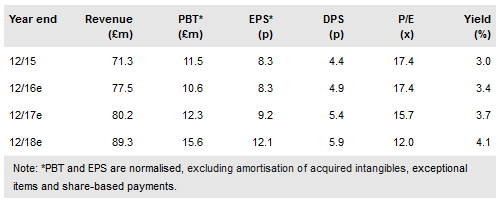

In its trading update Ifg Group (IR:IFG) reported that performance has been in line with management expectations. The cooling effect of market uncertainty on growth in James Hay and financial advice client numbers, together with the impact of low interest rates, remain a near-term head wind for revenues. Even so, with Saunderson House continuing to increase profits, IFG expects to match 2015 earnings. The long-term growth opportunity presented by an ageing population and pension freedoms remains in place and to address this IFG is continuing investment to enhance its service and increase operational gearing.

Trading in line

IFG reports that total assets under administration (AUA) at the end of October stood at £26.4bn, up 8% from the end of June and 12% from end December. At James Hay Partnership the number of clients, which remains the principal revenue driver, was stable although the average value per account has risen, which should be positive over time for the take up of more elements of the modular MiPlan offering. At Saunderson House, AUA increased from £4.1bn at end June to £4.5bn with the number of clients increasing by 2.6% to 1,945 over the same period. Clients are still seeking advice at higher levels than in previous years, reflecting uncertain market conditions; this increases fee income but has some impact on new client acquisition.

To read the entire report Please click on the pdf File Below