- Tuesday’s CPI shocker was not what the market bulls wanted to see.

- Investors were caught off guard with the S&P 500 suffering its worst day in months amid fresh fears surrounding the outlook for interest rates.

- The Fed is now likely to keep rates higher for longer than markets currently expect as hopes for a dovish pivot evaporate.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

Tuesday’s much-anticipated U.S. January CPI report was not what the bulls wanted to see.

Consumer prices jumped at the start of the year amid a surge in the cost of shelter, food, and healthcare, providing further evidence that the Federal Reserve is unlikely to cut interest rates anytime soon.

Investors now see just a 5% chance of a 25-basis point rate cut at the Fed's March meeting, according to the Investing.com Fed Monitor Tool, while the odds for May stand at about 30%, which is down from over 90% a few weeks ago.

Looking out to June, traders believe there is a 75% chance rates will be lower by the end of that meeting.

Hot & Sticky CPI Shocker

The U.S. consumer price index rose 0.3% last month after gaining 0.2% in December. In the 12 months through January, the annual CPI increased 3.1%.

That followed a 3.4% advance in December. Economists polled by Investing.com had been looking for a monthly increase of 0.2% and an annual gain of 2.9%.

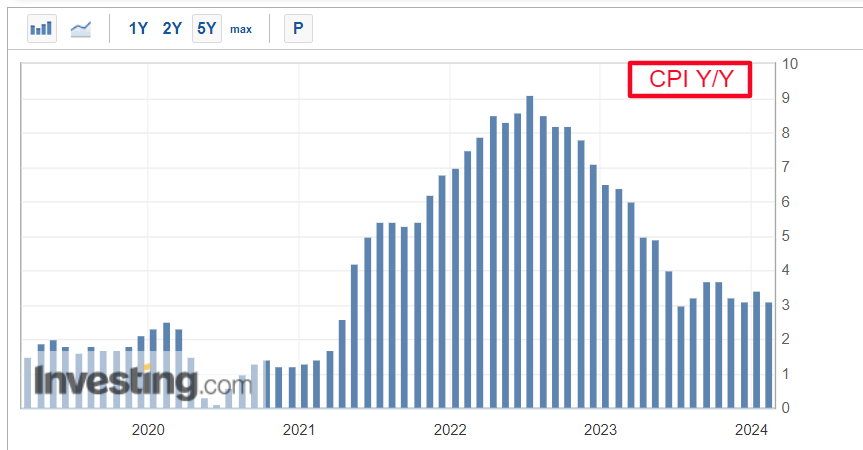

As seen in the chart below, U.S. CPI inflation has come down significantly since the summer of 2022, when it peaked at a 40-year high of 9.1%.

Source: Investing.com

Nonetheless, while the rate of inflation is trending lower, prices are still rising far more quickly than what the Fed would consider consistent with its 2% target range.

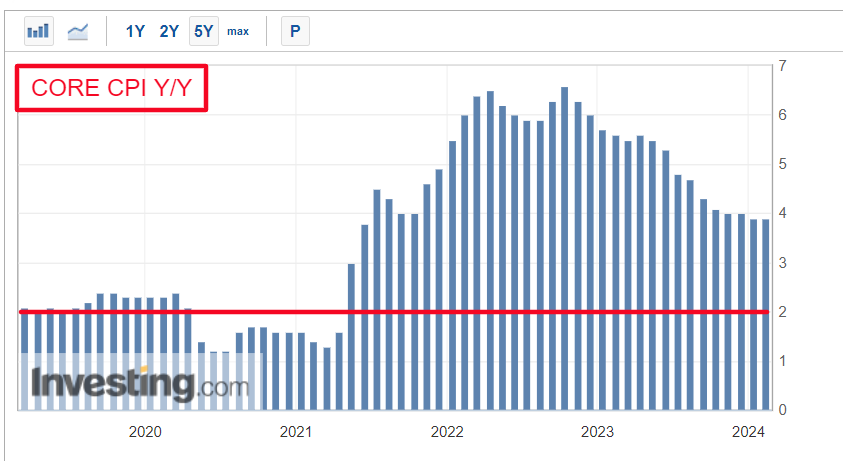

Excluding the volatile food and energy components, core CPI increased 0.4% in January after climbing 0.3% in the previous month. On an annual basis, core CPI rose 3.9%, matching December's increase.

Source: Investing.com

The forecast had been for 0.3% and 3.7%, respectively.

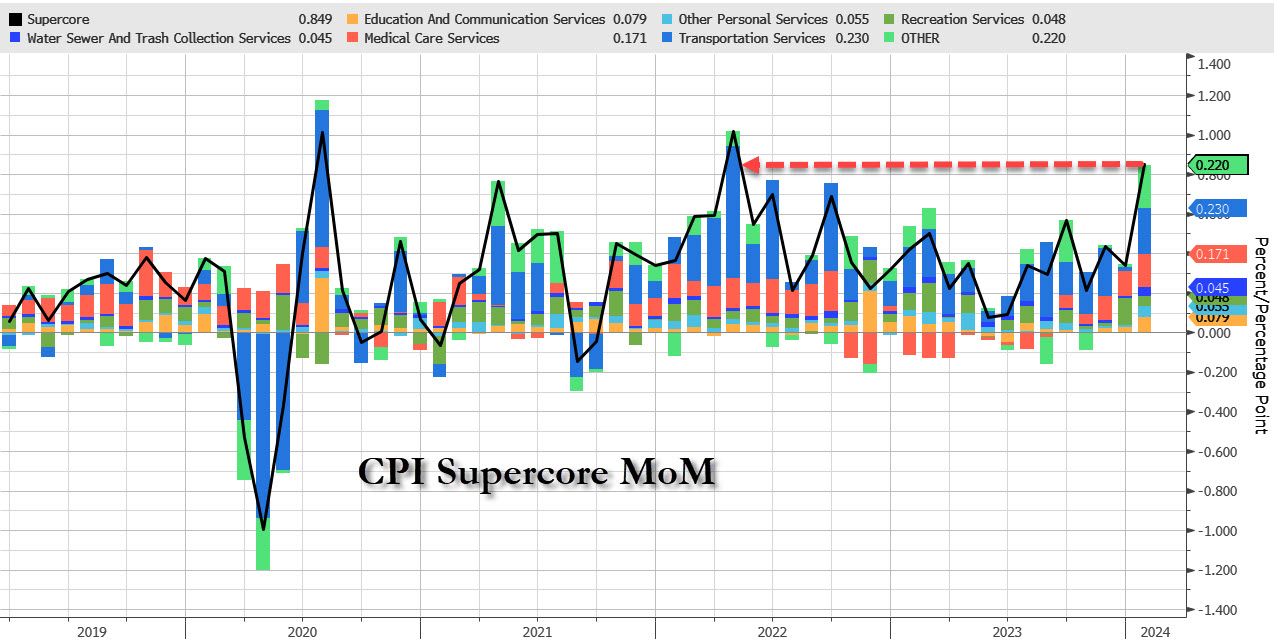

In a worrying sign, the so-called ‘supercore inflation’ measure, which tracks the cost of services minus housing and energy, jumped 0.8% on the month, the most since April 2022.

Source: ZeroHedge

The ‘supercore’ figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Key Takeaway

Overall, these numbers suggest that the Fed’s inflation battle is far from over and that policymakers would need to see further progress on sticky underlying core measures before they are comfortable cutting interest rates.

Furthermore, any additional reacceleration in consumer prices could risk reigniting talks that the FOMC might even deliver another rate hike after pausing its tightening cycle last year.

The Fed recently held its policy rate in the 5.25% to 5.50% range, where it has been since July 2023.

As such, the central bank is likely to keep policy rates higher for longer than markets currently expect as inflation stays elevated, and the economy continues to grow at a solid pace amid a resilient labor market and robust consumer spending.

What To Do Now

Investors should brace for fresh turmoil in the coming weeks as cracks begin to widen in the early-year rally on Wall Street and the stock market faces a growing risk of a near-term pullback.

Looking back on the fourth quarter and the recent rally in stocks, a lot of it was driven by hope and speculation of an imminent Fed rate cut, however, that no longer appears to be the base case with the Fed pivot evaporating before our eyes.

As such, I have rebalanced my portfolio of individual stocks and ETFs to reflect a mostly bearish position as I believe Tuesday’s negative price action is an inflection point for a more sustained move lower in equities.

At the time of writing, I have a short position on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P500 (NYSE:SH), ProShares Short QQQ (NYSE:PSQ), and ProShares Short Russell2000 (NYSE:RWM).

Investors should be prepared for a scenario that could see the S&P 500 fall back to the 4,500 level, a decline of almost 9% from where it currently stands, as the market grapples with fresh uncertainty surrounding the Fed's rate plans.

Source: Investing.com

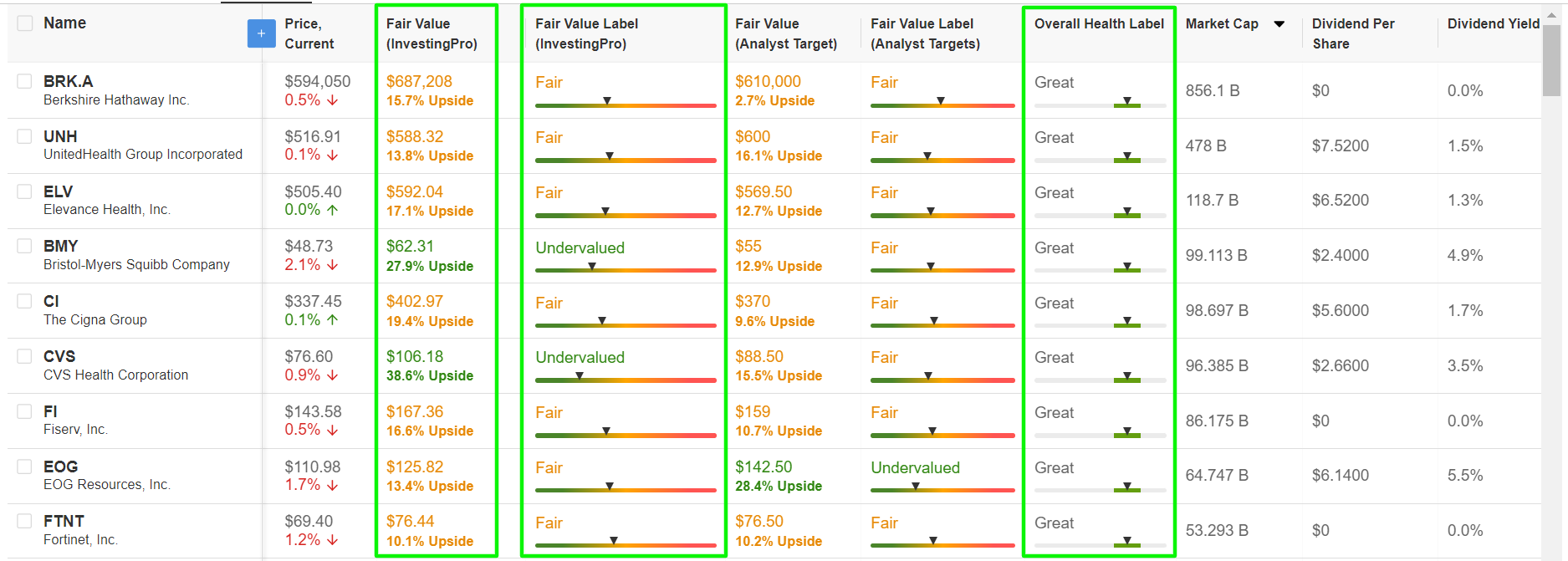

Taking that into consideration, I used the InvestingPro stock screener to identify top quality stocks that are undervalued and have strong fundamentals with more upside ahead based on the Pro models.

Not surprisingly some of the names to make the list include Warren Buffett’s Berkshire Hathaway (NYSE:BRKa), UnitedHealth Group (NYSE:UNH), Elevance Health (NYSE:ELV), Bristol-Myers Squibb (NYSE:BMY), Cigna (NYSE:CI), EOG Resources (NYSE:EOG), Fortinet (NASDAQ:FTNT), Capital One Financial (NYSE:COF), D.R. Horton (BVMF:D1HI34), and Delta Air Lines (NYSE:DAL).

Source: InvestingPro

With InvestingPro's stock screener, investors can filter through a vast universe of stocks based on specific criteria and parameters to identify cheap stocks with strong potential upside.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.