The real estate landscape is broad in nature, offering investors exposure to various property types such as in the retail, residential, and health care sectors. However, in recent years, there has been an increased demand for industrial real estate, due to the economic opportunities associated with it.

The COVID pandemic underlined the importance of supply chain management and industrial real estate in manufacturing, producing, storing, and distributing goods across global economies and within nations. As shipping ports on the coast of California became overwhelmed by containers coming in from China and other trading partners, the exponential rise in e-commerce during this period highlighted the need for more fulfillment centers, capable of shipping goods to consumers in a timely manner. The confluence of a global pandemic, the rise in e-commerce, and geopolitical tensions – both realized (Russia-Ukraine War) and anticipated (China-Taiwan) - led many companies to announce plans to reshore jobs to the U.S., and possibly build new factories or start new manufacturing projects as a means of mitigating supply chain risk.

A changing, but opportunistic landscape

As reported by CBRE in their U.S. Real Estate Market Outlook 2023, U.S. industrial leasing activity is expected to moderate in 2023 as (industrial tenant) occupiers delay expansion plans and the post-pandemic need to hold additional inventory dissipates. Also stated in the report is the projection that, e-commerce growth, supply chain transformation and location optimization will continue to drive demand for industrial space in 2023. Leading occupiers will focus on markets with strong population growth and modern distribution space to ensure quick delivery of online orders.

The U.S. government is supportive of business activity that advances industrial real estate development, as legislation, such as the Chips and Science Act and the Inflation Reduction Act, have tax breaks and other incentives for building and investing in manufacturing centers for goods such as semiconductors, electric vehicles, and pharmaceuticals.

Investing in Industrial Real Estate

The Pace Industrial Real Estate ETF (INDS) concentrates on developed market firms that derive the bulk of their revenue from the industrial real estate sector. This includes industrial services such as warehouses and distribution centers, as well as self-storage facilities. Holdings within this ETF include Prologis (NYSE:PLD), the largest industrial real estate company in the world and Rexford Industrial Realty, a firm that has concentrated ownership of industrial properties in the infill Southern California region, widely considered one of the largest and most valuable industrial markets in the United States.

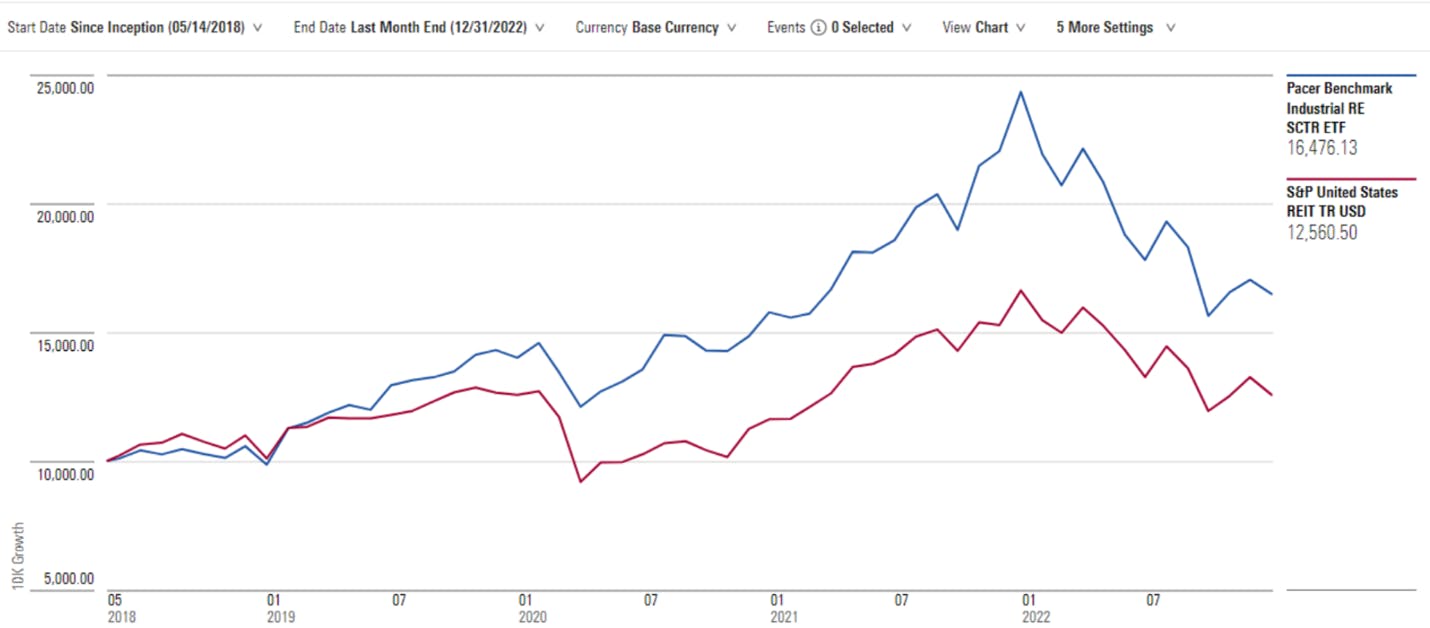

Though the fund has a moderate performance track record, thus far, it has proven to be a strong performer, even during periods of heightened market volatility.

For investors interested in gaining exposure to industrial real estate, INDS provides them with comprehensive exposure to an industry that is fundamentally necessary for ongoing economic development and is positioned to grow in innovative ways in the year to come.

This content was originally published by our partners at ETF Central.