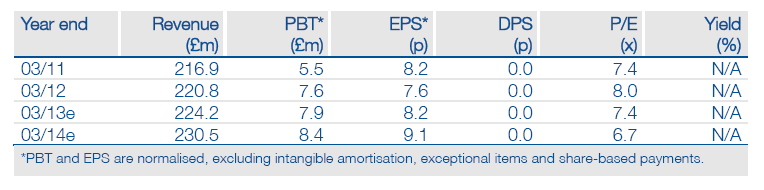

International Greetings’ (IGR.L) interim figures show the group making good progress in building its US business, with further expansion plans in place that should bring double-digit growth. However, Europe remains difficult and the Australian market, which had performed strongly, has weakened. We have trimmed our numbers, but at the earnings level the effect is offset by the higher Australian tax rates and JV status. The balance sheet continues to improve, moving the group closer to the dividend list.

US progress key to growing top line

Interim figures show sales 4.5% ahead and debt down by £4m against the previous year to £84.5m, already triggering a ratchet down in interest rate. The restructuring is starting to bear tangible results and is giving the group the flexibility to cope with economic stresses through product innovation and lower-cost manufacturing, with the new high-speed press in Holland and the relocation of the Chinese factory (both now fully operational). Wider distribution in the substantial US market (as described in previous notes) should build the top line despite the economic pressures in Europe and Australia, with the mass retailers (such as Walmart) and large dollar-store segment both driving the upscaling. US buyers are also currently notably more open to innovation and greater product complexity – beneficial to margins and less competitive. The growing product range is also helping the group move from being a commodity supplier to more of a retail partner, working on product development and category management and putting it more in control of achievable margin.

Mix adjustments

An exceptional item of £750k has been taken against the slowdown in the Australian market, including a customer of the JV entering administration. We have taken a cautious view of recovery both in quantity and timing. Australia market has historically been a higher-margin market, but the effect on the group result is mitigated by the high taxation levels and the minority element. H113 results were particularly notable given the input cost pressures (freight shipping costs were up 24%), but these appear to be stabilising in H2, as do paper prices, with inflation in Chinese labour costs moderating. The growing proportion of everyday (as opposed to seasonal) products in the mix (single everyday cards are up 25% in the UK and US) will also benefit margin.

Valuation: Remains undervalued

The shares continue to trade at a discount to its larger US-based peers, but now standing at 18% compared to c 30% in the summer. With the continued reduction of debt, a resumption of dividends gets closer, which will add to the corporate recovery argument and emphasise the value in the shares.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

International Greetings: U.S. Progress Key To Top Line Growth

Published 12/13/2012, 11:28 PM

Updated 07/09/2023, 06:31 AM

International Greetings: U.S. Progress Key To Top Line Growth

Crack(er)ing the US

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.