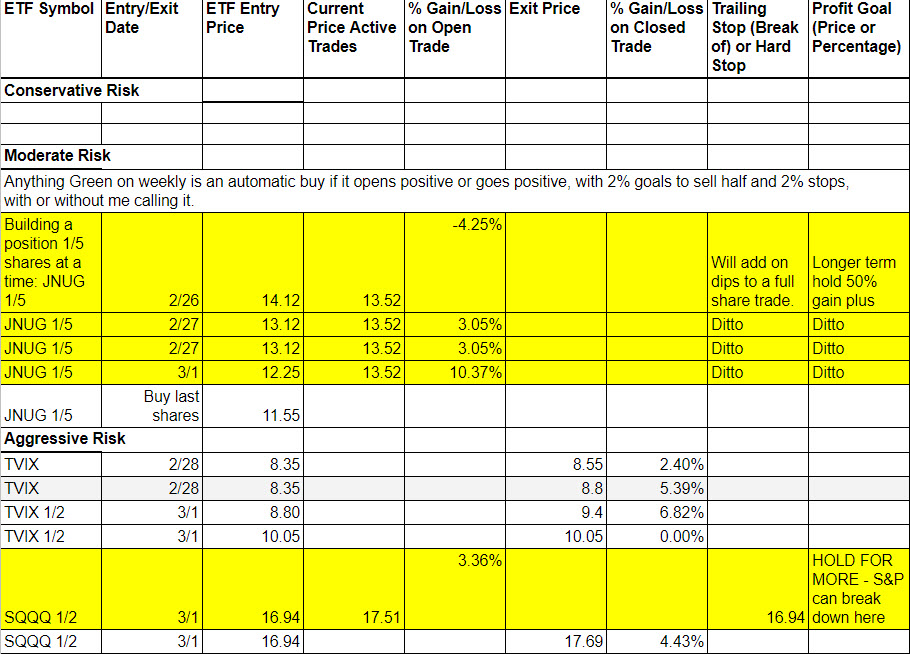

Today’s Trades and Current Positions (highlighted in yellow):

VelocityShares Daily 2x VIX Short Term linked to SP 500 VIX Short Fut Exp 4 Dec 2030 (NASDAQ:TVIX) was up 14.43% on Thursday and we got 11.2% total from it. It would have been 13.7% but I didn’t take the 5% profit on the last half shares. I’m not going to complain.

Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG) got going for us and when we add the final 1/5 shares, hopefully lower still, I’ll turn it into one trade where our 1st goal is to get 50% from it with an ultimate goal of 100%. Of course you know how I love to take profit but this time, as I alluded to today in an alert, I think we can ride out any downturns that naturally come and also trade Direxion Daily Junior Gold Miners Bear 3X Shares (NYSE:JDST) as a hedge at times. I have no problem with this strategy at all.

ProShares UltraPro Short QQQ (NASDAQ:SQQQ) turned out to be a good trade as well and we already locked in some good profit of 4.33%.

The savior for the market Thursday was the reversal in the dollar as it helped stocks rebound. We are out flat on our last trade of TVIX, and it fell hard to the 9.20’s after breaking 10.50. The push down in the dollar helped gold move 14 off the bottom.

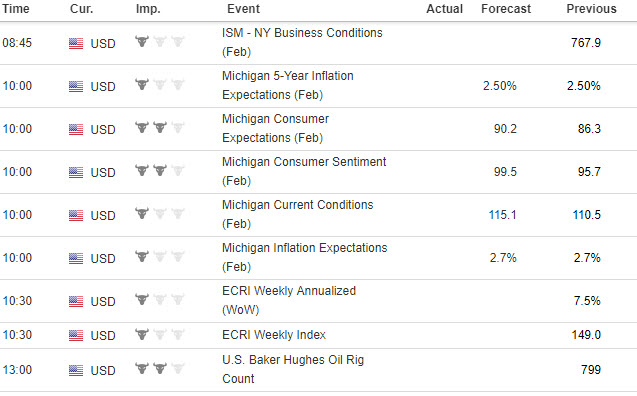

Economic Data For Friday

Stock Market

I had told some of you that TVIX could go to 9 when it was hovering around 8 and Thursday it did and kept going higher to 10. I said that once it broke 9.17 today it could go to 9.70 and it did. We ended the day lower than that but it did peak out just over 10.50. Thursday I waited on more calls until Powell was done testifying. It was a volatile market on Thursday and no negative trades. The only negative is the first 1/5 share purchase of JNUG as a start of our longer term position.

NOTE: We have to be very careful with ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) (TVIX) and LABD on Friday. Both are 3 days on the hot corner. For those new, we rarely go 4 days in a row in the hot corner, but if there was one that could, it would be TVIX.

Foreign Markets

These were mixed on Thursday and presently we are concentrating elsewhere.

Interest Rates

If you sold NYSE:TMF and bought NASDAQ:SQQQ, you came out well. If you held TMF, you were profitable as well.

Energy

NYSE:DWT up and NYSE:DRIP were down on Thursday and I think oil can still fall but now we have to see what the dollar does. It’s all about the dollar for commodities. NYSE:UGAZ had good data today but NYSE:DGAZ climbed up from the dead. Neutral here.

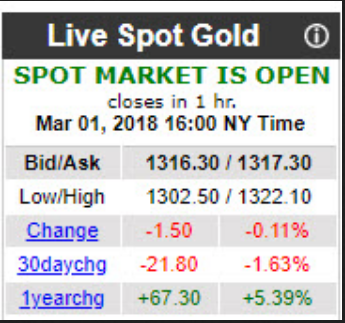

Precious Metals and Mining Stocks

Perhaps my impatient buy in JNUG wasn’t so bad after all. We got our 4th 1/5 trade and have 4/5 of a trade going now long JNUG. Still love to see one more dip for the final buy. We are about ready for a big move up in gold now, or in the next two weeks, whereby I think we finally break that $1,400 level that has been resistance for years. Time to load up on physical gold and silver coins if you haven’t yet.

Green Weekly’s

These are the ETFs that have turned green on the weekly and show a trend has developed. Your best way to profit with the service is stick with the green weekly trend each day and take profit while using a trailing stops. Also, if these green ETFs are up for the day at the open, they offer the best scalping opportunities. I am always fine tuning this section so if there is confusion at all, email me and be specific and I’ll be happy address.

I know I have said this many times but it is worth repeating; If you stick with the green weekly trades your odds of profit increase as there is more risk with the day trades. I call the day trades with the intent of catching some runners, so will get a few 1% stop outs but eventually catch the 5% to 10% or more runners. The important part of the list below is that the longer the ETF stays on the list the more likely it is to turn red on the weekly and the opposite ETF comes into play as a long. This will be tracked more when we automate the service.

Sell half shares on a spike up on any ETF you are long, even if goal is higher. Spikes higher are almost always followed by moves in the opposite direction. Try and get out with a market order quickly before the quick move back lower. Lock in that profit!

Wait for the sign of a positive day to go long anything beaten down, I think the odds swing to your favor.

New way to trade beaten down ETFs; The way that trade would work, and I really think it should be a rule from now on NOT to trade anything trending down until it reverses, is we would buy at the open if it is POSITIVE or GOES POSITIVE during the day. Then we would look to profit on 1/2 shares over and over, day after day until we get the red weekly signal on the opposite trade that could turn into bigger profits. The stop would be if it goes negative for the day. The rule of keeping a stop if it goes negative for the day is a must. Lastly for this type of trading we need to not be afraid to get back in if it goes positive once again.

Sometimes market makers will take an ETF negative and then reverse it right higher again because they know if it goes negative many exit. So we have to be willing to risk a few in and outs when it does this up and down move around that potential stop out area so we don’t miss the ride back up. That’s just part of trading and not a big deal. But no matter what, if it breaks to yet another lower low because you didn’t get out after giving it a little more wiggle room, you are more than likely further from the original stop out when it went negative and you are out, waiting for it to go positive again before you get back in. You are simply buying into strength.

Disclosure: Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.