In a world questioning if Italy can generate greater panic through the region, then today's European session could hold many clues.

The moves (in yield) in Italian 10-year BTPs relative to German bunds above 300 basis points seems to be the new epicentre of the universe. Although, in this case, the bond markets influence appears to be restricted to EURUSD and the EUR crosses, as well as European financial equities and Credit-Default Swaps. If the sell-off in Italian debt evoked real the fear of contagion, let alone something more systematic, then we would not be seeing implied volatility in the Eurostoxx index sitting at 15.4% and the middle of its recent range. We would not be seeing US high yield credit spreads near multi-year lows, and the US 10-year Treasury would already be sub-3%.

The markets psyche of ‘show me something tangible that is to become a genuine volatility event, and we will act’, seems to be validated by today’s news flow. Reports in Corriere della Sera that the Italian government will stagger its deficit targets, with a focus to hit 2.2% in 2020 and 2% of GDP in 2021 has been met with a wave of EUR short covering through Asia, with some traders feeling that the Italian government are the first to blink in this war of words. EURUSD volumes have been elevated relative to the 30-day average, with the pair pushing into the 1.16-handle, although the moves through yesterday’s highs of $1.1580 are unconvincing. While EURJPY spiked into ¥132 but has been offered from the figure. One suspects if traders genuinely felt this was a game-changer, should the news be correct, then the moves here are also unconvincing.

Perhaps, that is a reflection that FX traders want to see if the bond market buys into this news flow, causing the Italian 10-year to find strong buyers. It feels as though we are going to need to see a move lower of at least 10bp (in the Italian 10-year BTP) to drive EURUSD through 1.16 and EURJPY through 132. In equity markets, it feels as though the MIB will open slightly higher, building on yesterdays reasonably bullish tape, with the index opening on its low and closing not far off session highs. But, again a lot will depend on the financial sector, which will take its cues from the bond market.

Asia has not done much to inspire confidence, where the Hang Seng, after pushing up 0.5% in early trade, seems to be heading the same direction as we saw yesterday; that being lower. The Nikkei 225 is 0.8% lower, which is a reflection that USDJPY has found better sellers and we see the daily candle printing a ‘doji’, highlighting indecision. With US ISM service and ADP private payrolls due in upcoming trade, traders know that the US data needs to beat the street from here or we are going to see a flatter US yield curve, with UST 10s headed for 3% and USD sellers will push this pair through yesterday’s lows of ¥113.53. Still, at this stage, there is little evidence on the four- or daily chart to offer any compelling reason to be short USDJPY, although tactically there are increased reasons to own the JPY.

One factor for consideration are moves in the Italian bond market, and the answers we seek will soon be apparent. Where even if the numbers prove to be correct, a 2% deficit in 2021 could still run the risk of challenging rhetoric from EU officials. One also questions if the rating agencies will be enthused, with a focus on whether Moody’s or S&P cut Italy’s sovereign rating in the weeks ahead. Another concern involves global growth dynamics, and while it seems likely the IMF will lower their estimate of global growth in the short-term we can now marry this with the recent barrage of fairly poor PMI data points.

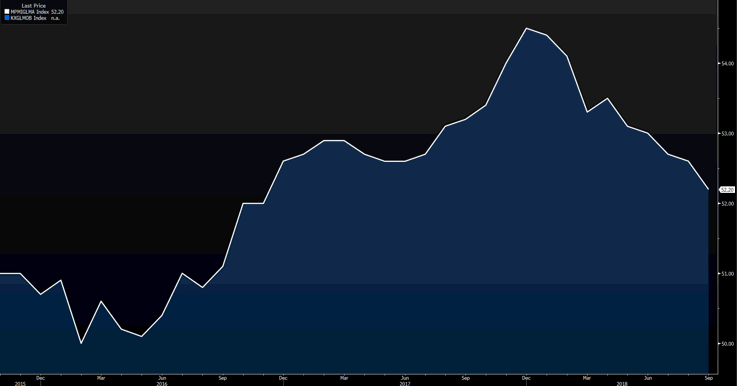

Interestingly, JP Morgan’s global PMI index now sits at the lowest levels since November 2016. And digging deeper into the subcomponents, we can see the new orders index at the lowest levels since September 2016, while new export orders are actually in contraction. Certainly, something to watch out for, especially if trade tensions do show up in the US data in the next couple of months.

The ASX 200 has bucked the trend in Asia, gaining 0.2% although value is some 16% below the 30-day average for this time. The materials sector has put in 11 of the 16 index points here, with solid moves in BHP, RIO, S32 and NCM, and perhaps if there are genuine global growth fears, they are not reflected in this sector.

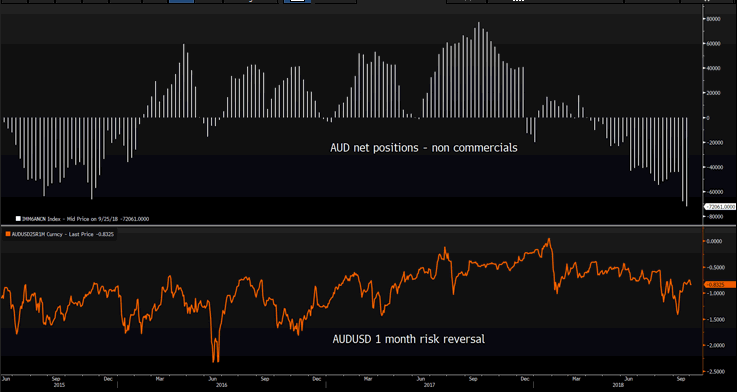

We have also seen a disaster of a building approvals number (-9.4% MoM), although the market hasn’t really looked too closely at this data point, and AUDUSD has its sights more closely linked to USDCNH again, which should we see a push through 6.9000 then AUDUSD will likely test yesterdays lows of $0.7162, despite non-commercial accounts currently running a very punchy short position. Those long AUDUSD need US data to come in on the weak side in the coming days, and ideally see US average hourly earnings falling into 2.5% yoy and below. This would cause a decent hunt for duration, smashing the yield curve and promoting better buying in EM and subsequently AUDUSD, although that is a big ‘if’ and outside of that thesis there isn’t a lot of reasons to own the AUD and selling rallies in this bearish trend remains the preferred trade.

(White histogram - net futures positions held by non-commercial accounts, lower pane - AUDUSD 1-month risk reversals)