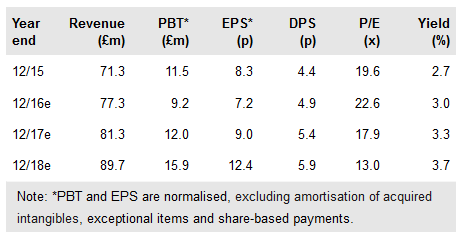

Uncertainty surrounding the EU referendum and the accompanying reduction in base rate has resulted in lower earnings estimates for IFG Group (LON:IFP), although the longer-term outlook for its two businesses remains promising. Both the retirement wealth platform and financial adviser stand to benefit from an ageing population and pension freedoms. Meanwhile, IFG continues to invest to address these opportunities and has sufficient capital and net cash to support growth while maintaining a progressive dividend policy.

First half results

IFG’s first half saw strong revenue and adjusted operating profit growth of 16% and 31% respectively compared with H115. Adjusted EPS were 41% ahead and the dividend was increased by 11%. At James Hay Partnership (JHP), EU referendum uncertainty and a focus on larger advisers left the number of SIPP accounts flat compared with the year end. New client growth slowed at Saunderson House (SH) as demand for financial advice surged around the time of the referendum which, combined with a fee increase, contributed to strong revenue growth.

To read the entire report Please click on the pdf File Below