As rate-hike speculation has heightened with the recent hawkish comments of Federal Reserve Chair Janet Yellen, bank stocks are in focus now as they typically benefit from higher rates. Currently sporting a Zacks Rank#1 (Strong Buy), Comerica Incorporated (NYSE:CMA) seems to be an attractive investment option among the regional banks with a significant upside potential.

According to the company’s latest quarterly filing, its net interest income (NII) should improve in a rising rate scenario due to an increase in yields on earning assets. Comerica projected that as of Jun 30, 2016, a 200 basis points (bps) expansion in rates will add $202 million or 11% to its NII during the next 12 months.

Comerica has guided that the benefits of full-year 2016 net interest income from the Dec 2015 rate hike is expected to be about $90 million, assuming stable deposit pricing. However, if the Federal Reserve raises its rates by 25 bps and deposit prices go up, the company will gain $70 million more in annualized net interest income.

Separately, the recent spike in LIBOR, a global benchmark for dollar lending, that stemmed from the pending SEC money market fund reforms (scheduled to be effective Oct 2016), is set to benefit banks with huge amount of commercial and industrial (C&I) loans as most of these loans are tied to one-and three-month LIBOR. The funding is usually from deposits, the costs of which are not tied to LIBOR. Notably, earnings of Comerica which have around 55% C&I loan concentration of total loans, could get a lift in the short term.

Further, Comerica’s ongoing efficiency and revenue Initiatives (GEAR Up) signal promising growth prospects. The initiatives are expected to deliver additional annual pre-tax income of around $230 million by year-end 2018, improve efficiency ratio to low-60% by the end of 2017, and a sub-60% efficiency ratio by year-end 2018 (without any increase in interest rates). Also, the initial actions will help in achieving a double-digit return on equity.

Additionally, the credit performance of Comerica’s energy portfolio, which represents 5% of total loans, improved during second-quarter 2016. Management remains cautious and believes that the company is adequately reserved with reserve allocation of over 8% of energy loans as of Jun 30, 2016. The pressure on the company’s asset quality should ease with stabilizing oil and gas prices.

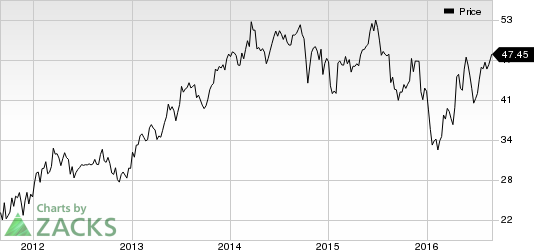

The stock of this Dallas, Texas-based banking giant gained nearly 35% over the past six months, compared with 15% increase in the KBW Nasdaq Bank Index.

Over the past 30 days, Zacks Consensus Estimate for 2016 advanced 1.9% to $2.72 per share while it moved north 2.9% to $3.55 for 2017.

Stocks to Consider

Some other top-ranked stocks in the finance space include Enterprise Financial Services Corp. (NASDAQ:EFSC) , Credit Acceptance Corp. (NASDAQ:CACC) and Meta Financial Group, Inc. (NASDAQ:CASH) , each sporting the same rank as Comerica.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

COMERICA INC (CMA): Free Stock Analysis Report

ENTERPRISE FINL (EFSC): Free Stock Analysis Report

CREDIT ACCEPT (CACC): Free Stock Analysis Report

META FINL GRP (CASH): Free Stock Analysis Report

Original post

Zacks Investment Research