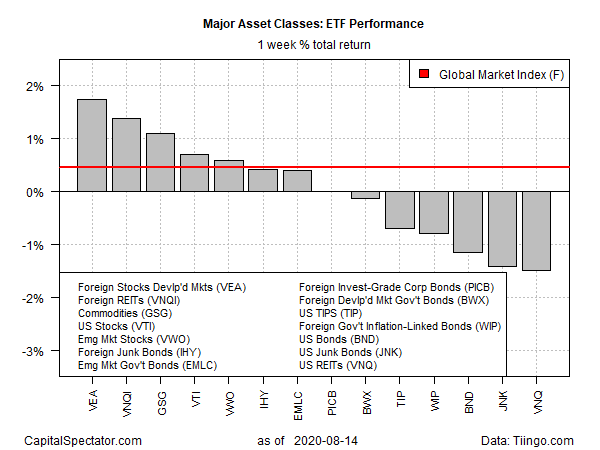

Equities in developed markets ex-US topped returns for the major asset classes during the trading week through Aug. 14, based on a set of exchange traded funds. In second place: real estate shares listed outside the US.

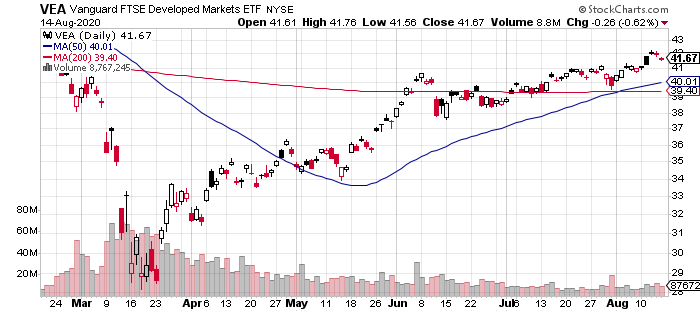

Vanguard FTSE Developed Markets (NYSE:VEA) led the winners last week with a 1.7% gain. The rally marks the fund’s second straight weekly increase and lifted the ETF to its highest close since February. Although VEA remains below its pre-coronavirus peak, the gap is modest after the latest rise.

Vanguard Global ex-U.S. Real Estate (NASDAQ:VNQI), the second-best performer last week for the major asset classes, rose 1.4%. The ETF has been struggling in recent months to regain the sharp losses sustained in March, but the past two weeks reflect modest upside progress after several weeks of trading in a tight trading range.

Last week’s biggest loser: US real estate investment trusts (REITs). In contrast with their foreign counterparts, real estate shares in America fell last week: the 1.5% loss ended a two-week rally.

The Global Markets Index (GMI.F) extended its rise for a seventh consecutive week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, edged up 0.5%. GMI.F hasn’t posted a weekly loss since the end of June.

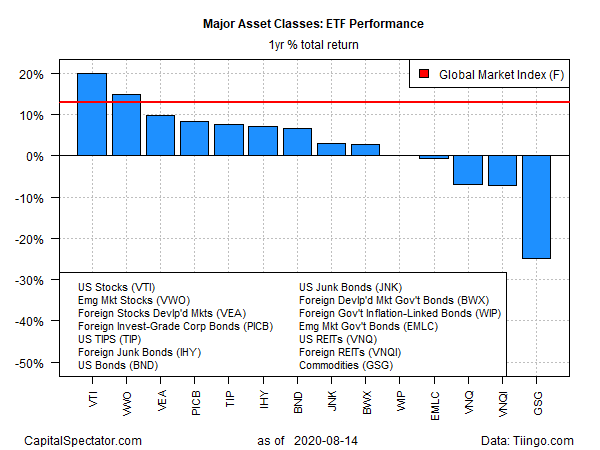

For the one-year trend, US stocks continue to lead the major asset classes by a comfortable margin. Vanguard Total US Stock Market (NYSE:VTI)) is up 20.3% through last week’s close.

Foreign equities are the second- and third-best one-year performers for the trailing 12-month window. Vanguard FTSE Emerging Markets (NYSE:VWO) posted a 15.6% total return at the end of trading on Friday – second only to VTI. In third place: Vanguard FTSE Developed Markets (VEA), which is up 10.1% over the past year.

Broadly defined commodities remain the worst one-year performer: iShares S&P GSCI Commodity-Indexed Trust (GSG) has shed more than 25% over the last 12 months.

Meanwhile, GMI.F continues to enjoy strong one-year results. The benchmark ended the week with a 13.0% total return for the trailing one-year window – a gain that exceeds all the major asset classes except for US and emerging-markets stocks.

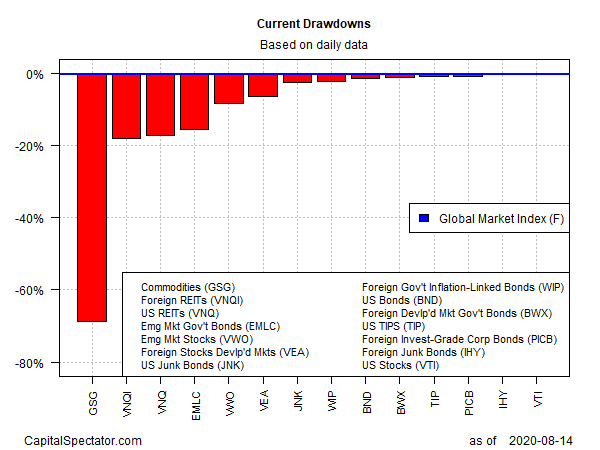

Ranking asset classes based on current drawdown shows that more than half of the 14 major asset classes listed above have low and in some cases trivial drawdowns. The smallest peak-to-trough decline at the moment: US stocks (VTI), which is down fractionally from its previous peak (set on Aug. 12).

The steepest drawdown by far is for broadly defined commodities via GSG, which ended last week’s trading at nearly 69% below its previous peak.

GMI.F’s current drawdown is a slight 0.3% decline below its previous peak.