Growth Opportunities Being Realized

IFG Group (IR:IFG) appears to have turned the corner. Strategic repositioning included selling businesses that generated approximately 40% of revenue while the continuing businesses have seen fundamental changes in management, technology, marketing, and product ranges. Franchise payback is being delivered, with Self Invested Personal Pension (SIPP) sales at James Hay doubling 2013 on 2012 and a marked acceleration in new client wins at Saunderson House. We expect this to lead to faster revenue and profit growth in 2014-15. The May Interim Management Statement (IMS) was positive.

Business Re-invigoration

Over the past two years, IFG has invested in every aspect of its core UK businesses. Technology has been upgraded, improving both customer flexibility and operational efficiency. Product ranges have been expanded and we note that James Hay Partnership (JHP) now has a broad wealth management platform offering not only SIPPs but also ISAs and a general investment account. The fund platform accessible, through these products, offers access to 3,000 collective investments and gives investors the option of dealing through over 200 external brokers, including a range of specialists in products such as forex and derivatives. The functionality and pricing is especially attractive to investors with sophisticated needs accessing the platform through their advisers and it is also very competitive in direct-to-customer distribution. We note its pricing for a customer with a £200k portfolio is c 60% lower than, say, Hargreaves Lansdown. In Saunderson House there has been new management and the scalability of that business model has led management to double its target new customer growth.

2014-15 Franchise Growth Turning Into Profit Growth

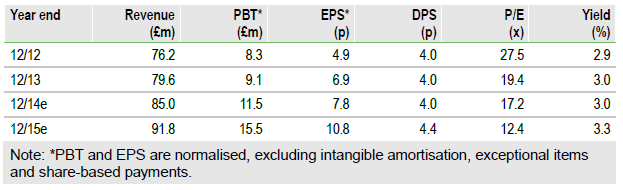

2013 saw a marked acceleration in the increased number of new accounts across the IFG franchise. It did not lead to profitability growth as investment remained high, and in JHP it will take 18-24 months for new accounts to fully reach the same level of income as existing accounts. Looking forward, we expect accelerated revenue and profit growth.

Valuation: 16% Upside

The average of our valuation approaches is €1.92 (£1.56), giving 16% upside. The business has accelerating franchise momentum and if this continues, it is likely to generate incremental profit growth and valuation upside.

To read the entire report, please click on the pdf file below.