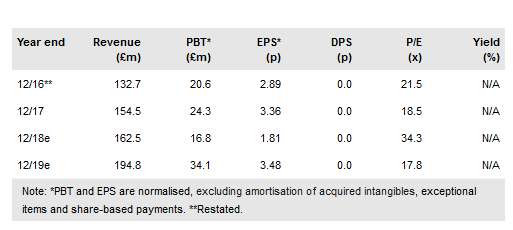

IQE PLC. (LON:IQE) is benefiting from multiple megatrends as it supplies epitaxy for the photonics chips that transmit data in the volumes required for full adoption of the Internet of Things and provide the accurate visual information required for autonomous vehicles, Industry 4.0, augmented reality and virtual reality. This is driving a second wave of growth, with an estimated 66% increase in PBT forecast between FY16 and FY19. Our DCF analysis indicates that the share price is undervalued if photonics growth resumes in Q219 and is sustained over a five-year period, in line with management guidance.

Beneficiary Of Multiple Megatrends

IQE enjoyed stellar growth between 2004 and 2013 because of the wireless handset boom. More recently, advances in IQE’s photonics capability underlie a second growth wave that accelerated in mid-2017 with VCSEL (vertical cavity surface emitting laser) volume ramp-ups that we infer were related to the face recognition functionality in the iPhone X. We expect photonics growth to resume in Q219 after a period of destocking related to this programme, having recently reported sales weakness in at least one new OEM product launched this autumn. Successful execution in the power electronics market with epitaxy for power conversion chips and 5G adoption could trigger a third wave of significant growth in two or three years’ time.

To read the entire report Please click on the pdf File Below..