Focused on growth businesses

Ifg Group (IFG.I), the parent of James Hay (platform provider) and Saunderson House (fee-based IFA) grew its franchises well in 2013 – new SIPPs doubled in the year, and UK fee-based IFAs gained 154 new clients. IFG’s 2013 revenue was ahead of our forecast at £79.6m and adjusted operating profits were £9.6m (in line with 2012). Earnings were affected as the company continues to invest heavily and the attrition of old SIPPs was only partially offset by new SIPPs, which management anticipates will only reach the same level of revenue in the second .

2013 franchise growth

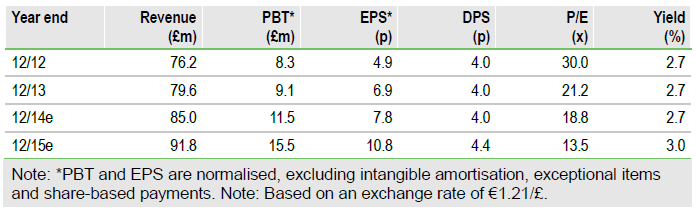

2013 saw a marked acceleration in rate of new business across all three IFG operations. The SIPP business saw a doubling in sales (5,071 against 2,469 and safely ahead of the 2014 target of 4,000 new sales) and now has net SIPP growth. Saunderson House saw 154 new clients in 2013 (2012: 100) and a further 59 in Jan/February 2014. In Ireland revenue grew nearly £2m (to £16.3m) with strong sales of high-value corporate pensions. The group’s franchise growth did not lead to profit growth because of heavy investment in people, systems and operational capacity across both UK businesses, and the 7% gross attrition of SIPPs was only partially offset by the new SIPPs, which are expected to reach the same level of revenue in year two. Excluding exceptional items, discontinued businesses and intangible amortisation, the adjusted earnings grew from £6.1m to £7.2m (EPS up to 6.92p against 4.89p). Statutory operating profits fell from £6.2m to £4.6m but this included redundancy costs of £1.5m and a one-off provision of £1.1m.

2014 outlook

The franchise growth in 2013 should feed through to faster revenue growth in 2014. We expect investment to remain an ongoing feature (including the depreciation from the £3.1m capex seen in 2013). However, as we are not forecasting a repeat of the £2.6m exceptional costs, there is strong pre-tax profit growth. This is partially offset by a normalised tax rate (2014e: 22%, 2013: 14%). We have built in a small loss on sale of IFG FS in 2014, but then profit from deferred consideration in 2015.

Valuation: Around fair value

Our range of valuation approaches indicates a fair value of c 156p, increasing from our previous estimate primarily due to rolling forward the base year. We are expecting a strong growth in profitability and cash generation in 2014/15. In our Gordon’s growth model, using the 2015e rather than 2014e NAV adds 11p to that approach. The sum-of-the-parts also benefits from moving to 2015 profit estimates.

To Read the Entire Report Please Click on the pdf File Below