(Monday Market Open) It looks like things might start the new week right where they left off last Friday: In the red. Those worries about global growth haven’t necessarily gone away, and yesterday’s political developments in Washington—which some analysts saw saw as positive for stocks—aren’t outweighing the global economic concerns.

Last week’s U.S. rate inversion (see more below) continues to be a primary discussion point. What could be interesting to watch today is whether the S&P 500 (SPX), which stayed just above 2800 Friday, can hold that level. From a technical perspective, it would probably be seen as a weak sign if it closed below it.

Some of Friday’s U.S. weakness appeared to spill over into Asian trading early Monday, especially Japan. The Nikkei 225 took a dive, falling 3%. Chinese and European stocks fell pretty much across the board.

If you’re looking for possible green alternatives this morning, the conclusion of the Mueller report with no collusion findings might be one, because it could remove some worries about more political tension potentially getting in the market’s way. Also, Apple (NASDAQ:AAPL) has an event scheduled today starting at 1 p.m. ET, where it’s expected to announce a new subscription TV service, according to media reports.

It’s a big week for data (see more below), but kind of quiet for earnings. This week will close out what’s been generally a great quarter for stocks.

Ending On A Weak Note

Looking back at last week’s disappointing finish, it’s pretty remarkable how fast the U.S. market went from sizzle to splatter. The S&P 500 (SPX) ended Friday just barely holding on at the key technical support level of 2800, after earlier plunging below another support level near 2830.

If the market could have held 2830, it might have still looked like a decent week for the bulls. However, ending the day with a slide all the way down to 2800 and finishing near the lows arguably doesn’t put things in great shape to start the new week, at least from a technical perspective.

Other indices didn’t do much better, including the (Russell) small-cap index, which had the worst day of all, falling more than 3.6%. Also, crude pulled back from four-month highs to slip under $59 a barrel.

Friday’s dramatic reversal from Thursday’s rally might seem shocking, but it also could be worth taking into perspective. Let’s not lose sight of the fact that we’ve had a nice rally over the last couple of weeks. Friday wasn’t a great day, but after a strong week or two, you sometimes tend to get a bit of a sell-off.

Now, that doesn’t mean caution isn’t warranted. A slowdown in economic performance worldwide is worth being concerned about. However, aside from another batch of weak European manufacturing news, most of that was already known heading into Friday’s session.

Grading On The Curve

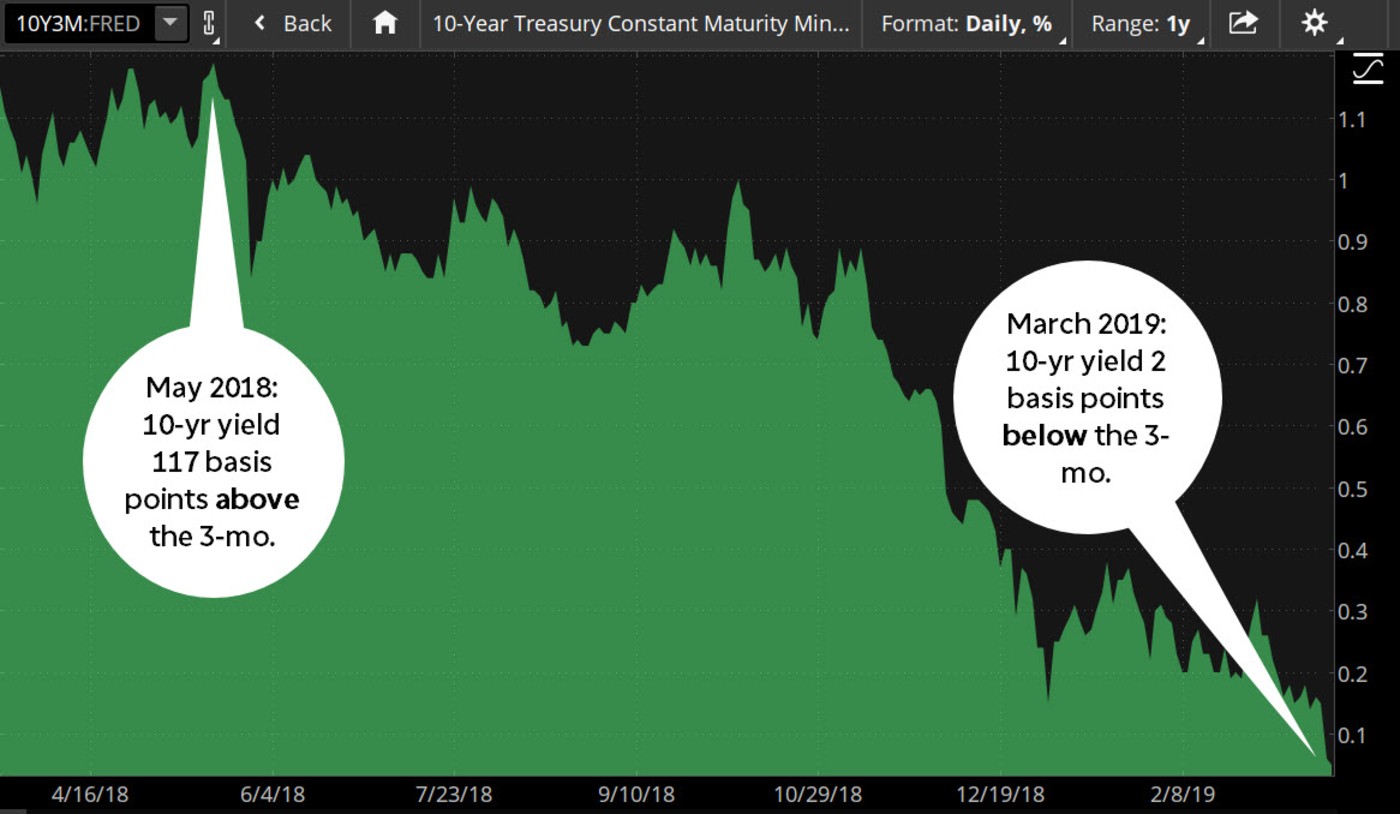

What did seem to really spook the markets at the end of the week was the performance of U.S. Treasuries. All eyes seemed to be on the yield curve Friday as Russell 2000 rose above Russell 2000, a so-called “inversion” that economists say is often associated with recessions, though past isn’t necessarily prologue. Inversions have preceded every U.S. recession going back to 1955 with only one false positive, MarketWatch reported Friday, citing data from researchers at the San Francisco Federal Reserve. See figure 1 below.

The gap on another closely watched curve—the one between 2-year and 10-year yields—still stood near 10 basis points Friday, down from around 15 basis points earlier last week but not inverted. However, it’s the lowest gap in the two since late last year.

All this talk about inverted yield curves helped keep the Financial sector in the red toward the end of the week. It was the only sector not to gain ground Thursday in a rally that sent some indices up more than 1%, and it was among Friday’s worst performers, down nearly 3%.

It wasn’t just the U.S. yield curve on investors’ minds. German 10-year yields fell below zero for the first time since late 2016, reinforcing concerns about the sputtering European economy.

Big Banks Face Yield Pressure

While the so-called “second-tier” banks took the brunt of the blow Thursday, on Friday it was the big banks getting hit. Bank of America (NYSE:BAC) and Citigroup (NYSE:C) both fell more than 4%, while JP Morgan Chase (NYSE:JPM) and Wells Fargo (NYSE:WFC) finished more than 3% lower. When you see the German yield go under zero and the U.S. curve flatten, U.S. banks can often be in for a tough time.

There’s major fear of a global slowdown, and that’s what’s making people nervous. When economies slow, the banking sector often suffers first and most. The weak manufacturing data out of Europe, the Brexit mess in the U.K., and the unresolved China trade situation all seem to be coming home to roost on a day like Friday.

One more thought on the weak European economy: It’s possible some of the softness there comes from the weight on China. China is one of the European Union’s top trading partners, so when Chinese growth slows down and it gets pulled into a trade battle, that can have a big impact on Europe. That’s why a trade resolution might help Europe as well as the U.S.

Speaking of China, the subject came up in Tiffany’s (TIF) earnings Friday. Investors already knew that the company’s holiday quarter had been affected by slower spending on luxury goods by foreign tourists in the U.S., because TIF reported that back in January. The company’s fiscal Q4 sales missed analysts’ estimates, and there’s still concern on the Street about the changing buying habits of high-end Chinese consumers. Keep in mind that about 30% of the world’s luxury products are sold in China, and if behavior there changes it could have repercussions.

Other sectors getting beaten up Friday other than Financials included Materials, Energy, Consumer Discretionary, Info Tech, and Industrials, all falling 2% or more.

Staples, Utilities Starting To Put Out Green Shoots

Anyone looking for a little green would have found it in the same places it showed up earlier this month when the market had a mini downturn. The Consumer Staples and Utilities suffered the least Friday,. Stocks like PepsiCo (NASDAQ:PEP), ConAgra (NYSE:CAG), Coca-Cola (NYSE:KO) and Colgate-Palmolive (NYSE:CL), managed to finish higher to solidly higher even as the rest of the market crumbled. Dividend stocks appeared to start looking more attractive to some investors, especially with Treasury yields on the run and finishing well below 2.5% for the 10-year.

The economic data calendar this week looks a little busier than last, highlighted by the government’s second estimate of Q4 gross domestic product scheduled for Thursday. Last time out, the estimate came in at 2.6%, down from 3.4% the prior quarter. While 2.6% isn’t usually considered a really fast growth pace, it could look pretty robust compared to what many analysts now expect for the current quarter (see more below).

Other key numbers on the way include new home sales for February, the March University of Michigan sentiment report, the Personal Consumption Expenditures (PCE) price index for February, and February housing starts and building permits. A lot of the housing data continues to be bunched together thanks to catch-up from the government shutdown earlier this year.

YIELD CURVE INVERSION. While four hikes in the Fed funds rate in 2018 raised the front end of the yield curve, the back end didn't follow suit. Last spring, the yield on 10-year notes was 117 basis points (1.17%) above the yield on 3-month bills. Spring 2019 started with the 10-year yield a couple basis points below that of the 3-month. Data source: Federal Reserve's FRED database. Chart source: The thinkorswim® platform from TD Ameritrade. FRED® is a registered trademark of the Federal Reserve Bank of St. Louis. The Federal Reserve Bank of St. Louis does not sponsor or endorse and is not affiliated with TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Feeling Jumpy: Friday’s volatility surge is like none seen so far in 2019. It took CBOE Volatility Index, the market’s most closely-watched “fear” index, all the way back to above 17 intraday, from under 13 earlier this week. The levels Friday were the highest since late January, and out ran other VIX rallies associated with market downturns earlier this year. As VIX moves higher, however, it’s also important to keep things in perspective.

First, we’re approaching the end of the quarter. Traditionally markets can get a little more choppy at this point because fund managers often use the last week of a quarter to do some “window dressing.” For instance, if a certain sector or sub-sector has been looking rosy lately, some fund managers will get out of other stocks and into that sector before the quarter’s close so that their clients will see positions in those “stocks du jour” when they get their quarterly statements. This moving in and out of positions can cause gyrations in the market when all done at once. Second, while a VIX at 17 may sound high, it’s actually not far above historic averages. Also, it’s not far above the previous VIX high for this month of around 16.6 just a couple weeks ago. If it goes to 20, that might be more meaningful.

Home Ec: Kind of lost in the sell-off Friday was another piece of strong U.S. economic news, as existing home sales for February surpassed Wall Street’s estimates. Existing home sales increased 11.8% month-over-month in February to a seasonally-adjusted annual rate of 5.51 million. That was above the Briefing.com consensus of 5.1. million, and up from a downwardly revised 4.93 million in January. While total sales were down slightly year over year, median prices did rise 3.6% from a year ago, the 84th-consecutive month of year-over-year gains.

The sharp jump from January to February might be a sign that improved weather got people out on the home-buying trail again. A lot of economic numbers looked soft in January, and that might be in part due to unusually bitter chill across much of the country that month. Also, the percentage of first-time home buyers rose in February. One month is never a trend, but that was good to see because it implies that maybe more young people started getting into the home ownership club.

Ganging Up on GDP: The existing home sales report was one factor in the Atlanta Fed’s GDPNow indicator for Q1 jumping slightly on Friday, but it still looks pretty weak at 1.2%. That’s certainly better than the previous GDPNow estimate of 0.4%, but well under what investors got used to last year when Q2 and Q3 saw growth of 4.2% and 3.4%, respectively. We won’t get any actual government estimates for Q1 until late next month, but a weak quarter is already getting built in by many analysts.

That shot of bitter January weather followed by the so-called “bomb cyclone” that hit Colorado and the Great Plains in March probably played a role in softening economic growth. So did continued weakness in overseas economies (which can reduce demand for U.S. goods), and the long government shutdown. The lack of any resolution to the China tariff situation continues to cause uncertainty for many corporations, contributing to the dim economic mood. While U.S. data and consumer health remained pretty positive for most of the quarter despite these challenges, it’s looking like quarterly growth is going to be the slowest since all the way back in Q4 2015, and the Fed now forecasts 2019 GDP growth of just 2.1%, the lowest for a full year since 2016.

Disclaimer: Charts For illustrative purposes only. Past performance does not guarantee future results.TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.