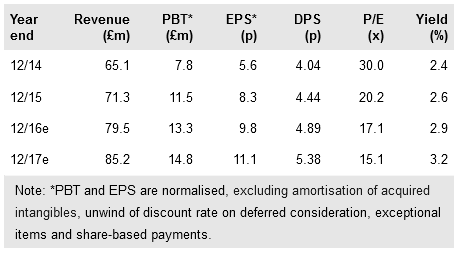

IFG Group's (LON:IFP) focus on core businesses and its investment for franchise growth clearly showed results in 2015 with growth in clients, assets and revenues, as well as meaningful profit growth. James Hay appears to have reached an inflexion point where the benefits of past investment were clearly seen in margin expansion and strong revenue growth. IFG is well positioned for further progress, supported by a strong and liquid balance sheet, in markets that offer good long-term growth potential and consolidation opportunities. We have increased our estimates and fair value.

2015 results

Revenues from James Hay Partnership (JHP) and Saunderson House (SH) grew 16% in 2015 with adjusted operating profit up 41%. With lower growth in central administrative costs, total group operating profit grew 48% to £11.6m. JHP revenues (+19%) benefited from prior year client growth, pricing changes and the addition of books acquired from Capita and Towry. More than 12k new SIPP accounts were added with stable attrition. Cost growth (10%) was well below revenue growth, generating a strong margin increase and 70% growth in adjusted operating profit. SH revenue growth (+12%) reflected higher average client numbers, continuing client wins (243 in the year) with continued strong retention, and broadly stable average fees per customer. SH adjusted operating profit grew 10% with a modest decline in the margin resulting from increased regulatory fees.

To read the entire report Please click on the pdf File Below