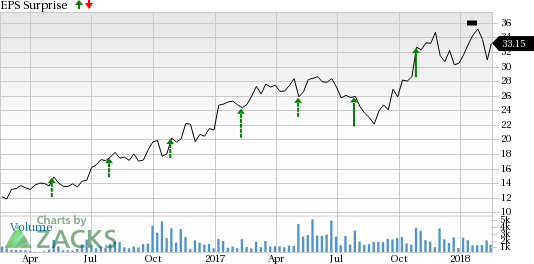

MINDBODY, Inc. (NASDAQ:MB) is slated to release fourth-quarter 2017 results on Feb 21. Last quarter, the company witnessed a positive earnings surprise of 125%. MINDBODY beat earnings estimates in all the trailing four quarters, delivering a positive surprise of 68.2%.

What to Expect?

The company might witness a year-over-year increase in revenues and earnings in the to-be-reported quarter. The Zacks Consensus Estimate for earnings is pegged at 1 cent per share, which is much better than the year-ago period loss of 4 cents. Further, analysts polled by Zacks expect revenues of $48.9 million, up 28.1% from the year-ago quarter.

Factors to Impact Q4 Results

MINDBODY develops cloud-based business management software and payments platform for the wellness services industry.

The company’s inorganic growth strategies are major tailwinds boosting subscriber and consumer adoption. Additionally, the company’s continuous efforts to enhance its software and payments platform are likely to be reflected in its quarterly results.

With its huge client base, MINDBODY is anticipated to post impressive earnings numbers in the fourth quarter. Investments for improving the growth segments are expected to boost margins as well.

What the Zacks Model Unveils

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or #5) are best avoided.

MINDBODY has a Zacks Rank #3 and an Earnings ESP of +66.67%. This indicates that the company is likely to beat estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

Other Stocks to Consider

Here are some companies you may also want to consider as our model shows that these have the right combination of elements to beat on earnings:

Workday, Inc. (NASDAQ:WDAY) has an Earnings ESP of +2.58% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Analog Devices, Inc. (NASDAQ:ADI) has an Earnings ESP of +0.18% and a Zacks Rank #3.

Broadcom Limited (NASDAQ:AVGO) has an Earnings ESP of +1.08% and a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Workday, Inc. (WDAY): Free Stock Analysis Report

MINDBODY, Inc. (MB): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Original post

Zacks Investment Research